Answered step by step

Verified Expert Solution

Question

1 Approved Answer

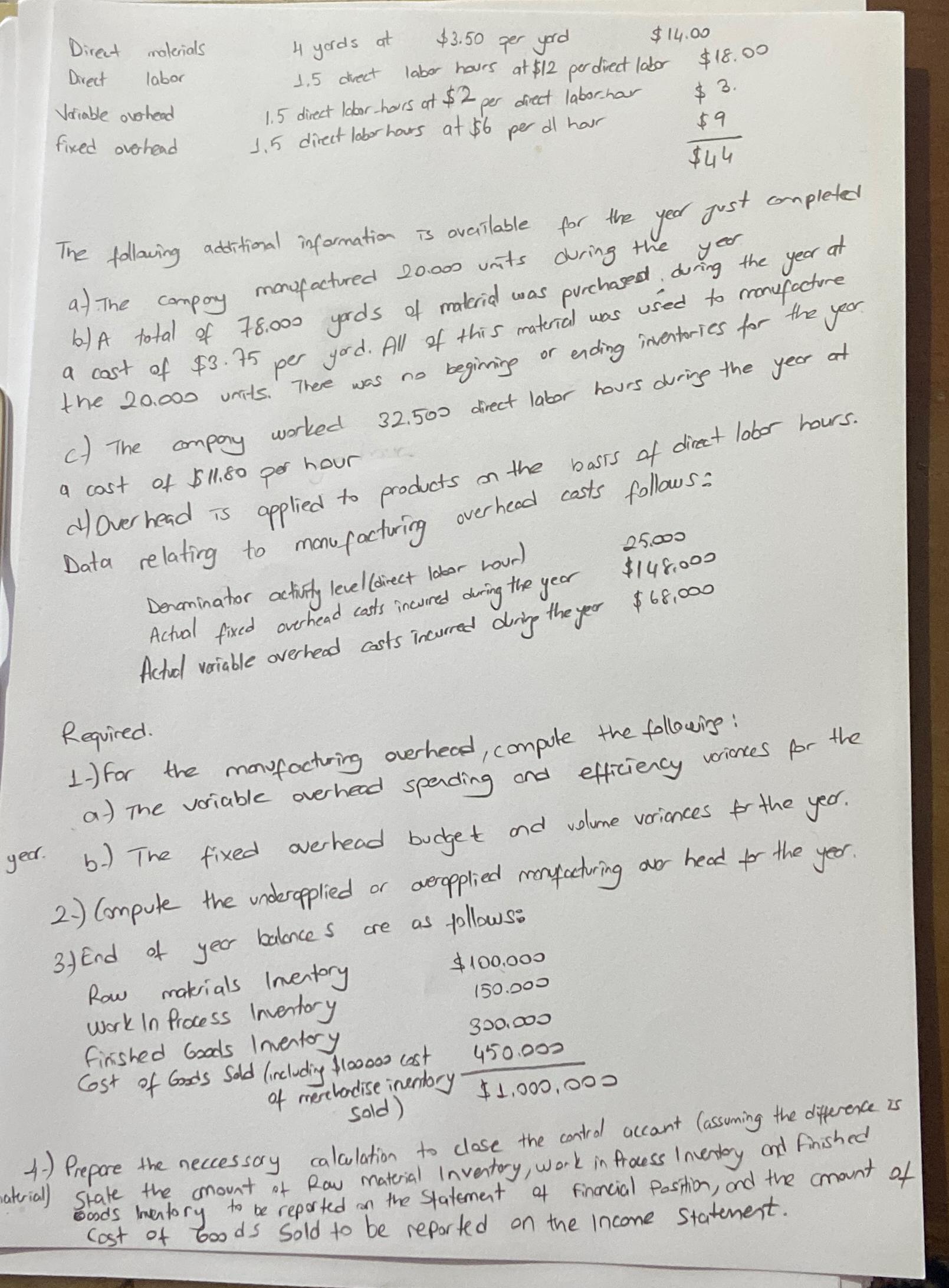

yed. Direct materials Direct labor Variable overhead fixed overhead 4 yards at 1.5 direct $3.50 per yard labor hours at $12 per direct labor

yed. Direct materials Direct labor Variable overhead fixed overhead 4 yards at 1.5 direct $3.50 per yard labor hours at $12 per direct labor $18.00 per direct labor-hour 1.5 direct labor-hours at $2 1.5 direct labor hours at $6 per dl hour The following additional information is overilable for the $14.00 $ 3. $9 $44 year just completed year at purchased during the year a). The company manufactured 20.000 units during the b.) A total of 78.000 yards of material was a cost of $3.75 per yord. All of this material was used to manufacture beginning or ending inventories for the year the 20.000 units. There was 32.500 direct labor hours during the year c) The company worked a cost of $11.80 per hour Co at basis of direct labor hours. d) Overhead is applied to products on the Data relating to manufacturing overhead casts follows= Denominator activity level (direct labor hour) Actual fixed overhead casts incuired during the year 25.000 $148,000 Actual variable overhead costs incurred during the year $68,000 Required. 1-) for the manufacturing overhead, compute the following: a) The variable overhead spending and efficiency variances for the b.) The fixed overhead budget and volume variances for the year. 2) Compute the underapplied 3) End of Row year balance s cre or overopplied manufacturing as follows: over head + the year. $100.000 materials Inventory Work In Process Inventory Finished Goods Inventory 150.000 4-) 300.000 Cost of Goods Sold (including $100000 cost 450.000 of merchandise inventory Sold) $1,000,000 Prepare the neccessory calculation to close the control account (assuming the difference is material) State the amount of Raw Material Inventory, work in Process Inventory and Finished Goods Inventory to be reported on the Statement of Financial Position, and the amount Cost of Goods Sold to be reported on the Income Statement. of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started