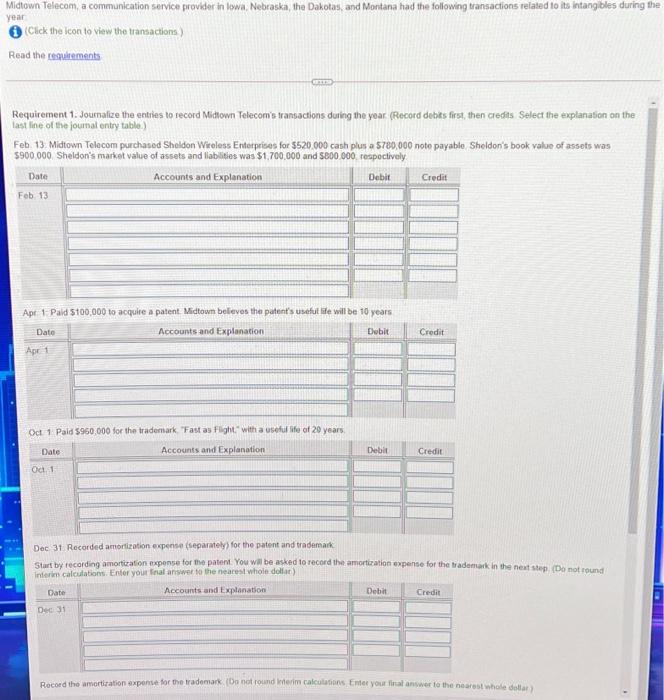

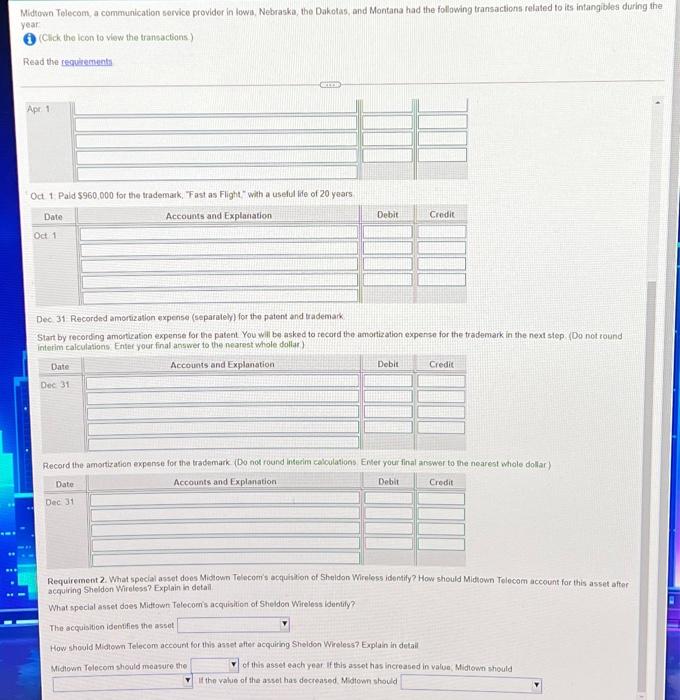

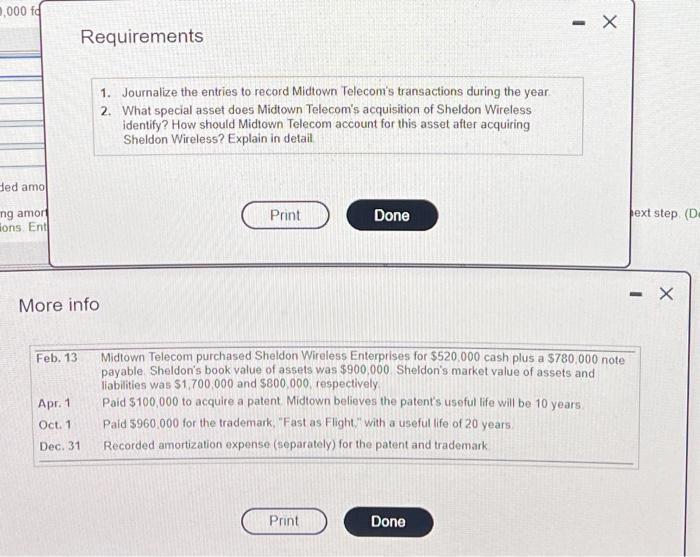

year Midtown Telecom, a communication service provider in Itwa, Nebraska, the Dakotas and Montana had the following transactions related to its intangibles during the Click the icon to view the transactions Read the requirements Requirement 1. Journalize the entries to record Midtown Telecom's transactions during the year (Record debits first, then credits Select the explanation on the last line of the journal entry table) Feb 13 Midtown Telecom purchased Sheldon Wieless Enterprises for $520.000 cash plus a 5780,000 noto payablo Sheldon's book value of assets was 5900000 Sheldon's market value of assets and liabilities was 51.700.000 and 5800 000 respectively Accounts and Explanation Credit Date Debit Feb 13 Apr 1- Paid $100,000 to acquire a patent. Midtown believes the patent's useful life will be 10 years Date Accounts and Explanation Debit Apr1 Credit Oct 1 Paid 5960,000 for the trademark "Fast as Flight with a useful life of 20 years Date Accounts and Explanation Deble Credit Od 1 Dec 31 Recorded amortization expense (separately for the patent and trademark Start by recording amortization expense for the patent. You will be asked to record the amortization expense for the trademark in the next step (Do not round Interim calculations. Enter your inal answer to the nearest whole dollar) Date Accounts and Explanation Debit Credit Dec 31 Record the motivation expense for the trademark (Do not round Imerim calculations. Enter your final answer to the nearest whole dollar) Midtown Tolcom a communication service provider in town, Nebraska, the Dakotas, and Montana had the following transactions related to its intangibles during the Click the icon to view the transactions) year Read the requirements Apr 1 Od 1 Pald 5960,000 for the trademark, Fast as Flight with a useful ide of 20 years Date Accounts and Explanation Debit Credit Oct 1 Dec 31 Recorded amortization expense (separately) for the patent and trademark Start by recording amortization expense for the patent. You will be asked to record the amortization expense for the trademark in the next step (Do not round interim calculations Enter your final answer to the nearest whole dollar) Date Accounts and Explanation Debit Credit Dec 31 Record the amortization expense for the trademark Do not round Interim calculations Enter your final answer to the nearest whole dolar) Date Accounts and Explanation Debit Credit Dec 31 Requirement2 What specialist docs Midtown Telecom's acquisition of Sheldon Wireless identity? How should Midtown Tolocor account for this asset after acquiring Sheldon ? Explain in What special asset does Midtown Telecom's acquisition of Sheldon Wireless identity? The acquisition identifies the asset How should Midtown Telecome account for this asset after acquiring Sheldon Wireless Explain in detail Midtown Telecom should measure the of this asset each year if this asset has increased in valoa Midtown should of the value of the asset has decreased Midtown should 0,000 to - X Requirements 1. Journalize the entries to record Midtown Telecom's transactions during the year 2. What special asset does Midtown Telecom's acquisition of Sheldon Wireless identify? How should Midtown Telecom account for this asset after acquiring Sheldon Wireless? Explain in detait Hed amo ng amor cons Ent Print Done bext step (D. More info Feb. 13 Apr. 1 Midtown Telecom purchased Sheldon Wireless Enterprises for $520,000 cash plus a $780,000 note payable Sheldon's book value of assets was $900,000 Sheldon's market value of assets and liabilities was $1,700,000 and $800,000, respectively Paid $100,000 to acquire a patent Midtown believes the patent's useful life will be 10 years Pald 5960 000 for the trademark "Fast as Flight" with a useful life of 20 years Recorded amortization expense (separately) for the patent and trademark Oct. 1 Dec. 31 Print Done