Answered step by step

Verified Expert Solution

Question

1 Approved Answer

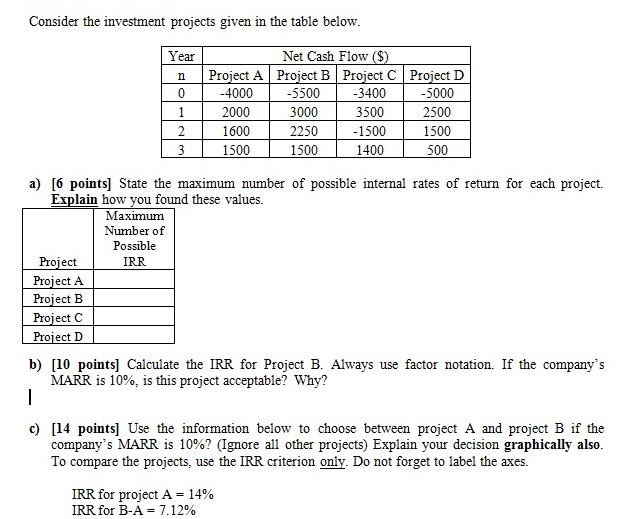

Year n Consider the investment projects given in the table below. Net Cash Flow ($) Project A Project B Project C Project D 0

Year n Consider the investment projects given in the table below. Net Cash Flow ($) Project A Project B Project C Project D 0 -4000 -5500 -3400 -5000 1 2000 3000 3500 2500 2 1600 2250 -1500 1500 3 1500 1500 1400 500 a) [6 points] State the maximum number of possible internal rates of return for each project. Explain how you found these values. Maximum Number of Possible IRR Project Project A Project B Project C Project D b) [10 points] Calculate the IRR for Project B. Always use factor notation. If the company's MARR is 10%, is this project acceptable? Why? | c) [14 points] Use the information below to choose between project A and project B if the company's MARR is 10%? (Ignore all other projects) Explain your decision graphically also. To compare the projects, use the IRR criterion only. Do not forget to label the axes. IRR for project A = 14% IRR for B-A 7.12% =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Internal Rate of Return IRR Analysis a Maximum Number of Possible IRRs Each project has a maximum of one possible IRR Heres why IRR is the discount ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started