Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Yeng and Sons Ltd prepares financial statements to 31 May each year. On 25 January 2020 , the company classifies a disposal group as held

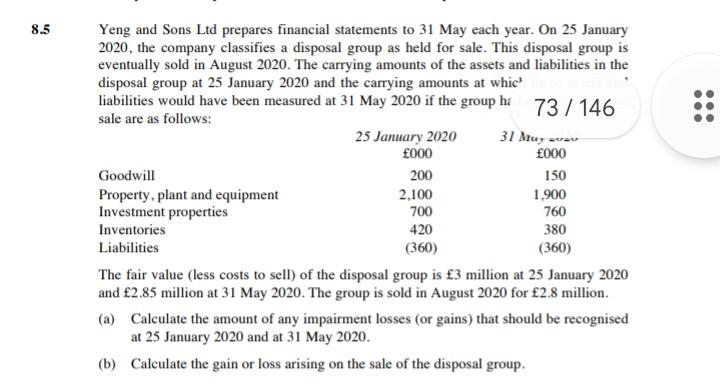

Yeng and Sons Ltd prepares financial statements to 31 May each year. On 25 January 2020 , the company classifies a disposal group as held for sale. This disposal group is eventually sold in August 2020 . The carrying amounts of the assets and liabilities in the disposal group at 25 January 2020 and the carrying amounts at whic 2 liabilities would have been measured at 31 May 2020 if the group hi 73/146 sale are as follows: The fair value (less costs to sell) of the disposal group is 3 million at 25 January 2020 and 2.85 million at 31 May 2020. The group is sold in August 2020 for 2.8 million. (a) Calculate the amount of any impairment losses (or gains) that should be recognised at 25 January 2020 and at 31 May 2020. (b) Calculate the gain or loss arising on the sale of the disposal group

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started