Answered step by step

Verified Expert Solution

Question

1 Approved Answer

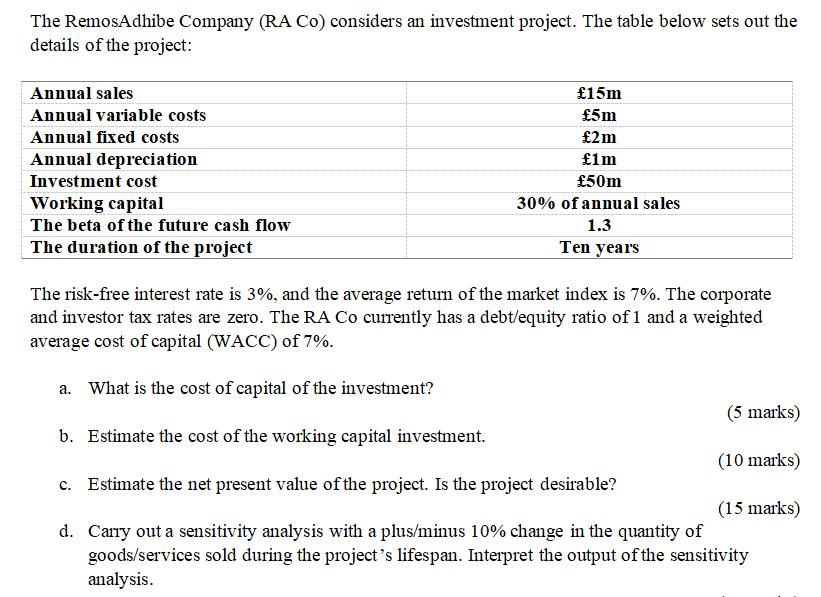

The RemosAdhibe Company (RA Co) considers an investment project. The table below sets out the details of the project: Annual sales Annual variable costs

The RemosAdhibe Company (RA Co) considers an investment project. The table below sets out the details of the project: Annual sales Annual variable costs Annual fixed costs Annual depreciation Investment cost 15m 5m 2m 1m 50m Working capital 30% of annual sales The beta of the future cash flow The duration of the project 1.3 Ten years The risk-free interest rate is 3%, and the average return of the market index is 7%. The corporate and investor tax rates are zero. The RA Co currently has a debt/equity ratio of 1 and a weighted average cost of capital (WACC) of 7%. a. What is the cost of capital of the investment? b. Estimate the cost of the working capital investment. c. Estimate the net present value of the project. Is the project desirable? (5 marks) (10 marks) (15 marks) d. Carry out a sensitivity analysis with a plus/minus 10% change in the quantity of goods/services sold during the project's lifespan. Interpret the output of the sensitivity analysis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started