Answered step by step

Verified Expert Solution

Question

1 Approved Answer

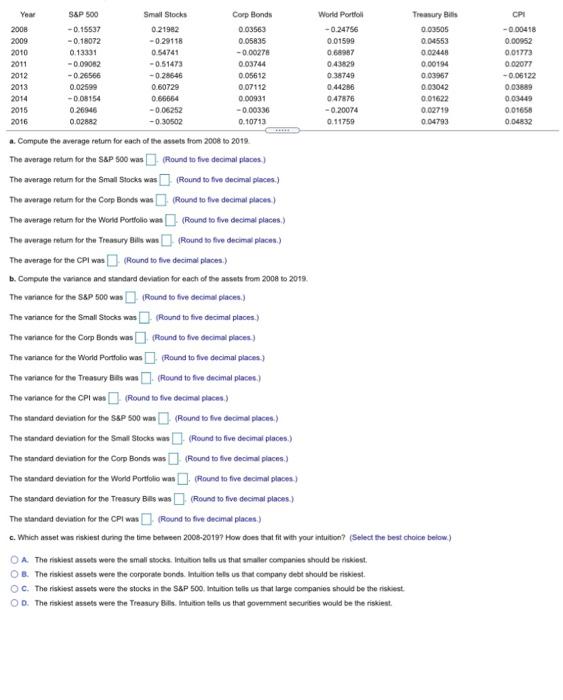

Year S&P 500 Small Stocks Corp Bonds World Portfoli Treasury Bills CPI 2008 0.15537 0.21982 0.03563 0.24756 0.03505 0.00418 2009 0.18072 0.29118 0.05835 0.01599 0.04553

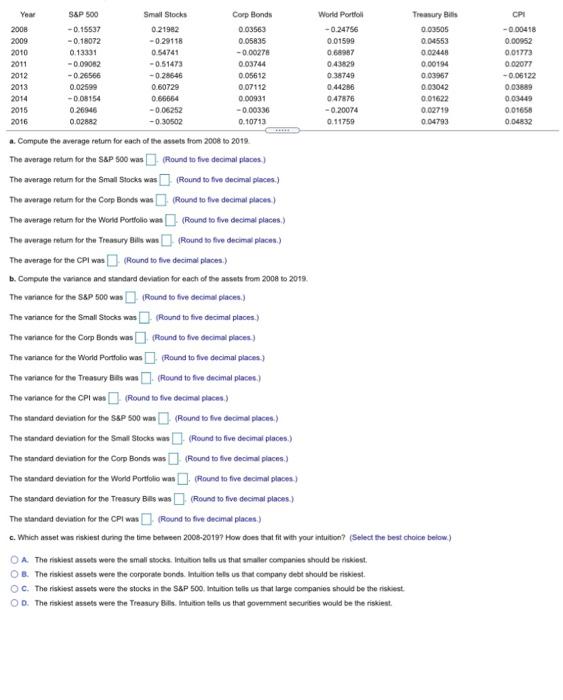

Year S&P 500 Small Stocks Corp Bonds World Portfoli Treasury Bills CPI 2008 0.15537 0.21982 0.03563 0.24756 0.03505 0.00418 2009 0.18072 0.29118 0.05835 0.01599 0.04553 0.00952 2010 0.13331 0.54741 0.00278 0.68987 0.02448 0.01773 2011 0.09082 0.51473 0.03744 0.43829 0.00194 0.02077 2012 0.26566 0.28646 0.05612 0.38749 0.03967 0.06122 2013 0.02599 0.60729 0.07112 0.44286 0.03042 0.03889 2014 0.08154 0.66664 0.00931 0.47876 0.01622 0.03449 2015 0.26946 0.06252 0.00336 0.20074 0.02719 0.01658 2016 0.02882 0.30502 0.10713 0.11759 0.04793 0.04832 a.Compute the average return for each of the assets from 2008 to 2019 The average retum for the S&P 500 was Round to five decimal places.) The average retum for the Small Stocks was Round to five decimal places.) The average retum for the Corp Bonds was Round to five decimal places.) The average retum for the World Portfolio was Round to five decimal places.) The average returm for the Treasury Bills was Round to five decimal places.) The average for the CPI was Round to five decimal places.) b.Compute the variance and standard deviation for each of the assets from 2008 to 2019. The vanance for the S&P 500 was Round to five decimal places.) The variance for the Small Stocks was Round to five decimal places.) The variance for the Corp Bonds was Round to five decimal places.) The variance for the World Portfolio was Round to five decimal places.) The variance for the Treasury Bills was RounId to five decimal places.) The vaniance for the CPI was Round to five decimal places.) The standard deviation for the S&P 500 was Round to five decimal places.) The standard deviation for the Small Stocks was Round to five decimal places.) The standard deviation for the Corp Bonds was Round to five decimal places.) The standard deviation for the World Portfolio was Round to five decimal places.) The standard deviation for the Treasury Bills was Round to five decimal places.) The standard deviation for the CPI was Round to five decimal places.) c.Which asset was riskiest during the time between 2008-20197 How does that fit with your intuition? (Select the best choice below.) OA.The nskiest assots were the small stocks. Intuition tells us that smaller companies should be riskiest. OB.The nskiest assels were the corporate bonds.Intuiton tells us that company debt should be riskiest. O C. The niskiest assets were the stocks in the S&P 500.Intuition tells us that large companies should be the riskiest. O D. The niskiest assets were the Treasury Bills.Intuition tells us that government secunities would be the riskiest.  CPI -0.00418 0.00952 0.01773 0.02077 -0.06122 0.03889 0.03449 0.01658 0.04832 Your S&P 500 Small Stocks Corp Blonds World Portfold Treasury Bills 2008 -0.15537 0.21982 0.03563 -0.24756 0.03505 2009 -0.18072 -0.29118 0.05835 0.01599 0.04553 2010 0.13331 0.54741 -0.00278 0.68967 0.02448 2011 -0.09082 -0.51473 0.03744 043820 0,00194 2012 -0.26566 -0.28646 0.05612 0.38749 0.03967 2013 0.02599 0.60729 007112 0.44286 0.03042 2014 -0.08154 0.66664 0.00931 0.47876 0.01622 2015 0.26945 -0.06252 -0.00336 -0.20074 0.02719 2016 0.02882 -0.30502 0.10713 0.11759 0.04793 GE a Compute the average return for each of the assets from 2008 to 2019 The average return for the S&P 500 was (Round to five decimal places) The average retum for the Small Stocks was (Round to five decimal places) The average return for the Corp Bonds was Round to five decimal places The average retum for the World Portfolio wan (Round to five decimal places) The average ratum for the Treasury Bills wan (Round to five decimal places) The average for the CPi was (Round to five decimal places) b. Compute the variance and standard deviation for each of the assets from 2008 to 2019, The variance for the S&P 500 was ) Round to five decimal places.) The variance for the Small Stocks wasRound to five decimal places.) The variance for the Corp Bonds was Round to the decimal places The variance for the World Portfolio was Round to five decimal places The variance for the Treasury Bas was. (Round to fvo decimal places.) The variance for the CPI was Round to five decimal places) The standard deviation for the S&P 500 wan (Round to five decimal places.) The standard deviation for the Small Stocks was Round to five decimal places.) The standard deviation for the Corp Bonds was Round to five decimal places.) The standard deviation for the World Portfolio wa Round to five decimal places) The standard deviation for the Treasury Bilis was (Round to five decimal places) The standard deviation for the CPI was Round to five decimal places) c. Which asset was riskiest during the time between 2008-2019? How does that it with your intuition? (Select the best choice below) OA The riskiest assets were the small stocks. Intuition tells us that smaller companies should be riskiest OB. The riskiest assets were the corporate bonds. Intuition tells us that company debt should be risklest. OC. The riskiest assets were the stocks in the S&P 500. Intuition tells us that large companies should be the nickest OD. The riskiest assets were the Treasury Bils. Intuition teils us that government securities would be the riskiest

CPI -0.00418 0.00952 0.01773 0.02077 -0.06122 0.03889 0.03449 0.01658 0.04832 Your S&P 500 Small Stocks Corp Blonds World Portfold Treasury Bills 2008 -0.15537 0.21982 0.03563 -0.24756 0.03505 2009 -0.18072 -0.29118 0.05835 0.01599 0.04553 2010 0.13331 0.54741 -0.00278 0.68967 0.02448 2011 -0.09082 -0.51473 0.03744 043820 0,00194 2012 -0.26566 -0.28646 0.05612 0.38749 0.03967 2013 0.02599 0.60729 007112 0.44286 0.03042 2014 -0.08154 0.66664 0.00931 0.47876 0.01622 2015 0.26945 -0.06252 -0.00336 -0.20074 0.02719 2016 0.02882 -0.30502 0.10713 0.11759 0.04793 GE a Compute the average return for each of the assets from 2008 to 2019 The average return for the S&P 500 was (Round to five decimal places) The average retum for the Small Stocks was (Round to five decimal places) The average return for the Corp Bonds was Round to five decimal places The average retum for the World Portfolio wan (Round to five decimal places) The average ratum for the Treasury Bills wan (Round to five decimal places) The average for the CPi was (Round to five decimal places) b. Compute the variance and standard deviation for each of the assets from 2008 to 2019, The variance for the S&P 500 was ) Round to five decimal places.) The variance for the Small Stocks wasRound to five decimal places.) The variance for the Corp Bonds was Round to the decimal places The variance for the World Portfolio was Round to five decimal places The variance for the Treasury Bas was. (Round to fvo decimal places.) The variance for the CPI was Round to five decimal places) The standard deviation for the S&P 500 wan (Round to five decimal places.) The standard deviation for the Small Stocks was Round to five decimal places.) The standard deviation for the Corp Bonds was Round to five decimal places.) The standard deviation for the World Portfolio wa Round to five decimal places) The standard deviation for the Treasury Bilis was (Round to five decimal places) The standard deviation for the CPI was Round to five decimal places) c. Which asset was riskiest during the time between 2008-2019? How does that it with your intuition? (Select the best choice below) OA The riskiest assets were the small stocks. Intuition tells us that smaller companies should be riskiest OB. The riskiest assets were the corporate bonds. Intuition tells us that company debt should be risklest. OC. The riskiest assets were the stocks in the S&P 500. Intuition tells us that large companies should be the nickest OD. The riskiest assets were the Treasury Bils. Intuition teils us that government securities would be the riskiest

Year

S&P 500

Small Stocks

Corp Bonds

World Portfoli

Treasury Bills

CPI

2008

0.15537

0.21982

0.03563

0.24756

0.03505

0.00418

2009

0.18072

0.29118

0.05835

0.01599

0.04553

0.00952

2010

0.13331

0.54741

0.00278

0.68987

0.02448

0.01773

2011

0.09082

0.51473

0.03744

0.43829

0.00194

0.02077

2012

0.26566

0.28646

0.05612

0.38749

0.03967

0.06122

2013

0.02599

0.60729

0.07112

0.44286

0.03042

0.03889

2014

0.08154

0.66664

0.00931

0.47876

0.01622

0.03449

2015

0.26946

0.06252

0.00336

0.20074

0.02719

0.01658

2016

0.02882

0.30502

0.10713

0.11759

0.04793

0.04832

a.Compute the average return for each of the assets from 2008 to 2019

The average retum for the S&P 500 was

Round to five decimal places.)

The average retum for the Small Stocks was

Round to five decimal places.)

The average retum for the Corp Bonds was

Round to five decimal places.)

The average retum for the World Portfolio was

Round to five decimal places.)

The average returm for the Treasury Bills was

Round to five decimal places.)

The average for the CPI was

Round to five decimal places.)

b.Compute the variance and standard deviation for each of the assets from 2008 to 2019.

The vanance for the S&P 500 was

Round to five decimal places.)

The variance for the Small Stocks was

Round to five decimal places.)

The variance for the Corp Bonds was

Round to five decimal places.)

The variance for the World Portfolio was

Round to five decimal places.)

The variance for the Treasury Bills was

RounId to five decimal places.)

The vaniance for the CPI was

Round to five decimal places.)

The standard deviation for the S&P 500 was

Round to five decimal places.)

The standard deviation for the Small Stocks was

Round to five decimal places.)

The standard deviation for the Corp Bonds was

Round to five decimal places.)

The standard deviation for the World Portfolio was

Round to five decimal places.)

The standard deviation for the Treasury Bills was

Round to five decimal places.)

The standard deviation for the CPI was

Round to five decimal places.)

c.Which asset was riskiest during the time between 2008-20197 How does that fit with your intuition? (Select the best choice below.)

OA.The nskiest assots were the small stocks. Intuition tells us that smaller companies should be riskiest.

OB.The nskiest assels were the corporate bonds.Intuiton tells us that company debt should be riskiest.

O C. The niskiest assets were the stocks in the S&P 500.Intuition tells us that large companies should be the riskiest.

O D. The niskiest assets were the Treasury Bills.Intuition tells us that government secunities would be the riskiest.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started