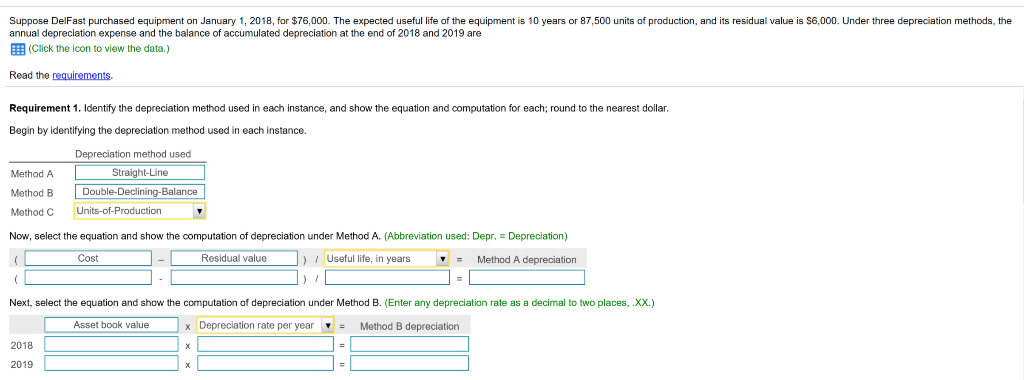

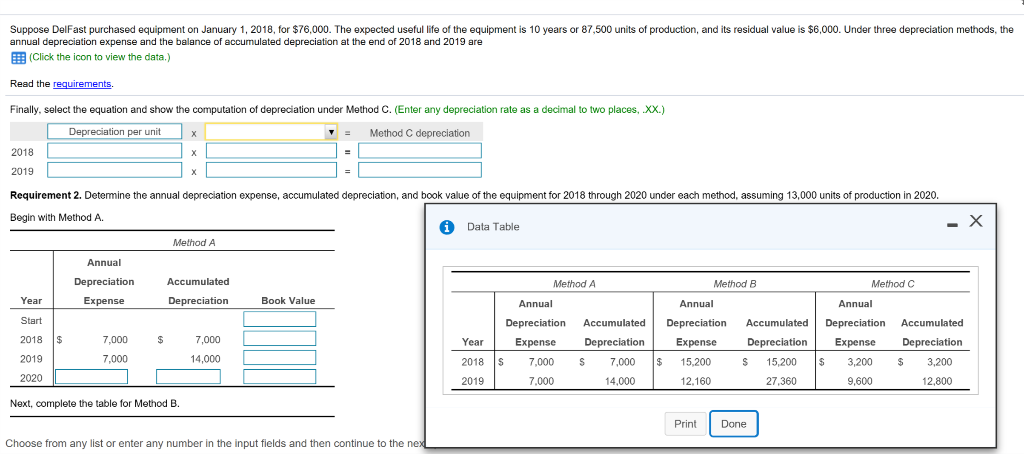

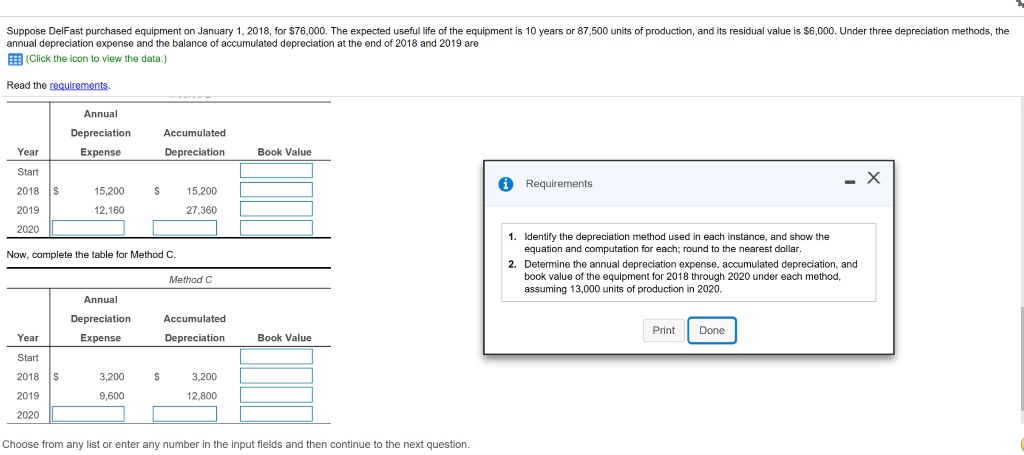

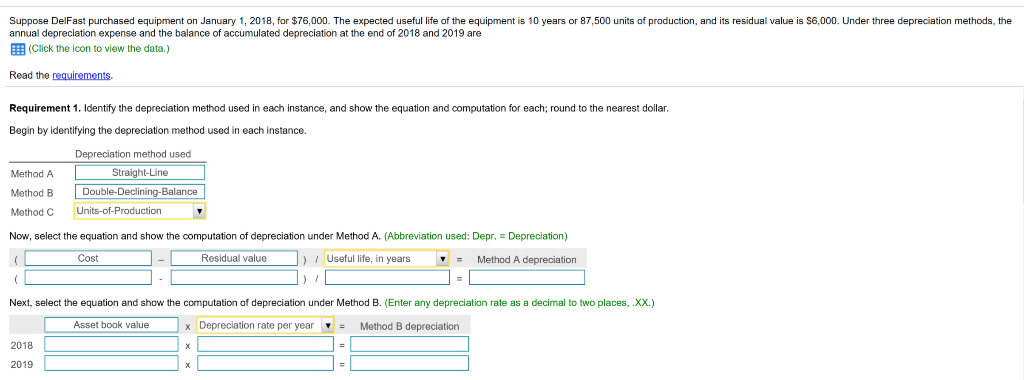

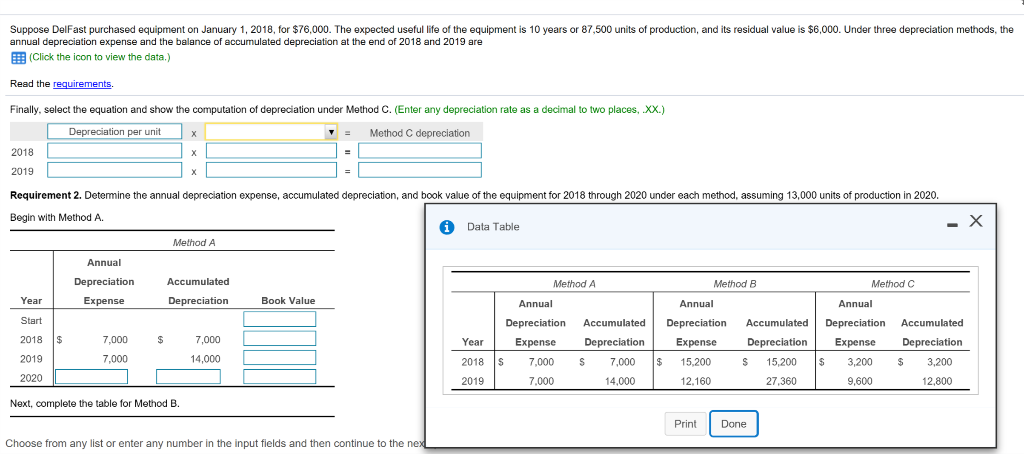

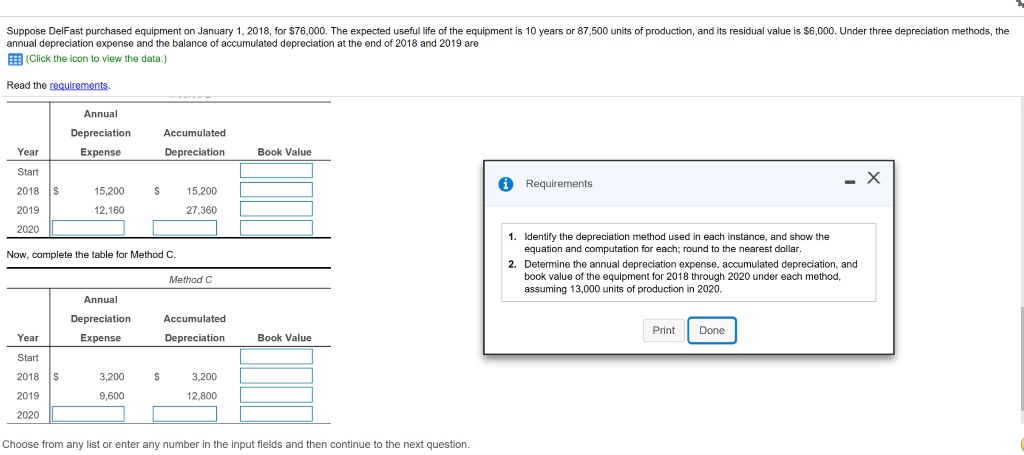

years or 87,500 units of production, and its residual value is $6,000. Under three depreciation methods, the uipment is" Suppos ltion cn nd the balance of accumulated denreciation at the end of 2018 and 2019 are EE(Click the icon to view the data.) Read the requirements. Requirement 1. Identify the depreciation method used in each instance, and show the equation and computation for each; round t the nearest dollar. Begin by identifying the depreciation method used in each instance Depreciation method used Straight-Line Method A Double-Declining-Balance Method B Units-of-Production Method C Now, select the equation and show the computation of depreciation under Method A. (Abbreviation used: Depr. Depreciation) Useful life, in years Residual value Method A depreciation Cost Next, select the equation and show the computation of depreciation under Method B. (Enter any depreciation rate as a decimal to two places, .XX.) Asset book value x Depreciation rate per vear - Method B depreciation 2018 2019 Suppose DelFast purchased equipment on January 1, 2018, for $76,000. The expected useful life of the equipment is 10 years annual depreciation expense and the balance of accumulated depreciation at the end of 2018 and 2019 are 87,500 units of production, and its residual value is $6,000. Under three depreciation methods, the EE(Click the icon view the data.) Read the requirements Finally, select the equation and show the computation of depreciation under Method C (Enter any depreciation rate as a decimal to two places, XX.) Depreciation per unit Method C depreciation 2018 2019 production in 2020, Requirement 2. Detemine the annual depreciation expense, accumulated depreciation, and book value of the equipment for 2018 through 2020 under each method, assuming 13,000 units Begin with Method A. X Data Table Method A Annual Depreciation Accumulated Method C Method A Method B Year Expense Depreciation Book Value Annual Annual Annual Start Accumulated Accumulated Depreciation Depreciation Depreciation Accumulated 7,000 2018 7,000 Year Expense Depreciation Expense Depreciation Expense Depreciation 7,000 14,000 2019 2018 7,000 15.200 3.200 3,200 7,000 15.200 2020 2019 7,000 12.160 9.600 14.000 27.360 12.800 Next, complete the table for Method B Print Done Choose from any list or enter any number in the input fields and then continue to the nex Suppose DelFast purchased equipment on January 1, 2018, for $76,000. The expected useful life of the equipment is 10 years or 87,500 units of production, and its residual value is $6,000. Under three depreciation methods, the annual depreciation expense and the balance of accumulated depreciation at the end 2018 and 2019 are (Click the icon to view the data.) Read the requirements. Annual Depreciation Accumulated Depreciation Book Value Year Expense Start - X Requirements 2018 15,200 15.200 2019 12.160 27,360 2020 1. Identify the depreciation method used in each instance, and show the equation and computation for each; round to the nearest dollar Now, complete the table for Method C. 2. Detemine the annual depreciation expense, accumulated depreciation, and book value of the equipment for 2018 through 2020 under each method, assuming 13,000 units of production in 2020. Method C Annual Depreciation Accumulated Print Done Book Value Year Expense Depreciation Start 2018 S 3,200 S 3.200 2019 9,600 12.800 2020 Choose from any list or enter any number in the input fields and then continue to the next