Answered step by step

Verified Expert Solution

Question

1 Approved Answer

year-end 2019 , total assets for Arrington Inc. were $1.9 million and accounts payable were $305,000. Sales, which in 2019 were $2.40 million, are expected

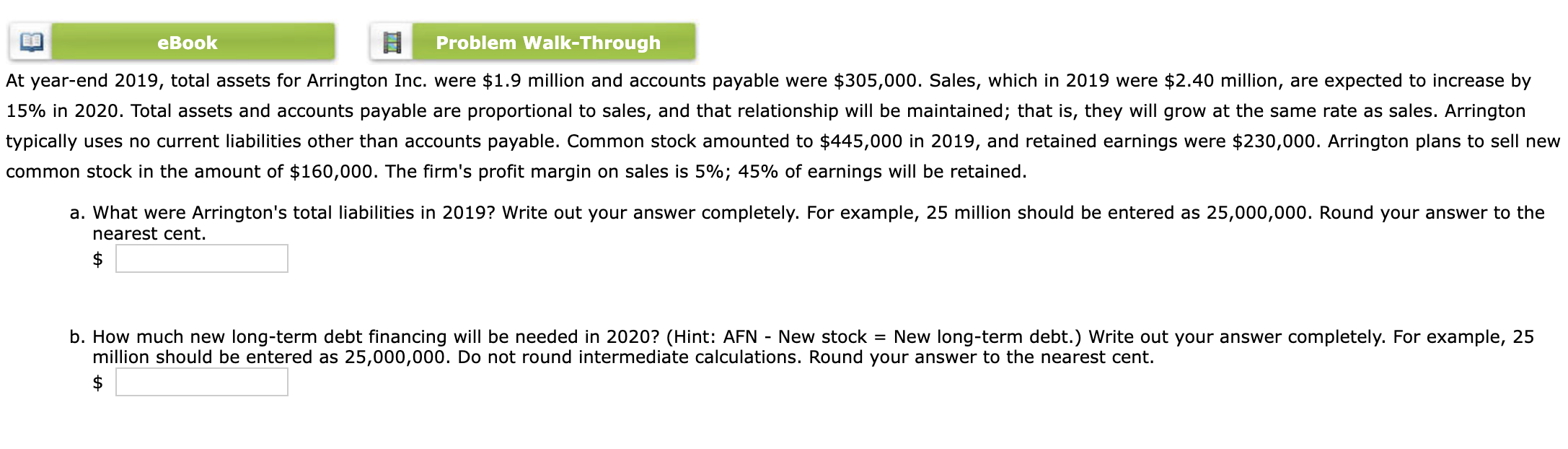

year-end 2019 , total assets for Arrington Inc. were $1.9 million and accounts payable were $305,000. Sales, which in 2019 were $2.40 million, are expected to increase by 5% in 2020. Total assets and accounts payable are proportional to sales, and that relationship will be maintained; that is, they will grow at the same rate as sales. Arrington pically uses no current liabilities other than accounts payable. Common stock amounted to $445,000 in 2019 , and retained earnings were $230,000. Arrington plans to sell new mmon stock in the amount of $160,000. The firm's profit margin on sales is 5%;45% of earnings will be retained. a. What were Arrington's total liabilities in 2019 ? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Round your answer to the nearest cent. $ b. How much new long-term debt financing will be needed in 2020 ? (Hint: AFN - New stock = New long-term debt.) Write out your answer completely. For example, 25 million should be entered as 25,000,000. Do not round intermediate calculations. Round your answer to the nearest cent. $

year-end 2019 , total assets for Arrington Inc. were $1.9 million and accounts payable were $305,000. Sales, which in 2019 were $2.40 million, are expected to increase by 5% in 2020. Total assets and accounts payable are proportional to sales, and that relationship will be maintained; that is, they will grow at the same rate as sales. Arrington pically uses no current liabilities other than accounts payable. Common stock amounted to $445,000 in 2019 , and retained earnings were $230,000. Arrington plans to sell new mmon stock in the amount of $160,000. The firm's profit margin on sales is 5%;45% of earnings will be retained. a. What were Arrington's total liabilities in 2019 ? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Round your answer to the nearest cent. $ b. How much new long-term debt financing will be needed in 2020 ? (Hint: AFN - New stock = New long-term debt.) Write out your answer completely. For example, 25 million should be entered as 25,000,000. Do not round intermediate calculations. Round your answer to the nearest cent. $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started