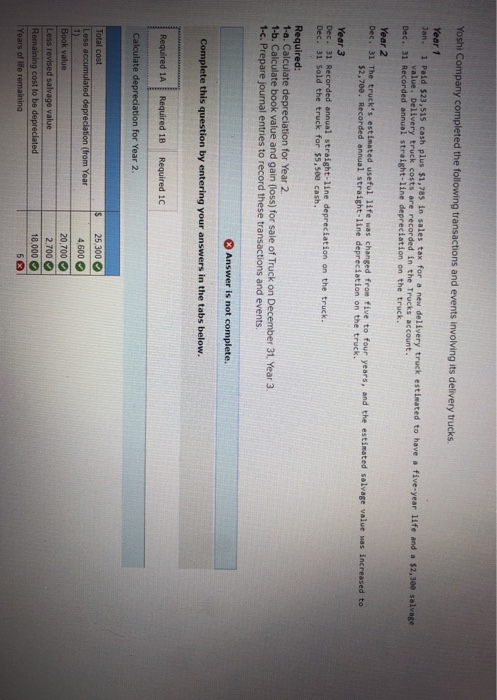

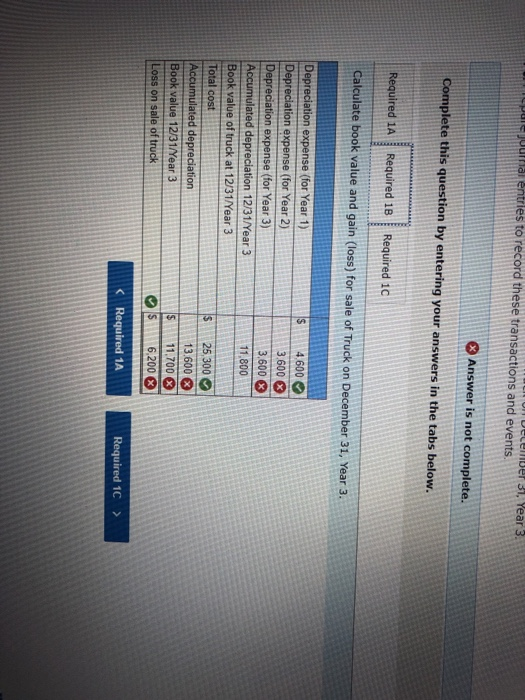

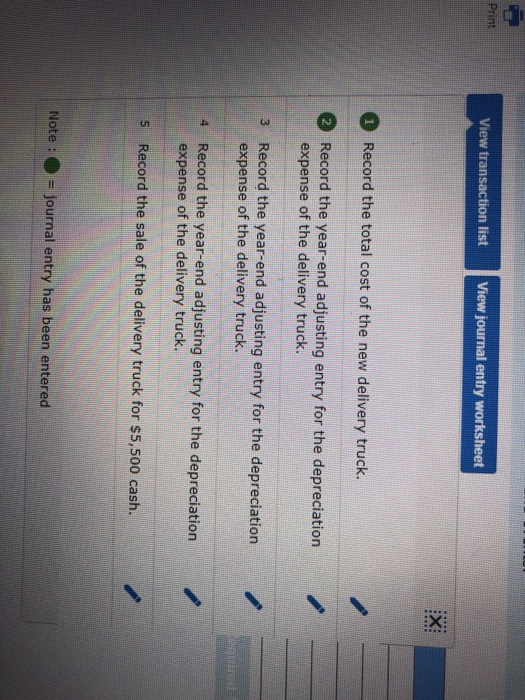

Yoshi Company completed the following transactions and events involving its delivery trucks Year 1 Jan. 1 Paid $23,515 cash plus $1,785 in sales tax for a new delivery truck estimated to have a five-year life and a $2,300 salvage value. Delivery truck costs are recorded in the Trucks account. Dec. 31 Recorded annual straight-line depreciation on the truck. Year 2 Dec. 31 The truck's estimated useful life was changed from five to four years, and the estimated salvage value was increased to $2,700. Recorded annual straight-line depreciation on the truck. Year 3 Dec. 31 Recorded annual straight-line depreciation on the truck. Dec. 31 Sold the truck for $5,500 cash. Required: 1-a. Calculate depreciation for Year 2 1-b. Calculate book value and gain (loss) for sale of Truck on December 31, Year 3 1-c. Prepare journal entries to record these transactions and events. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 1C Calculate depreciation for Year 2. S 25 300 Total cost Less accumulated depreciation (from Year 4,600 Book value Less revised salvage value Remaining cost to be depreciated Years of life remaining 20,700 2.700 18,000 OOOO ember 31, Year 3 DU- juural entries to record these transactions and events Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 10 Calculate book value and gain (loss) for sale of Truck on December 31, Year 3. IS 4.600 3.600 X 3.600 11,800 Depreciation expense (for Year 1) Depreciation expense (for Year 2) Depreciation expense (for Year 3) Accumulated depreciation 12/31/Year 3 Book value of truck at 12/31/Year 3 Total cost Accumulated depreciation Book value 12/31/Year 3 Loss on sale of truck $ 25 300 $ 13.600 11.700 X 6,200 X Print View transaction list View journal entry worksheet X: RRRR Record the total cost of the new delivery truck. 2 Record the year-end adjusting entry for the depreciation expense of the delivery truck. 3 Record the year-end adjusting entry for the depreciation expense of the delivery truck. 4 Record the year-end adjusting entry for the depreciation expense of the delivery truck. 5 Record the sale of the delivery truck for $5,500 cash. Note: = journal entry has been entered