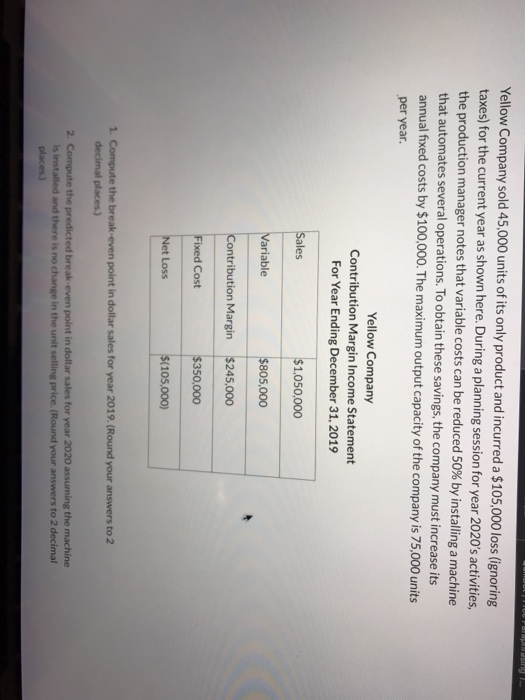

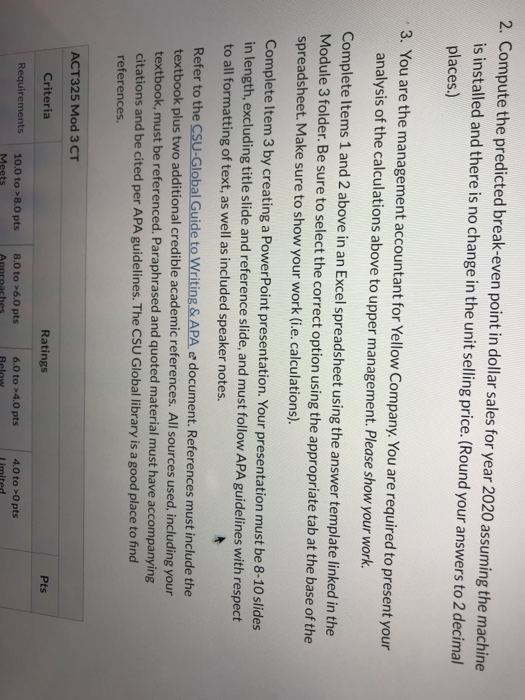

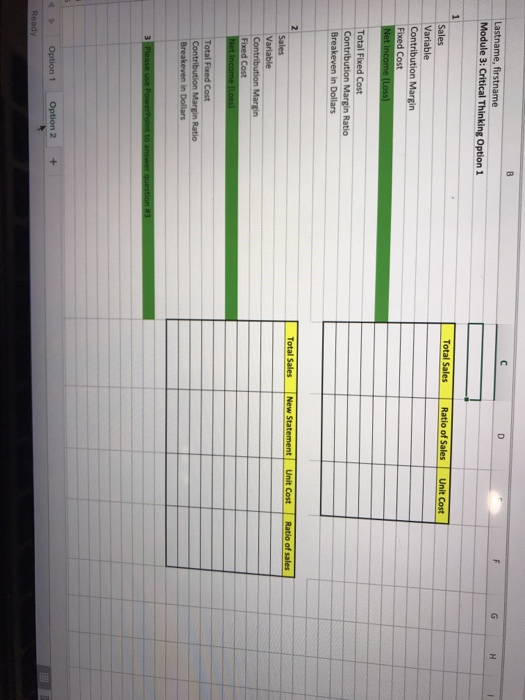

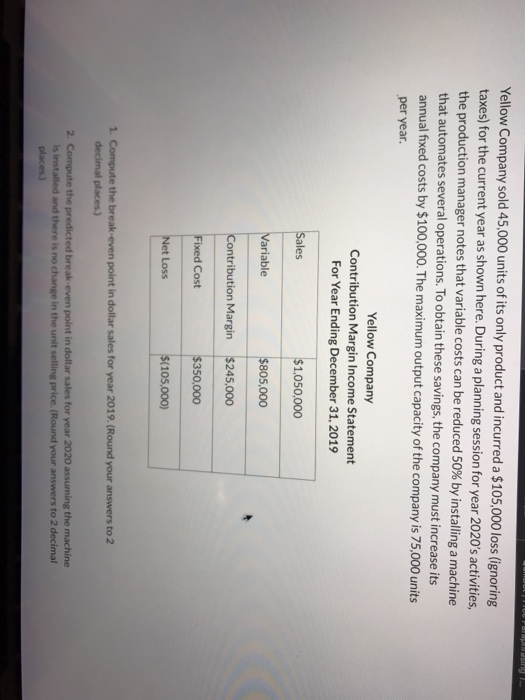

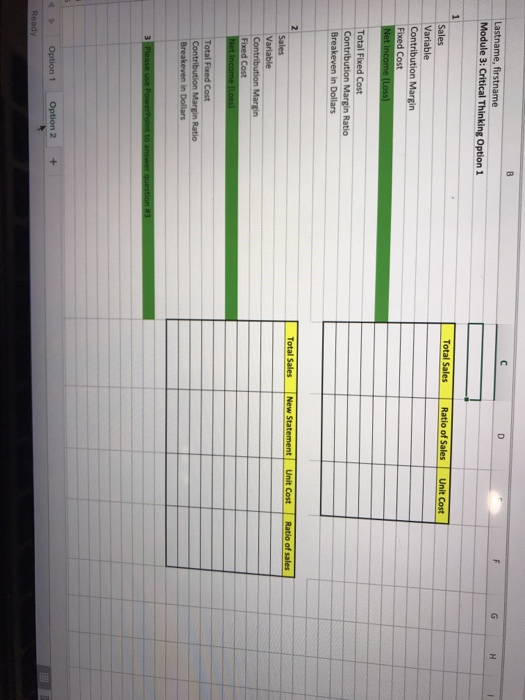

Yellow Company sold 45,000 units of its only product and incurred a $105,000 loss (ignoring taxes) for the current year as shown here. During a planning session for year 2020's activities, the production manager notes that variable costs can be reduced 50% by installing a machine that automates several operations. To obtain these savings, the company must increase its annual fixed costs by $100,000. The maximum output capacity of the company is 75,000 units per year. Yellow Company Contribution Margin Income Statement For Year Ending December 31, 2019 Sales $1,050,000 Variable $805,000 Contribution Margin $245,000 Fixed Cost $350,000 Net Loss $(105,000) 1. Compute the break-even point in dollar sales for year 2019. (Round your answers to 2 decimal places.) 2. Compute the predicted break-even point in dollar sales for year 2020 assuming the machine is installed and there is no change in the unit selling price. (Round your answers to 2 decimal places) 2. Compute the predicted break-even point in dollar sales for year 2020 assuming the machine is installed and there is no change in the unit selling price. (Round your answers to 2 decimal places.) 3. You are the management accountant for Yellow Company. You are required to present your analysis of the calculations above to upper management. Please show your work. Complete Items 1 and 2 above in an Excel spreadsheet using the answer template linked in the Module 3 folder. Be sure to select the correct option using the appropriate tab at the base of the spreadsheet. Make sure to show your work (i.e. calculations). Complete Item 3 by creating a PowerPoint presentation. Your presentation must be 8-10 slides in length, excluding title slide and reference slide, and must follow APA guidelines with respect to all formatting of text, as well as included speaker notes. Refer to the CSU-Global Guide to Writing & APA e document. References must include the textbook plus two additional credible academic references. All sources used, including your textbook, must be referenced. Paraphrased and quoted material must have accompanying citations and be cited per APA guidelines. The CSU Global library is a good place to find references. ACT325 Mod 3 CT Criteria Ratings Pts Requirements 10.0 to >8.0 pts Meets ats 8.0 to > 6.0 pts Approaches entre los Alto-4.0pts 6.0 to >4.0 pts 4.0 to 0 pts limited totoropts Below Lastname, firstname Module 3: Critical Thinking Option 1 Total Sales Ratio of Sales Unit Cost Sales Variable Contribution Margin Fixed Cost Net income (Loss) Total Fixed Cost Contribution Margin Ratio Breakeven in Dollars Total Sales New Statement Unit Cost Ratio of sales Sales Variable Contribution Margin Fixed Cost Net Income (Loss) Total Fixed Cost Contribution Margin Ratio Breakeven in Dollars 3 Please use Powerpoint to answer question 3 Option 1 Option 2 + Ready