Answered step by step

Verified Expert Solution

Question

1 Approved Answer

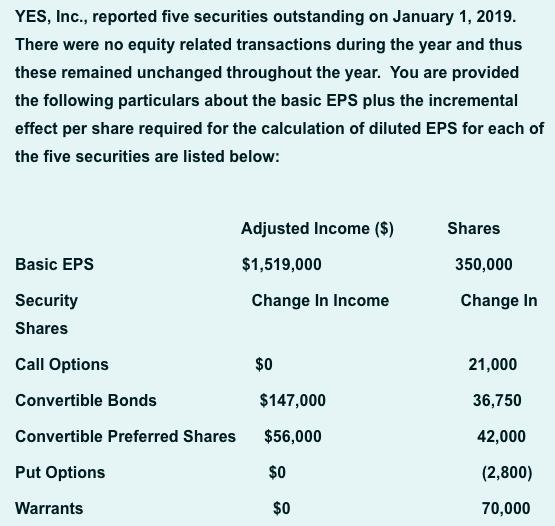

YES, Inc., reported five securities outstanding on January 1, 2019. There were no equity related transactions during the year and thus these remained unchanged

![[66] YES reported $877,000 as income from operations and 200,000 shares as weighted average common shares in 2017. YES also r](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/08/612cc63a2d9f7_1630324277031.jpg)

YES, Inc., reported five securities outstanding on January 1, 2019. There were no equity related transactions during the year and thus these remained unchanged throughout the year. You are provided the following particulars about the basic EPS plus the incremental effect per share required for the calculation of diluted EPS for each of the five securities are listed below: Adjusted Income ($) Shares Basic EPS $1,519,000 350,000 Security Change In Income Change In Shares Call Options $0 21,000 Convertible Bonds $147,000 36,750 Convertible Preferred Shares $56,000 42,000 Put Options $0 (2,800) Warrants $0 70,000 [66] YES reported $877,000 as income from operations and 200,000 shares as weighted average common shares in 2017. YES also reported outstanding, 27,000 of 6%, $100 par value, non-cumulative, nonconvertible preferred shares. The company had not declared any dividends for either the current year or the previous year. Further, it had issued 1,500 8% , long-term convertible bonds, par value of $1,000 each. These bonds had been issued several years ago and were still outstanding as at January, 2017. Each bond can be converted into 40 common shares. No amount of the bond issue was credited towards contributed surplus-conversion. The annual tax rate for 2017 was 40%. On September 1, bondholders of 25% of the outstanding bonds converted them. YES had no other potentially dilutive securities and no other conversions occurred during the year. The denominators for calculating the basic EPS and the diluted EPS would be O a. 200,000 shares and 215,000 shares. O b. 205,000 shares and 215,000 shares. Oc. 200,000 shares and 255,000 shares. O d. 260,000 shares and 215,000 shares. O e. None of the above.

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

c 200000 shares and 255000 shares As given weighted ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started