Answered step by step

Verified Expert Solution

Question

1 Approved Answer

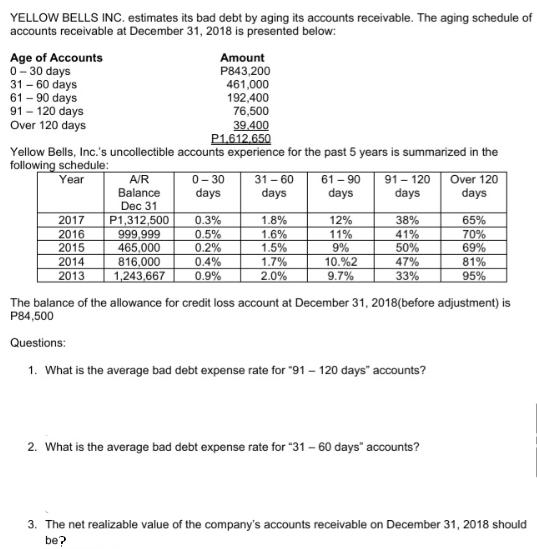

YELLOW BELLS INC. estimates its bad debt by aging its accounts receivable. The aging schedule of accounts receivable at December 31, 2018 is presented

YELLOW BELLS INC. estimates its bad debt by aging its accounts receivable. The aging schedule of accounts receivable at December 31, 2018 is presented below: Age of Accounts 0-30 days 31-60 days 61-90 days 91 - 120 days Over 120 days Yellow Bells, Inc.'s uncollectible accounts experience for the past 5 years is summarized in the following schedule: Year 2017 2016 2015 2014 2013 A/R Balance Dec 31 Amount P843,200 461,000 192,400 76,500 39.400 P1.612.650 P1,312,500 999,999 465,000 816,000 0-30 days 0.3% 0.5% 0.2% 0.4% 1,243,667 0.9% 31-60 61-90 days days 1.8% 1.6% 1.5% 1.7% 2.0% 12% 11% 9% 10.%2 9.7% 91 - 120 days 38% 41% 50% 47% 33% Over 120 days 2. What is the average bad debt expense rate for "31-60 days" accounts? 65% 70% 69% 81% 95% The balance of the allowance for credit loss account at December 31, 2018(before adjustment) is P84,500 Questions: 1. What is the average bad debt expense rate for "91-120 days" accounts? 3. The net realizable value of the company's accounts receivable on December 31, 2018 should be?

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the average bad debt expense rate for specific account categories we need to use the hi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started