Answered step by step

Verified Expert Solution

Question

1 Approved Answer

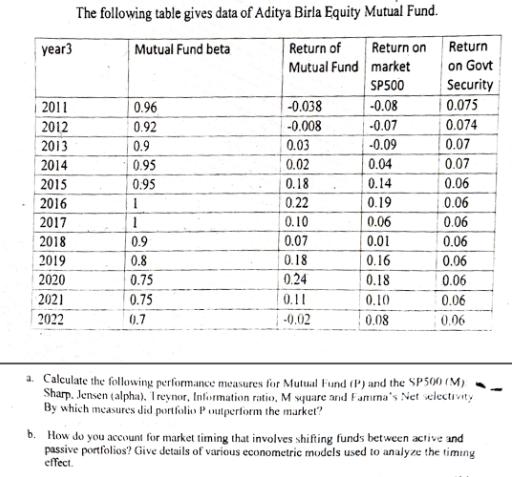

year3 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 The following table gives data of Aditya Birla Equity Mutual Fund.

year3 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 The following table gives data of Aditya Birla Equity Mutual Fund. Mutual Fund beta Return of Mutual Fund 0.96 0.92 0.9 0.95 0.95 1 1 0.9 0.8 0.75 0.75 0.7 -0.038 -0.008 0.03 0.02 0.18 0.22 0.10 0.07 0.18 0.24 0.11 -0.02 Return on market SP500 -0.08 -0.07 -0.09 0.04 0.14 0.19 0.06 0.01 0.16 0.18 0.10 0.08 Return on Govt Security 0.075 0.074 0.07 0.07 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06 a. Calculate the following performance measures for Mutual Fund (P) and the SP500 (M) Sharp. Jensen (alpha), Ireynor, Information ratio, M square and Famma's Net selectivity By which measures did portfolio Poutperform the market? b. How do you account for market timing that involves shifting funds between active and passive portfolios? Give details of various econometric models used to analyze the timing effect. (Show calculations)

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started