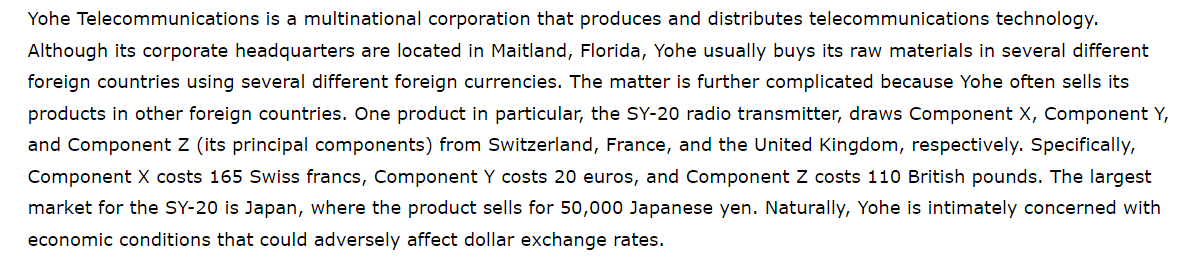

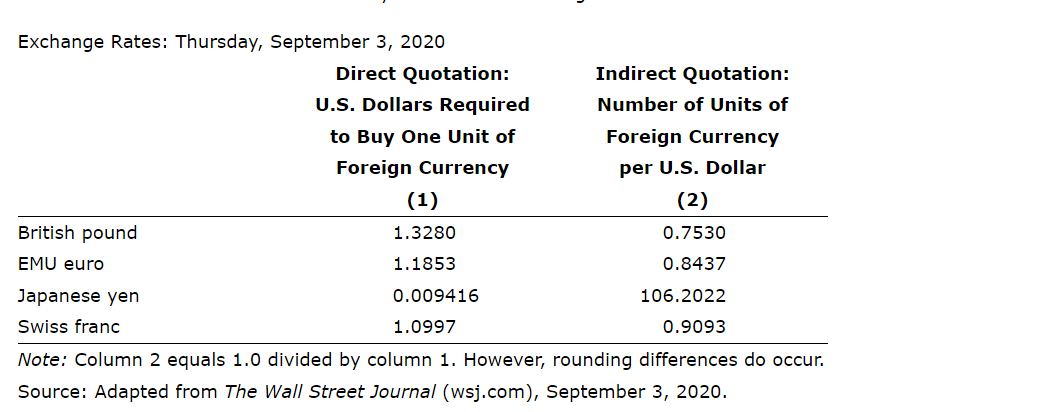

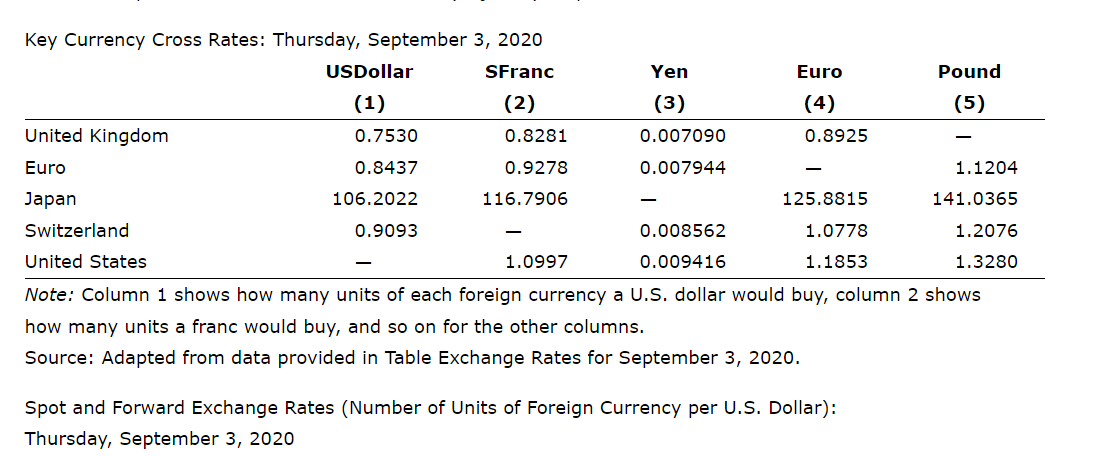

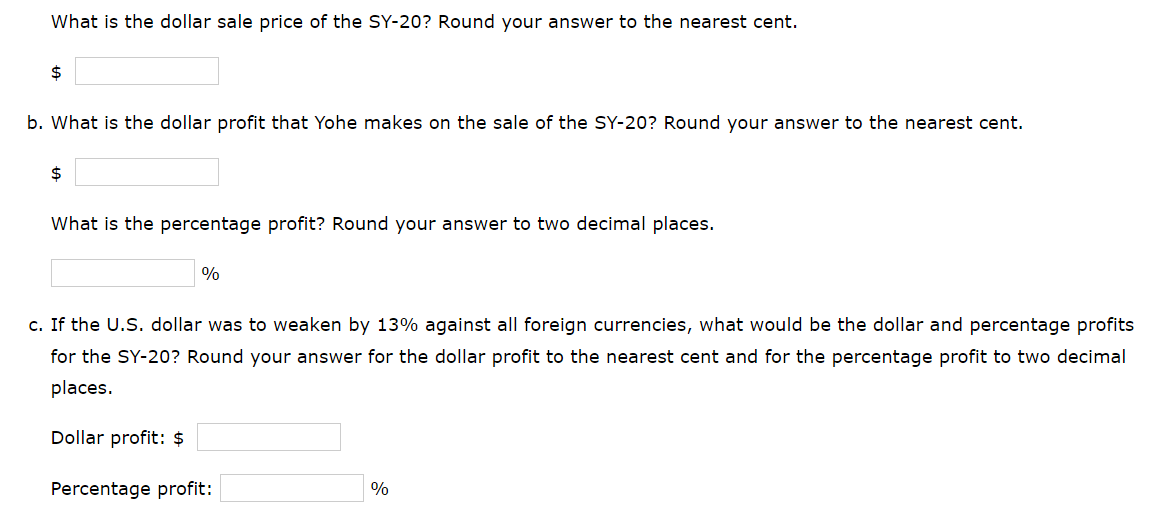

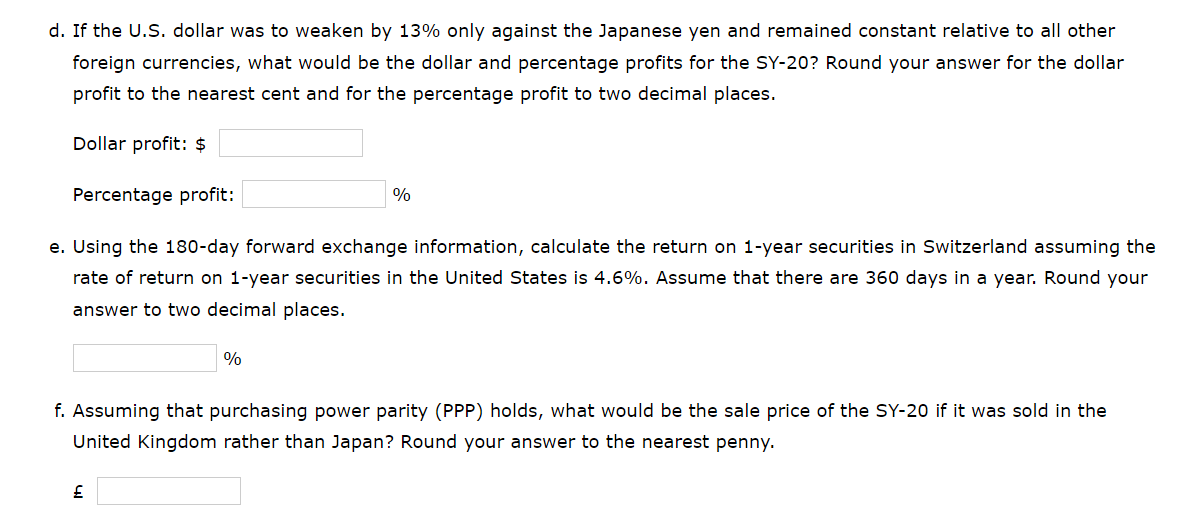

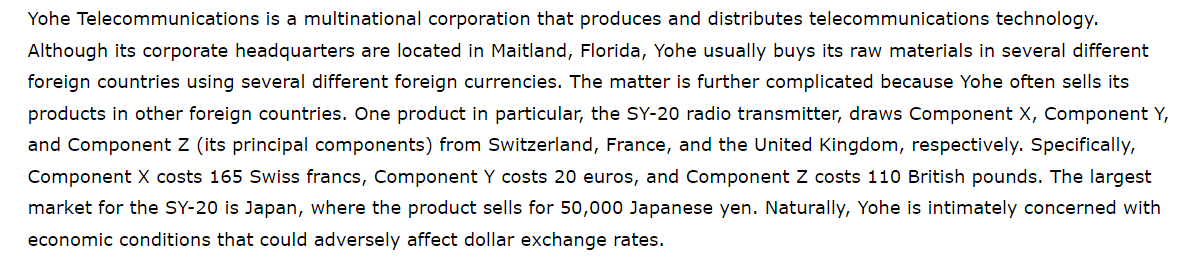

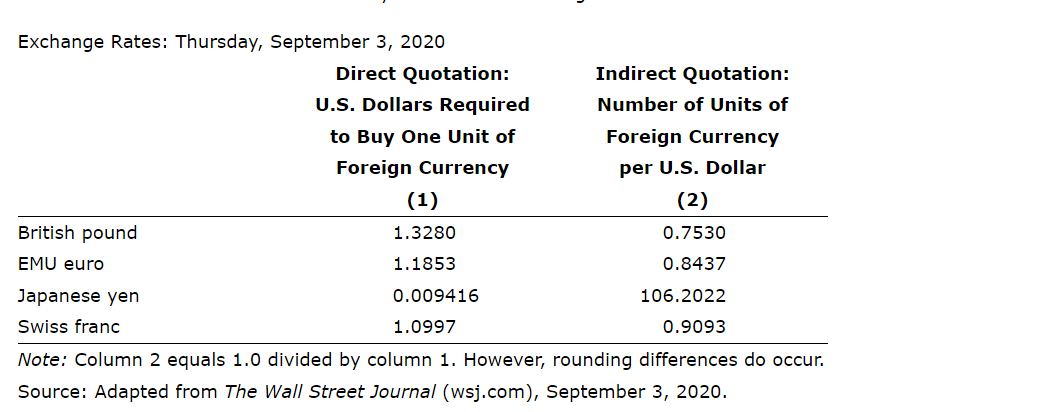

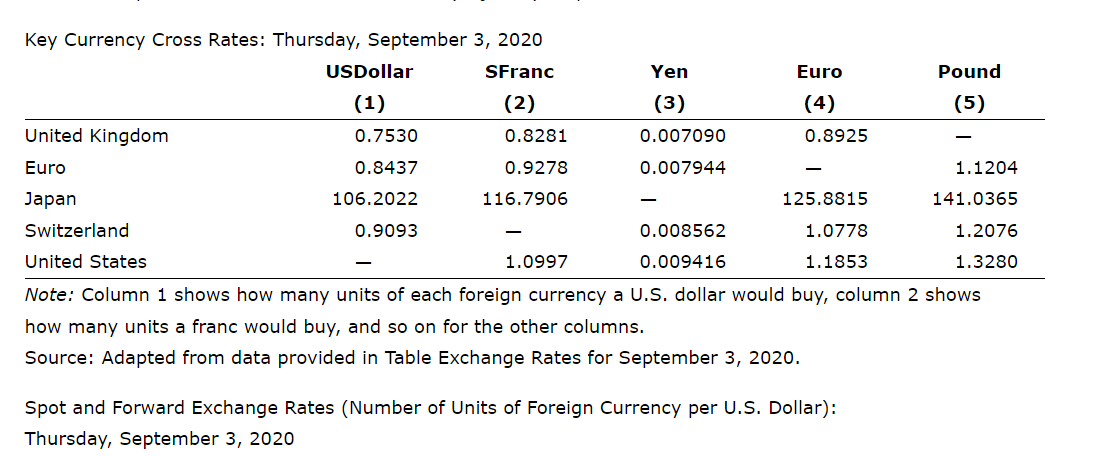

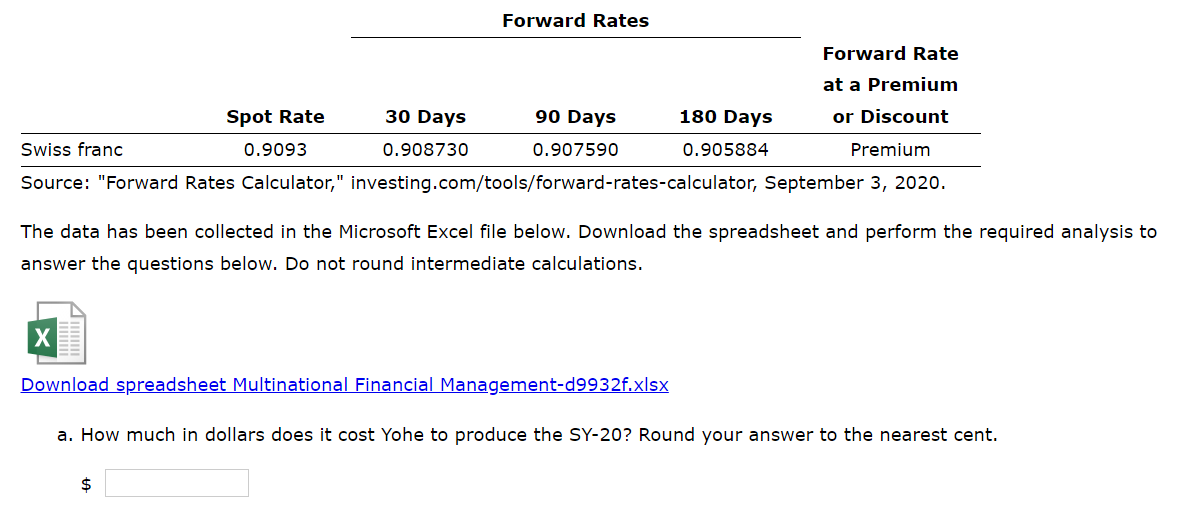

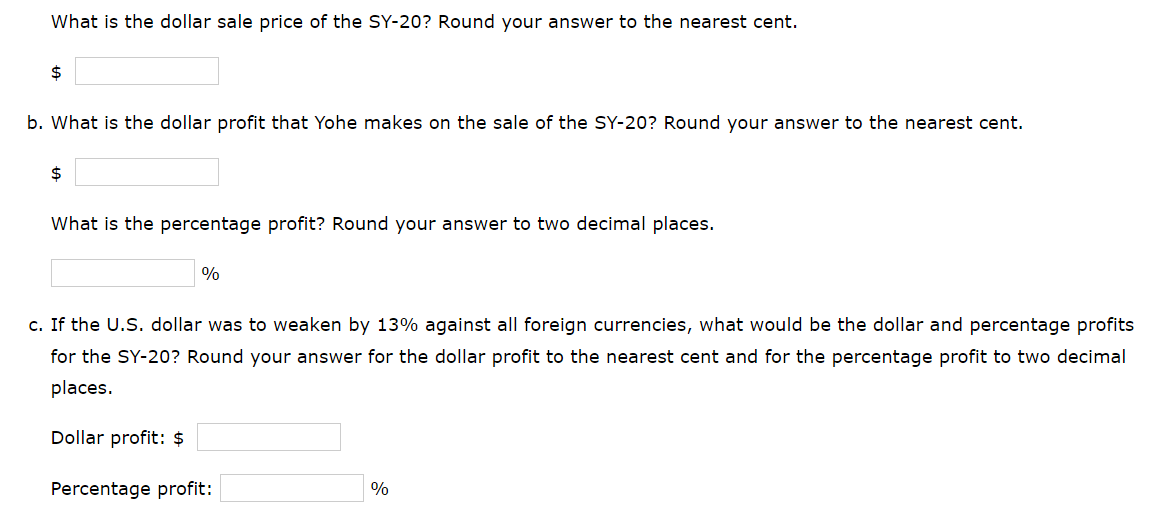

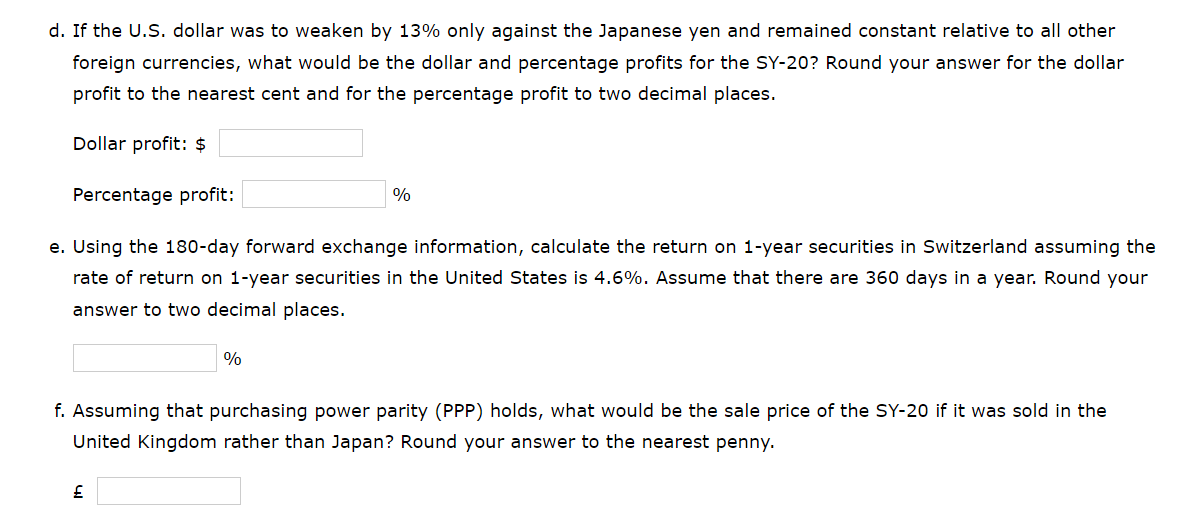

Yohe Telecommunications is a multinational corporation that produces and distributes telecommunications technology. Although its corporate headquarters are located in Maitland, Florida, Yohe usually buys its raw materials in several different foreign countries using several different foreign currencies. The matter is further complicated because Yohe often sells its products in other foreign countries. One product in particular, the SY-20 radio transmitter, draws Component X, Component Y, and Component z (its principal components) from Switzerland, France, and the United Kingdom, respectively. Specifically, Component X costs 165 Swiss francs, Component Y costs 20 euros, and Component z costs 110 British pounds. The largest market for the SY-20 is Japan, where the product sells for 50,000 Japanese yen. Naturally, Yohe is intimately concerned with economic conditions that could adversely affect dollar exchange rates. Exchange Rates: Thursday, September 3, 2020 Direct Quotation: U.S. Dollars Required to Buy One Unit of Foreign Currency (1) British pound 1.3280 EMU euro 1.1853 Japanese yen 0.009416 Swiss franc 1.0997 Indirect Quotation: Number of Units of Foreign Currency per U.S. Dollar (2) 0.7530 0.8437 106.2022 0.9093 Note: Column 2 equals 1.0 divided by column 1. However, rounding differences do occur. Source: Adapted from The Wall Street Journal (wsj.com), September 3, 2020. Yen Euro Pound (5) (1) (4) Key Currency Cross Rates: Thursday, September 3, 2020 USDollar SFranc (2) United Kingdom 0.7530 0.8281 Euro 0.8437 0.9278 Japan 106.2022 116.7906 Switzerland 0.9093 (3) 0.007090 0.8925 0.007944 1.1204 125.8815 141.0365 0.008562 1.0778 1.2076 United States 1.0997 0.009416 1.1853 1.3280 Note: Column 1 shows how many units of each foreign currency a U.S. dollar would buy, column 2 shows how many units a franc would buy, and so on for the other columns. Source: Adapted from data provided in Table Exchange Rates for September 3, 2020. Spot and Forward Exchange Rates (Number of Units of Foreign Currency per U.S. Dollar): Thursday, September 3, 2020 Forward Rates Forward Rate at a Premium Spot Rate 30 Days 90 Days 180 Days or Discount Swiss franc 0.9093 0.908730 0.907590 0.905884 Premium Source: "Forward Rates Calculator," investing.com/tools/forward-rates-calculator, September 3, 2020. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Download spreadsheet Multinational Financial Management-d9932f.xlsx a. How much in dollars does it cost Yohe to produce the SY-20? Round your answer to the nearest cent. $ What is the dollar sale price of the SY-20? Round your answer to the nearest cent. $ b. What is the dollar profit that Yohe makes on the sale of the SY-20? Round your answer to the nearest cent. $ What is the percentage profit? Round your answer to two decimal places. % c. If the U.S. dollar was to weaken by 13% against all foreign currencies, what would be the dollar and percentage profits for the SY-20? Round your answer for the dollar profit to the nearest cent and for the percentage profit to two decimal places. Dollar profit: $ Percentage profit: % d. If the U.S. dollar was to weaken by 13% only against the Japanese yen and remained constant relative to all other foreign currencies, what would be the dollar and percentage profits for the SY-20? Round your answer for the dollar profit to the nearest cent and for the percentage profit to two decimal places. Dollar profit: $ Percentage profit: % e. Using the 180-day forward exchange information, calculate the return on 1-year securities in Switzerland assuming the rate of return on 1-year securities in the United States is 4.6%. Assume that there are 360 days in a year. Round your answer to two decimal places. % f. Assuming that purchasing power parity (PPP) holds, what would be the sale price of the SY-20 if it was sold in the United Kingdom rather than Japan? Round your answer to the nearest penny. Yohe Telecommunications is a multinational corporation that produces and distributes telecommunications technology. Although its corporate headquarters are located in Maitland, Florida, Yohe usually buys its raw materials in several different foreign countries using several different foreign currencies. The matter is further complicated because Yohe often sells its products in other foreign countries. One product in particular, the SY-20 radio transmitter, draws Component X, Component Y, and Component z (its principal components) from Switzerland, France, and the United Kingdom, respectively. Specifically, Component X costs 165 Swiss francs, Component Y costs 20 euros, and Component z costs 110 British pounds. The largest market for the SY-20 is Japan, where the product sells for 50,000 Japanese yen. Naturally, Yohe is intimately concerned with economic conditions that could adversely affect dollar exchange rates. Exchange Rates: Thursday, September 3, 2020 Direct Quotation: U.S. Dollars Required to Buy One Unit of Foreign Currency (1) British pound 1.3280 EMU euro 1.1853 Japanese yen 0.009416 Swiss franc 1.0997 Indirect Quotation: Number of Units of Foreign Currency per U.S. Dollar (2) 0.7530 0.8437 106.2022 0.9093 Note: Column 2 equals 1.0 divided by column 1. However, rounding differences do occur. Source: Adapted from The Wall Street Journal (wsj.com), September 3, 2020. Yen Euro Pound (5) (1) (4) Key Currency Cross Rates: Thursday, September 3, 2020 USDollar SFranc (2) United Kingdom 0.7530 0.8281 Euro 0.8437 0.9278 Japan 106.2022 116.7906 Switzerland 0.9093 (3) 0.007090 0.8925 0.007944 1.1204 125.8815 141.0365 0.008562 1.0778 1.2076 United States 1.0997 0.009416 1.1853 1.3280 Note: Column 1 shows how many units of each foreign currency a U.S. dollar would buy, column 2 shows how many units a franc would buy, and so on for the other columns. Source: Adapted from data provided in Table Exchange Rates for September 3, 2020. Spot and Forward Exchange Rates (Number of Units of Foreign Currency per U.S. Dollar): Thursday, September 3, 2020 Forward Rates Forward Rate at a Premium Spot Rate 30 Days 90 Days 180 Days or Discount Swiss franc 0.9093 0.908730 0.907590 0.905884 Premium Source: "Forward Rates Calculator," investing.com/tools/forward-rates-calculator, September 3, 2020. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Download spreadsheet Multinational Financial Management-d9932f.xlsx a. How much in dollars does it cost Yohe to produce the SY-20? Round your answer to the nearest cent. $ What is the dollar sale price of the SY-20? Round your answer to the nearest cent. $ b. What is the dollar profit that Yohe makes on the sale of the SY-20? Round your answer to the nearest cent. $ What is the percentage profit? Round your answer to two decimal places. % c. If the U.S. dollar was to weaken by 13% against all foreign currencies, what would be the dollar and percentage profits for the SY-20? Round your answer for the dollar profit to the nearest cent and for the percentage profit to two decimal places. Dollar profit: $ Percentage profit: % d. If the U.S. dollar was to weaken by 13% only against the Japanese yen and remained constant relative to all other foreign currencies, what would be the dollar and percentage profits for the SY-20? Round your answer for the dollar profit to the nearest cent and for the percentage profit to two decimal places. Dollar profit: $ Percentage profit: % e. Using the 180-day forward exchange information, calculate the return on 1-year securities in Switzerland assuming the rate of return on 1-year securities in the United States is 4.6%. Assume that there are 360 days in a year. Round your answer to two decimal places. % f. Assuming that purchasing power parity (PPP) holds, what would be the sale price of the SY-20 if it was sold in the United Kingdom rather than Japan? Round your answer to the nearest penny.