Answered step by step

Verified Expert Solution

Question

1 Approved Answer

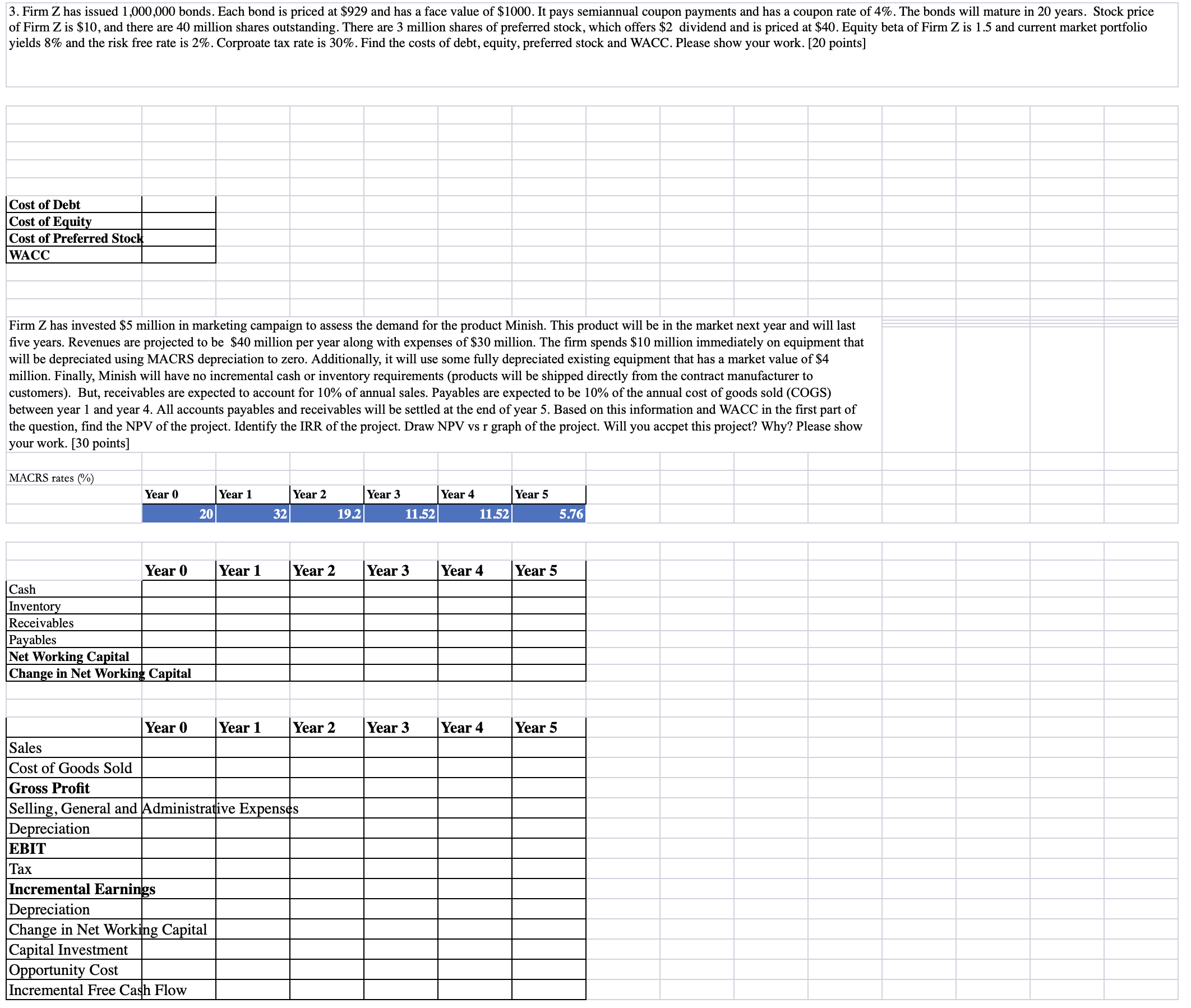

yields 8% and the risk free rate is 2%. Corproate tax rate is 30%. Find the costs of debt, equity, preferred stock and WACC. Please

yields 8% and the risk free rate is 2%. Corproate tax rate is 30%. Find the costs of debt, equity, preferred stock and WACC. Please show your work. [20 points] Firm Z has invested $5 million in marketing campaign to assess the demand for the product Minish. This product will be in the market next year and will last five years. Revenues are projected to be $40 million per year along with expenses of $30 million. The firm spends $10 million immediately on equipment that will be depreciated using MACRS depreciation to zero. Additionally, it will use some fully depreciated existing equipment that has a market value of $4 million. Finally, Minish will have no incremental cash or inventory requirements (products will be shipped directly from the contract manufacturer to customers). But, receivables are expected to account for 10% of annual sales. Payables are expected to be 10% of the annual cost of goods sold (COGS) between year 1 and year 4. All accounts payables and receivables will be settled at the end of year 5 . Based on this information and WACC in the first part of the question, find the NPV of the project. Identify the IRR of the project. Draw NPV vs r graph of the project. Will you accpet this project? Why? Please show your work. [ 30 points] MACRS rates (\%)

yields 8% and the risk free rate is 2%. Corproate tax rate is 30%. Find the costs of debt, equity, preferred stock and WACC. Please show your work. [20 points] Firm Z has invested $5 million in marketing campaign to assess the demand for the product Minish. This product will be in the market next year and will last five years. Revenues are projected to be $40 million per year along with expenses of $30 million. The firm spends $10 million immediately on equipment that will be depreciated using MACRS depreciation to zero. Additionally, it will use some fully depreciated existing equipment that has a market value of $4 million. Finally, Minish will have no incremental cash or inventory requirements (products will be shipped directly from the contract manufacturer to customers). But, receivables are expected to account for 10% of annual sales. Payables are expected to be 10% of the annual cost of goods sold (COGS) between year 1 and year 4. All accounts payables and receivables will be settled at the end of year 5 . Based on this information and WACC in the first part of the question, find the NPV of the project. Identify the IRR of the project. Draw NPV vs r graph of the project. Will you accpet this project? Why? Please show your work. [ 30 points] MACRS rates (\%) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started