Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Yesterday, the CFO of Global Altines computed the net present value (NPV) anwarplane te pony is considering purchasing. Using the mis required nule of retum,

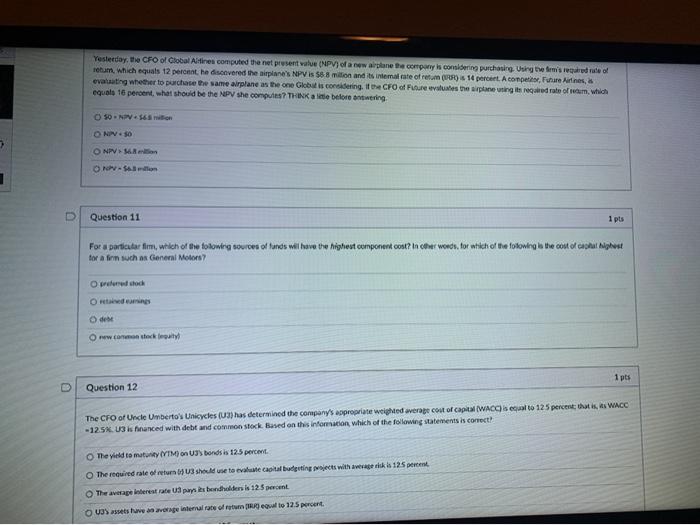

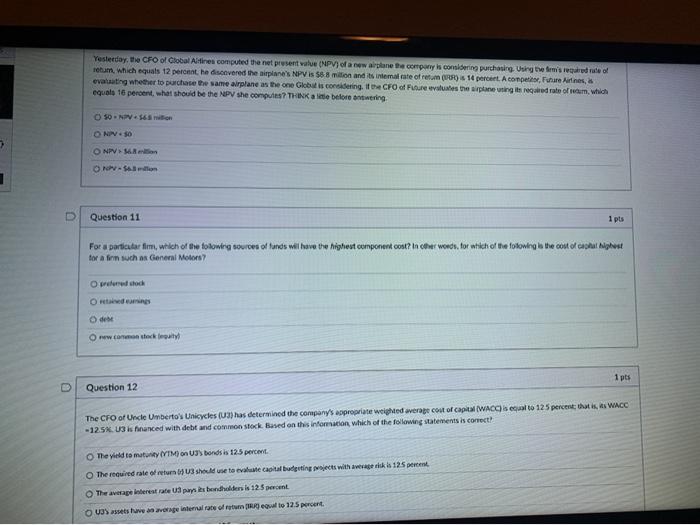

Yesterday, the CFO of Global Altines computed the net present value (NPV) anwarplane te pony is considering purchasing. Using the mis required nule of retum, which equals 12 percent, he discovered the airplane's NPV is $88 million and its intemal rate ofreu () 14 percent. A competitor, Fine Airlines, evaluating whether to purchase the same airplane as the one Global is considering if the CFO of Fire states the airplane ting its regard rate of Hum, which equals 16 percent, what should be the NPV she comples? THINK ale before ontwering 50-56 milion OMV50 ONPVM Question 11 1 pts For a particular fim, which of the following sources of funds will have the highest component cost? In other words, for which of the following la the cost of caput Night for a firm such as General Motors Ortoch Ondan dem Owonostock 1 pts Question 12 The CFO of Uncle Umberto's Unicycles (3) has determined the company's appropriate weighted average cost of capital (WACC) is equal to 125 percent that is, as WACC -12.5%. U3 is financed with debt and common stock. Based on this information, which of the following statements is correct! The yield to maturity IVTM) on Ubonds is 125 percent The required rate of return 3 should use to evaluate capital budgeting projects with averagedik is 125 percent The average interest rate u pays bondholders is 12.5 percent assets tuve average interual rate of retum equal to 12.5 percent

Yesterday, the CFO of Global Altines computed the net present value (NPV) anwarplane te pony is considering purchasing. Using the mis required nule of retum, which equals 12 percent, he discovered the airplane's NPV is $88 million and its intemal rate ofreu () 14 percent. A competitor, Fine Airlines, evaluating whether to purchase the same airplane as the one Global is considering if the CFO of Fire states the airplane ting its regard rate of Hum, which equals 16 percent, what should be the NPV she comples? THINK ale before ontwering 50-56 milion OMV50 ONPVM Question 11 1 pts For a particular fim, which of the following sources of funds will have the highest component cost? In other words, for which of the following la the cost of caput Night for a firm such as General Motors Ortoch Ondan dem Owonostock 1 pts Question 12 The CFO of Uncle Umberto's Unicycles (3) has determined the company's appropriate weighted average cost of capital (WACC) is equal to 125 percent that is, as WACC -12.5%. U3 is financed with debt and common stock. Based on this information, which of the following statements is correct! The yield to maturity IVTM) on Ubonds is 125 percent The required rate of return 3 should use to evaluate capital budgeting projects with averagedik is 125 percent The average interest rate u pays bondholders is 12.5 percent assets tuve average interual rate of retum equal to 12.5 percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started