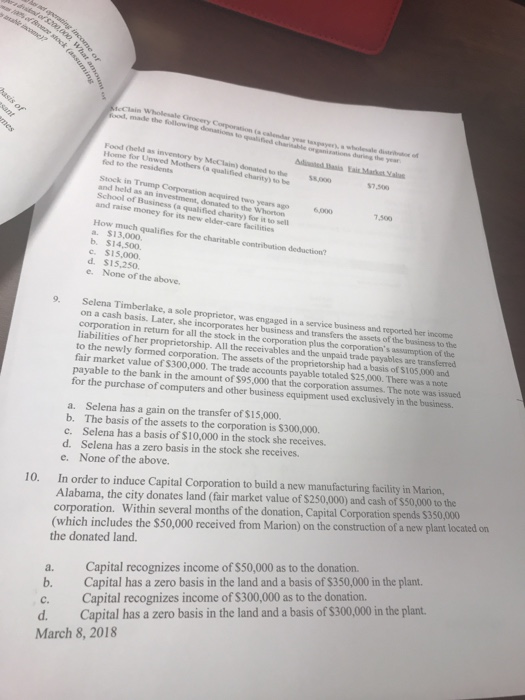

year taxpayer), Food Cheld as inventory by McClain) donated to the Home for Unwed Mothers (a qualified charity) to be fed to the residents $8,000 7,500 Stock in Trump Coporation acquired two years ags and held as an investment, donated to the Whortorn School of Business (a qualified charity) for it to sell and raise money for its new elder-care facilities 6,000 7,500 How much qualifies for the charitable contribution a. $13,000 b. $14,500. c. $15,000 d. $15,25o. e. None of the above deduction? 9. Selena Timberlake, a sole proprictor, was engaged in a service business and reported her income on a cash basis. Later, she incorporates her business and transfers the assets of the basiness to the corporation in return for all the stock in the corporation plus the corporation's liabilities of her proprietorship. All the receivables and the unpaid trade payables are transfered to the newly formed corporation. The assets of the proprietorship had a basis of S105,000 and on of the fair market value of $300,000. The trade accounts payable totaled $25,000. There was a note payable to the bank in the amount of $95,000 that the for the purchase of computers and other business equipment used exclusively in the business. corporation assumes. The note was issued Selena has a gain on the transfer of $15,000. The basis of the assets to the corporation is $300,000. Selena has a basis of $10,000 in the stock she receives. Selena has a zero basis in the stock she receives. None of the above. a. b c. d. e. Alabama, the city donates land (fair market value of $250,000) and cash of $50,000 to the corporation. (which includes the $50,000 received from Marion) on the construction of a new plant located on the donated land. 10. In order to induce Capital Corporation to build a new manufacturing facility in Marion. Within several months of the donation, Capital Corporation spends $350,000 a. b. c. d. Capital has a zero basis in the land and a basis of $300,000 in the plant March 8, 2018 Capital recognizes income of $50,000 as to the donation. Capital has a zero basis in the land and a basis of $350,000 in the plant. Capital recognizes income of $300,000 as to the donation