Question: Yearly depreciation expense schedules have been computed under three different methods for an asset having a salvage value of $90 at the end of its

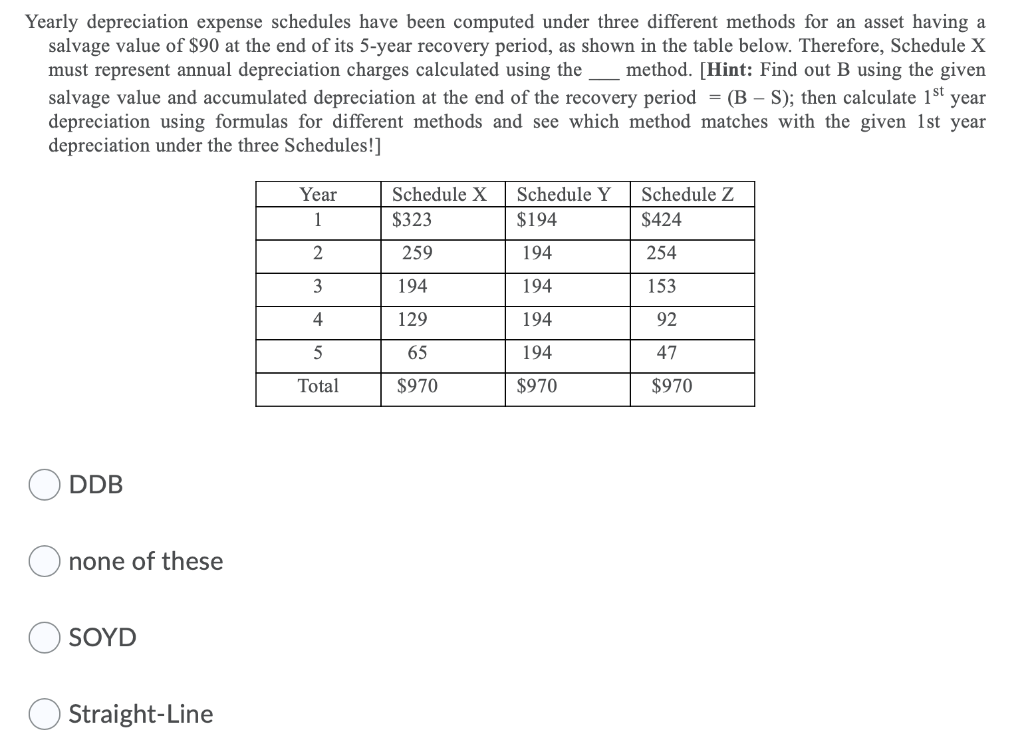

Yearly depreciation expense schedules have been computed under three different methods for an asset having a salvage value of $90 at the end of its 5-year recovery period, as shown in the table below. Therefore, Schedule X must represent annual depreciation charges calculated using the method. (Hint: Find out B using the given salvage value and accumulated depreciation at the end of the recovery period = (B-S); then calculate 1st year depreciation using formulas for different methods and see which method matches with the given 1st year depreciation under the three Schedules!] Year 1 2 Schedule X $323 259 194 Schedule Y $194 1 94 Schedule Z $424 254 153 194 129 194 92 47 65 194 $970 Total $970 $970 ODDB O none of these O SOYD O Straight-Line

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts