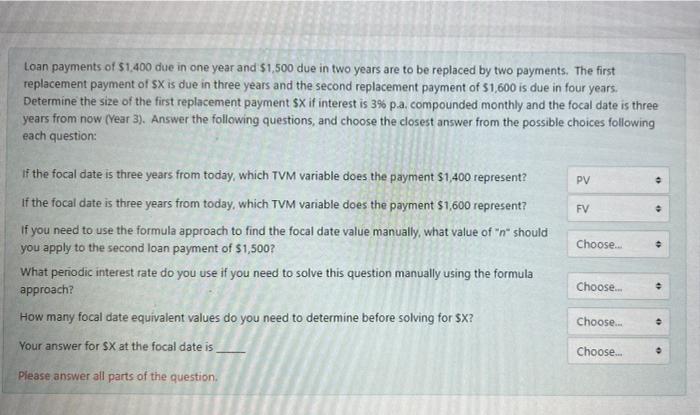

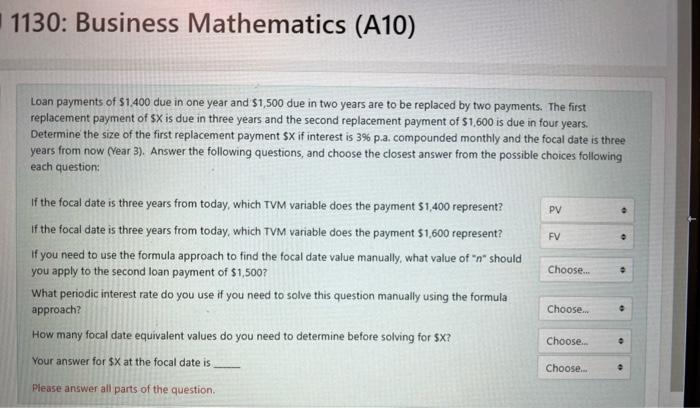

years. Loan payments of $1.400 due in one year and $1,500 due in two years are to be replaced by two payments. The first replacement payment of SX is due in three years and the second replacement payment of $1,600 is due in four Determine the size of the first replacement payment sx if interest is 3% p.a. compounded monthly and the focal date is three years from now (Year 3). Answer the following questions, and choose the closest answer from the possible choices following each question: PV FV Choose . If the focal date is three years from today, which TVM variable does the payment $1,400 represent? If the focal date is three years from today, which TVM variable does the payment $1,600 represent? If you need to use the formula approach to find the focal date value manually, what value of n should you apply to the second loan payment of $1,500? What periodic interest rate do you use if you need to solve this question manually using the formula approach? How many focal date equivalent values do you need to determine before solving for $X? Your answer for SX at the focal date is Choose.. Choose.. Choose.. Please answer all parts of the question. 1130: Business Mathematics (A10) Loan payments of 1.400 due in one year and $1,500 due in two years are to be replaced by two payments. The first replacement payment of SX is due in three years and the second replacement payment of $1,600 is due in four years. Determine the size of the first replacement payment sx if interest is 3% p.a. compounded monthly and the focal date is three years from now (Year 3). Answer the following questions, and choose the closest answer from the possible choices following each question: PV e FV Choose. . If the focal date is three years from today, which TVM variable does the payment 51,400 represent? If the focal date is three years from today, which TVM variable does the payment S1600 represent? if you need to use the formula approach to find the focal date value manually. what value of "n" should you apply to the second loan payment of $1,500? What periodic interest rate do you use if you need to solve this question manually using the formula approach? How many focal date equivalent values do you need to determine before solving for $X? Your answer for SX at the focal date is Choose.. Choose Choose Please answer all parts of the