Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Yorkton Supply Company is a partnership with net income of $123,000 and needs to split this between partners Moonias Melbourne and Sharmila Sajjad. As

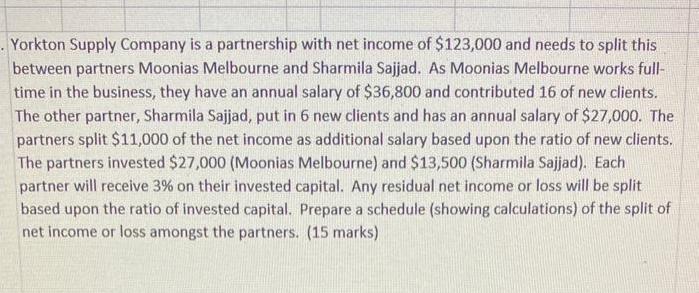

Yorkton Supply Company is a partnership with net income of $123,000 and needs to split this between partners Moonias Melbourne and Sharmila Sajjad. As Moonias Melbourne works full- time in the business, they have an annual salary of $36,800 and contributed 16 of new clients. The other partner, Sharmila Sajjad, put in 6 new clients and has an annual salary of $27,000. The partners split $11,000 of the net income as additional salary based upon the ratio of new clients. The partners invested $27,000 (Moonias Melbourne) and $13,500 (Sharmila Sajjad). Each partner will receive 3% on their invested capital. Any residual net income or loss will be split based upon the ratio of invested capital. Prepare a schedule (showing calculations) of the split of net income or loss amongst the partners. (15 marks)

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the split of net income or loss among the partners we need to consider the following factors 1 Annual salary of each partner 2 Contributi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started