Answered step by step

Verified Expert Solution

Question

1 Approved Answer

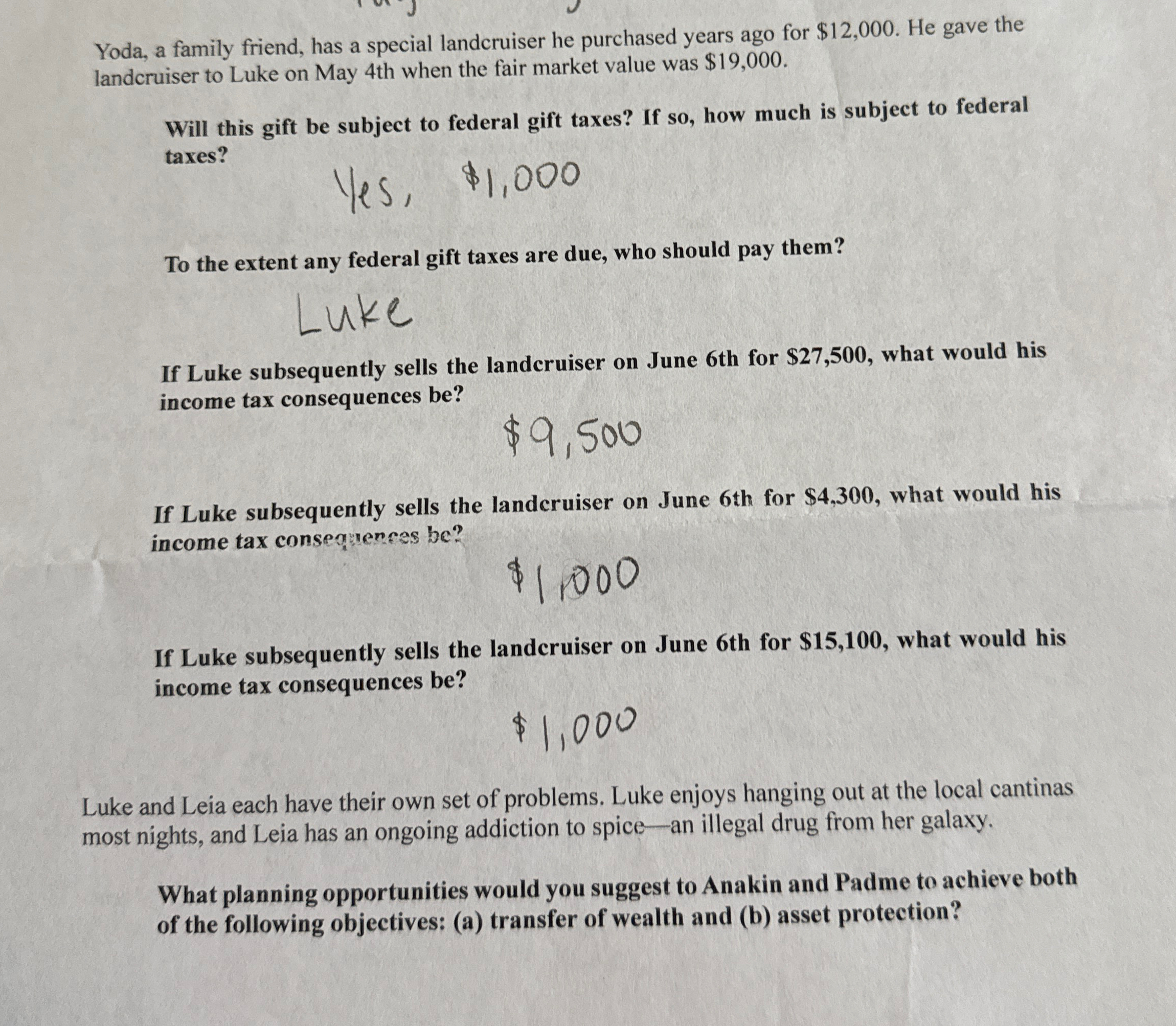

Yoda, a family friend, has a special landcruiser he purchased years ago for $ 1 2 , 0 0 0 . He gave the landcruiser

Yoda, a family friend, has a special landcruiser he purchased years ago for $ He gave the

landcruiser to Luke on May th when the fair market value was $

Will this gift be subject to federal gift taxes? If so how much is subject to federal

taxes?

To the extent any federal gift taxes are due, who should pay them?

If Luke subsequently sells the landeruiser on June th for $ what would his

income tax consequences be

If Luke subsequently sells the landeruiser on June th for $ what would his

income tax consegineneas be

If Luke subsequently sells the landcruiser on June th for $ what would his

income tax consequences be

Luke and Leia each have their own set of problems. Luke enjoys hanging out at the local cantinas

most nights, and Leia has an ongoing addiction to spicean illegal drug from her galaxy.

What planning opportunities would you suggest to Anakin and Padme to achieve both

of the following objectives: a transfer of wealth and b asset protection?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started