Answered step by step

Verified Expert Solution

Question

1 Approved Answer

yelrs old is kept at a 14000 this year, all of which was carned by Mary. Assuming Tad attends 11300 thhs year to keep the

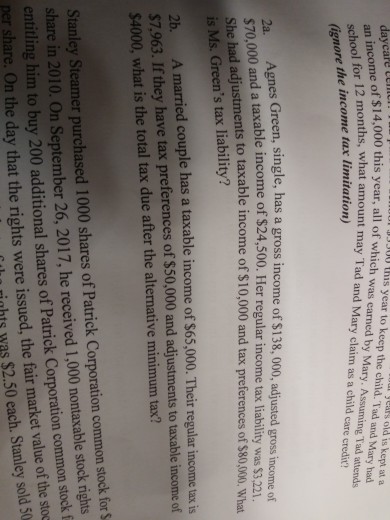

yelrs old is kept at a 14000 this year, all of which was carned by Mary. Assuming Tad attends 11300 thhs year to keep the child. Tad and Mary had an 1 income o r 12 months, what amount may lad and Mary claim as a child care credit? ignore the income tax limitation Agnes Green, single, has a gross income of $138, 000, adjusted gross income of taxable income of $24,500. Her regular income tax liability was $3,221. S70,000 and a She had adjustments to taxable inc is Ms. Green's tax liability? ome of $10,000 and tax preferences of $80,.00. Wha 2b. A married couple has a taxable income of $65,000. Their regular income tax is $7,963. If they have tax preferences of $50,000 and adjustments to taxable income f $4000, what is the total tax due after the alternative minimum tax? Stanley Steamer purchased 1000 shares of Patrick Corporation common stock for S share in 2010. On September 26, 2017, he received 1,000 nontaxable stock rights entitling him to buy 200 additional shares of Patrick Corporation common stock f per share. On the day that the rights were issued, the fair market value of the sto rights was $2.50 each. Stanley sold 50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started