Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Yes year 2021 An investor needs to decide whether to invest in Bond A or Bond B. Before making a decision, the investor wants to

Yes

year 2021

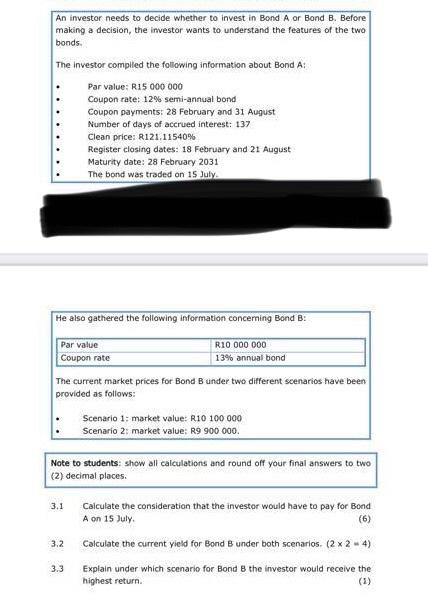

An investor needs to decide whether to invest in Bond A or Bond B. Before making a decision, the investor wants to understand the features of the two bonds. The investor compiled the following information about Bond A: Par value: R15 000 000 Coupon rate: 12% semi-annual bond Coupon payments: 28 February and 31 August Number of days of accrued interest: 137 Clean price: R121.11540% Register closing dates: 18 February and 21 August Maturity date: 28 February 2031 The bond was traded on 15 July He also gathered the following information concerning Bond B: Par value Coupon rate R10 000 000 13% annual bond The current market prices for Bond B under two different scenarios have been provided as follows: Scenario 1: market value: R10 100 000 Scenario 2: market value: R9 900 000 Note to students show all calculations and round off your final answers to two (2) decimal places. 3.1 Calculate the consideration that the investor would have to pay for Bond A on 15 July (6) 3.2 Calculate the current yield for Bond B under both scenarios. (2x2 - 4) Explain under which scenario for Bond 8 the investor would receive the highest return. 3.3 (1) An investor needs to decide whether to invest in Bond A or Bond B. Before making a decision, the investor wants to understand the features of the two bonds. The investor compiled the following information about Bond A: Par value: R15 000 000 Coupon rate: 12% semi-annual bond Coupon payments: 28 February and 31 August Number of days of accrued interest: 137 Clean price: R121.11540% Register closing dates: 18 February and 21 August Maturity date: 28 February 2031 The bond was traded on 15 July He also gathered the following information concerning Bond B: Par value Coupon rate R10 000 000 13% annual bond The current market prices for Bond B under two different scenarios have been provided as follows: Scenario 1: market value: R10 100 000 Scenario 2: market value: R9 900 000 Note to students show all calculations and round off your final answers to two (2) decimal places. 3.1 Calculate the consideration that the investor would have to pay for Bond A on 15 July (6) 3.2 Calculate the current yield for Bond B under both scenarios. (2x2 - 4) Explain under which scenario for Bond 8 the investor would receive the highest return. 3.3 (1) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started