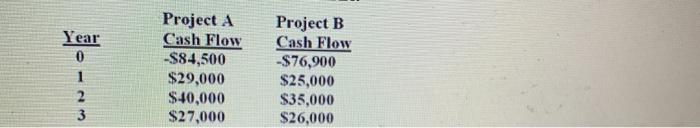

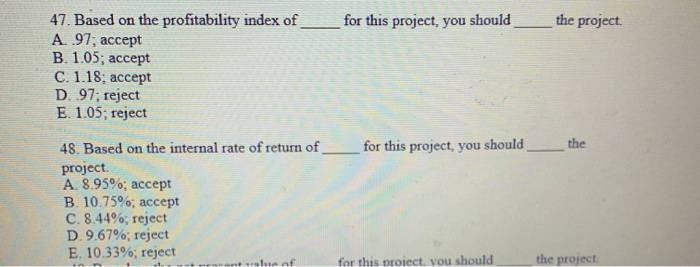

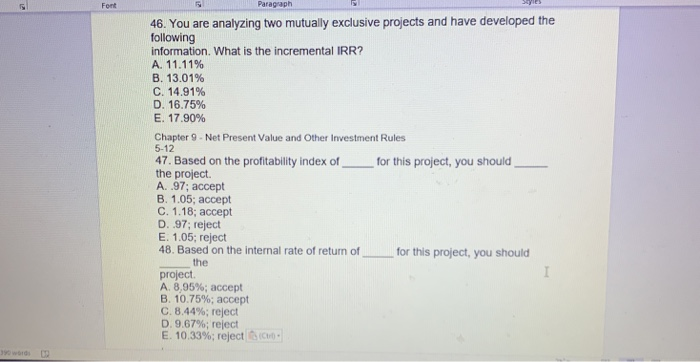

Year Project A Cash Flow -$84,500 $29,000 $40,000 $27,000 Project B Cash Flow -$76,900 $25,000 $35,000 $26,000 3 __for this project, you should ._ the project. 47. Based on the profitability index of A. 97; accept B. 1.05; accept C. 1.18: accept D. 97; reject E. 1.05; reject for this project, you should the 48. Based on the internal rate of return of project. A. 8.95%; accept B. 10.75%; accept C. 8.44%; reject D. 9.67%; reject E. 10.33%; reject for this project, you should the project Paragraph 46. You are analyzing two mutually exclusive projects and have developed the following information. What is the incremental IRR? A. 11.11% B. 13.01% C. 14.91% D. 16.75% E. 17.90% Chapter 9 - Net Present Value and Other Investment Rules 5-12 47. Based on the profitability index of_ _for this project, you should the project A. .97, accept B. 1.05; accept C. 1.18; accept D. .97, reject E. 1.05: reject 48. Based on the internal rate of return of for this project, you should the project A 8,95%; accept B. 10.75%; accept C.8.44%; reject D. 9.67%; reject E. 10.33%; reject Year Project A Cash Flow -$84,500 $29,000 $40,000 $27,000 Project B Cash Flow -$76,900 $25,000 $35,000 $26,000 3 __for this project, you should ._ the project. 47. Based on the profitability index of A. 97; accept B. 1.05; accept C. 1.18: accept D. 97; reject E. 1.05; reject for this project, you should the 48. Based on the internal rate of return of project. A. 8.95%; accept B. 10.75%; accept C. 8.44%; reject D. 9.67%; reject E. 10.33%; reject for this project, you should the project Paragraph 46. You are analyzing two mutually exclusive projects and have developed the following information. What is the incremental IRR? A. 11.11% B. 13.01% C. 14.91% D. 16.75% E. 17.90% Chapter 9 - Net Present Value and Other Investment Rules 5-12 47. Based on the profitability index of_ _for this project, you should the project A. .97, accept B. 1.05; accept C. 1.18; accept D. .97, reject E. 1.05: reject 48. Based on the internal rate of return of for this project, you should the project A 8,95%; accept B. 10.75%; accept C.8.44%; reject D. 9.67%; reject E. 10.33%; reject