Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Yield to maturity) Fitzgerald's 25 -year bonds pay 11 percent interest annually on a $1,000 par value. If the bonds sell at $875, what is

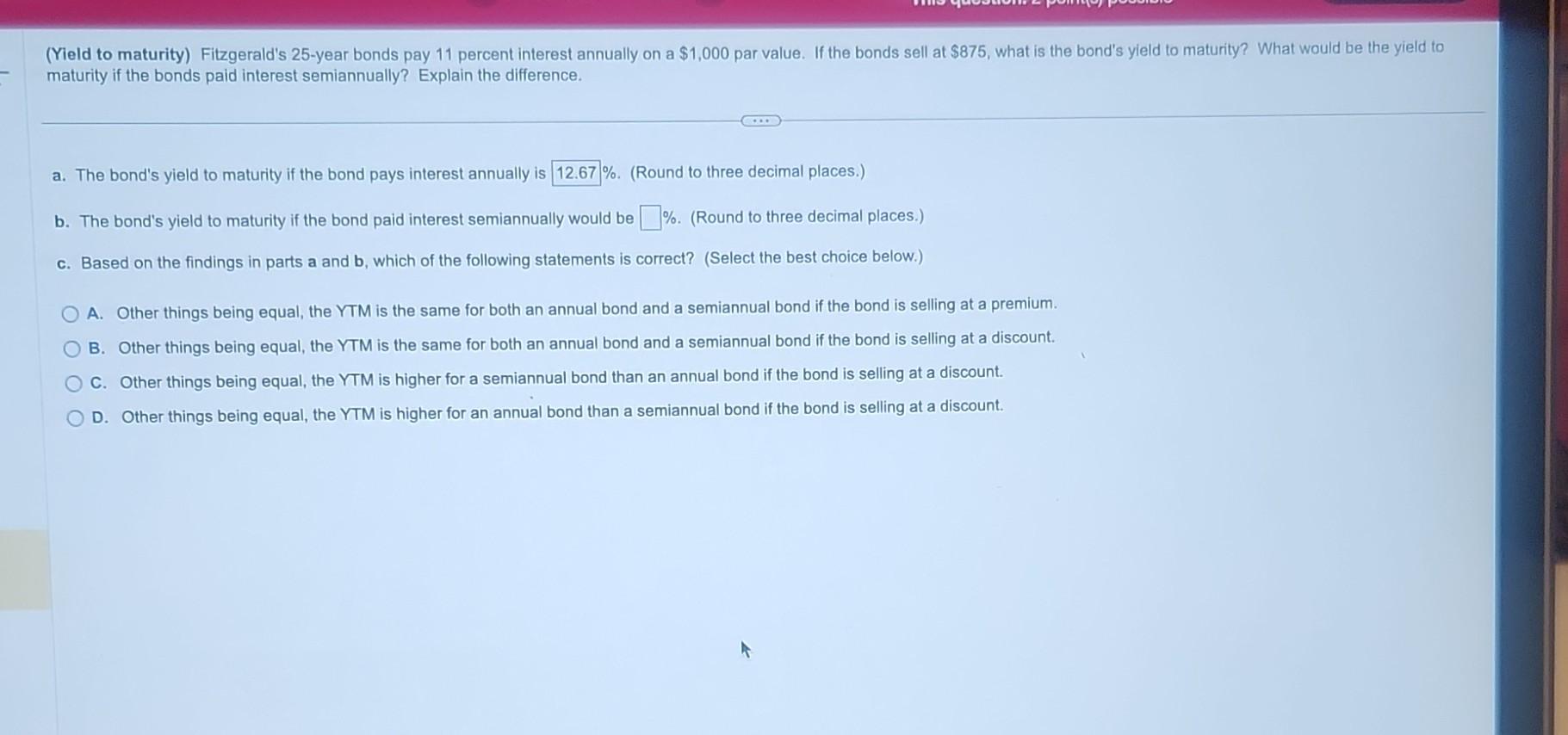

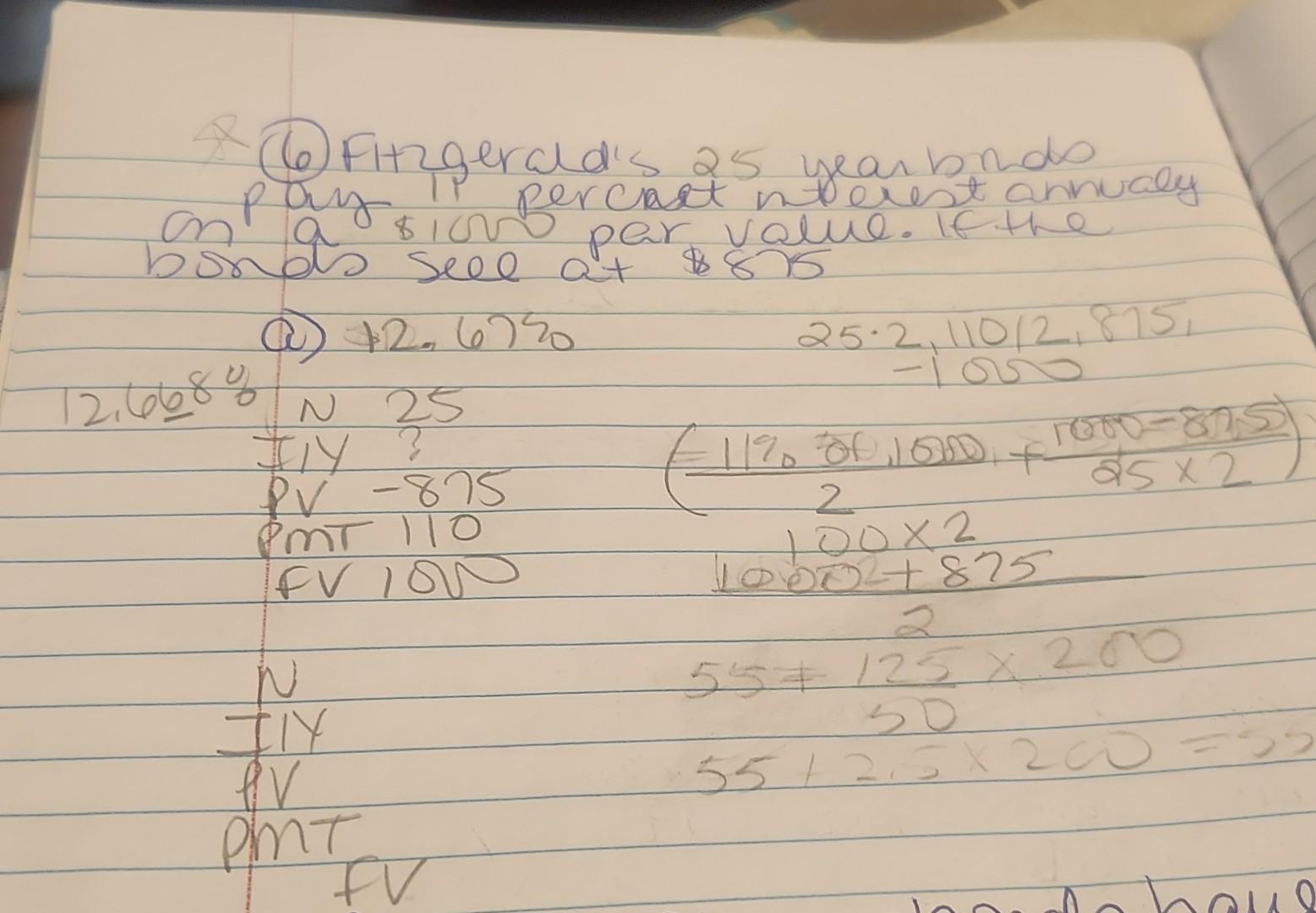

(Yield to maturity) Fitzgerald's 25 -year bonds pay 11 percent interest annually on a $1,000 par value. If the bonds sell at $875, what is the bond's yield to maturity? What would be the yield to maturity if the bonds paid interest semiannually? Explain the difference. a. The bond's yield to maturity if the bond pays interest annually is b. (Round to three decimal places.) b. The bond's yield to maturity if the bond paid interest semiannually would be \%. (Round to three decimal places.) c. Based on the findings in parts a and b, which of the following statements is correct? (Select the best choice below.) A. Other things being equal, the YTM is the same for both an annual bond and a semiannual bond if the bond is selling at a premium. B. Other things being equal, the YTM is the same for both an annual bond and a semiannual bond if the bond is selling at a discount. C. Other things being equal, the YTM is higher for a semiannual bond than an annual bond if the bond is selling at a discount. D. Other things being equal, the YTM is higher for an annual bond than a semiannual bond if the bond is selling at a discount. (6) Fitzeralis 25 year bn db pary 11 perciset nterest annualy on ay $100 percart value. If the binds seee at \$8 85 a) 12.67% 12,6680N25 252,11012,875, (2119.051000+2521000875)21000023055+12520055+2.5200=53

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started