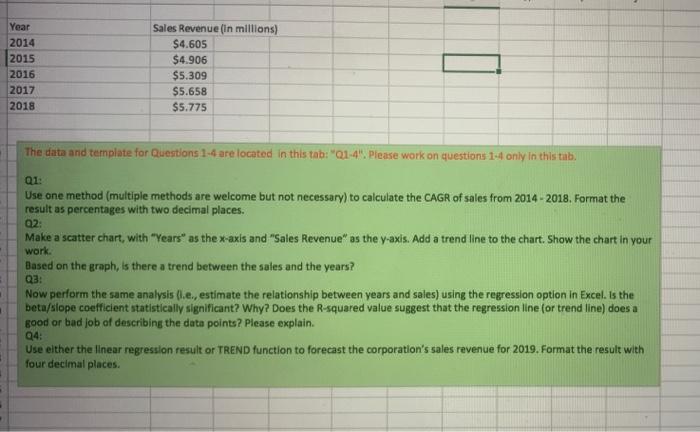

Year Sales Revenue (in millions) $4.605 2014 2015 $4.906 2016 $5.309 2017 $5.658 2018 $5.775 The data and template for Questions 1-4 are located in this tab: "Q1-4". Please work on questions 1-4 only in this tab. Q1: Use one method (multiple methods are welcome but not necessary) to calculate the CAGR of sales from 2014-2018. Format the result as percentages with two decimal places. Q2: Make a scatter chart, with "Years" as the x-axis and "Sales Revenue" as the y-axis. Add a trend line to the chart. Show the chart in your work. Based on the graph, is there a trend between the sales and the years? Q3: Now perform the same analysis (l.e., estimate the relationship between years and sales) using the regression option in Excel. Is the beta/slope coefficient statistically significant? Why? Does the R-squared value suggest that the regression line (or trend line) does a good or bad job of describing the data points? Please explain. Q4: Use either the linear regression result or TREND function to forecast the corporation's sales revenue for 2019. Format the result with four decimal places. Year Sales Revenue (in millions) $4.605 2014 2015 $4.906 2016 $5.309 2017 $5.658 2018 $5.775 The data and template for Questions 1-4 are located in this tab: "Q1-4". Please work on questions 1-4 only in this tab. Q1: Use one method (multiple methods are welcome but not necessary) to calculate the CAGR of sales from 2014-2018. Format the result as percentages with two decimal places. Q2: Make a scatter chart, with "Years" as the x-axis and "Sales Revenue" as the y-axis. Add a trend line to the chart. Show the chart in your work. Based on the graph, is there a trend between the sales and the years? Q3: Now perform the same analysis (l.e., estimate the relationship between years and sales) using the regression option in Excel. Is the beta/slope coefficient statistically significant? Why? Does the R-squared value suggest that the regression line (or trend line) does a good or bad job of describing the data points? Please explain. Q4: Use either the linear regression result or TREND function to forecast the corporation's sales revenue for 2019. Format the result with four decimal places