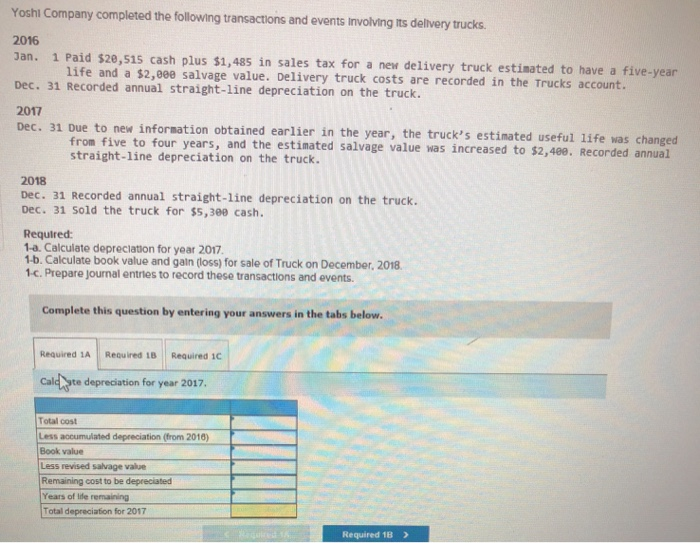

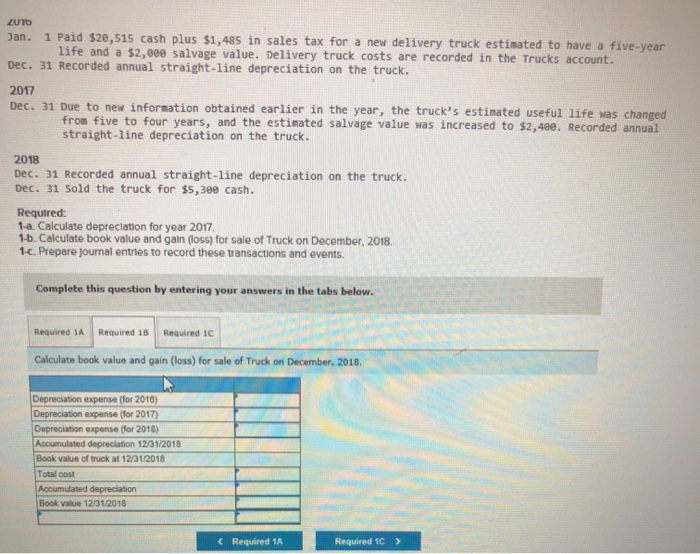

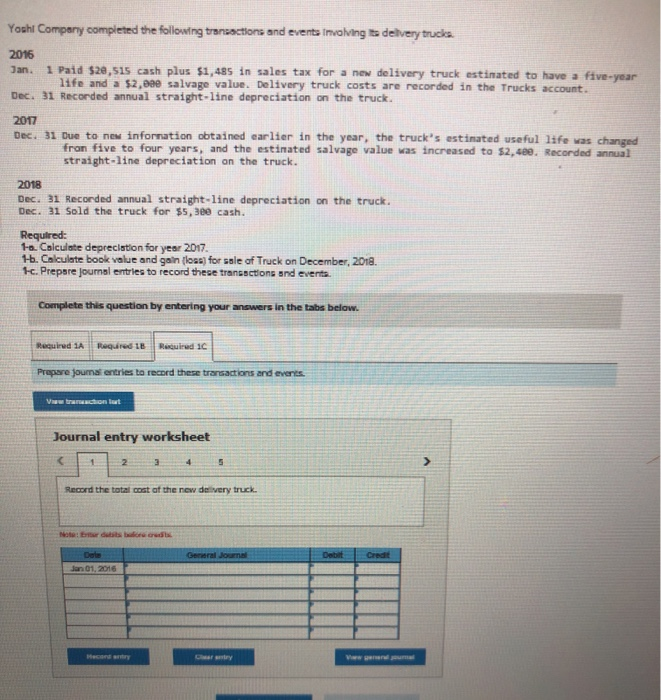

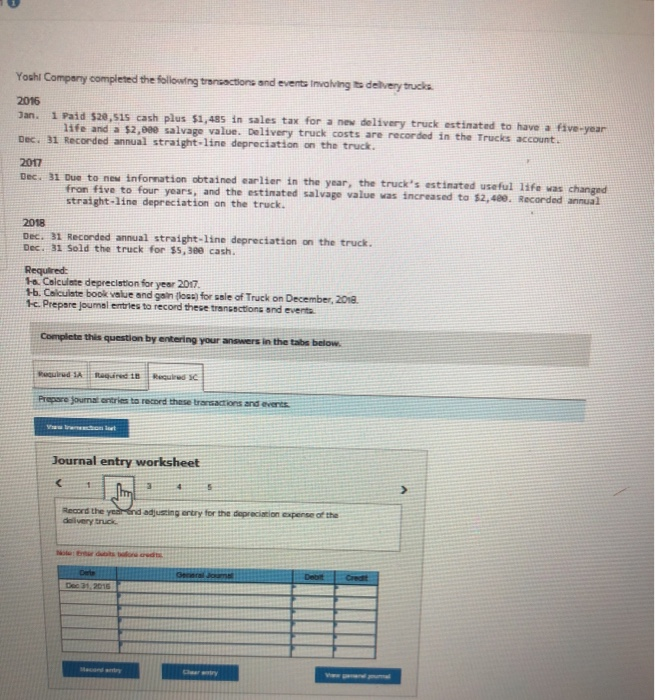

Yoshi Company completed the following transactions and events Involving its delivery trucks 2016 Jan. 1 Paid $20,515 cash plus $1,485 in sales tax for a new delivery truck estimated to have a five-year life and a $2,00e salvage value. Delivery truck costs are recorded in the Trucks account. Dec. 31 Recorded annual straight- line depreciation on the truck. 2017 Dec. 31 Due to new information obtained earlier in the year, the truck's estimated useful life was changed from five to four years, and the estimated salvage value was increased to $2,400. Recorded annual straight-line depreciation on the truck. 2018 Dec. 31 Recorded annual straight -line depreciation on the truck. Dec. 31 Sold the truck for $5,300 cash. Required: 1-a. Calculate depreciation for year 2017 1-b. Calculate book value and galn (loss) for sale of Truck on December, 2018. 1c. Prepare journal entries to record these transactions and events. Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 1C Calc te depreciation for year 2017. Total cost Less accumulated depreciation (from 2018) Book value Less revised salvage value Remaining cost to be depreciated Years of life remaining Total depreciation for 2017 Required 1B 1 Paid $20,515 cash plus $1,485 in sales tax for a new delivery truck estimated to have a five-year life and a $2,000 salvage value. Delivery truck costs are recorded in the Trucks account. Jan. Dec. 31 Recorded annual straight - line depreciation on the truck. 2017 Dec. 31 Due to new information obtained earlier in the year, the truck's estinated useful life was changed from five to four years, and the estimated salvage value was increased to $2,400. Recorded annual straight-line depreciation on the truck. 2018 Dec. 31 Recorded annual straight - line depreciation on the truck. Dec. 31 Sold the truck for $s,30e cash. Required: 1-a. Calculate depreclation for year 2017 1-b. Calculate book value and gain (loss) for sale of Truck on December, 2018. 1c. Prepare journal entries to record these transactions and events. Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 1C Calculate book value and gain (loss) for sale of Truck on December, 2018. Depreciation expense (for 2016) Depreciation expense (for 2017) Depreciation expense (for 2018) Accumulated depreciation 12/31/2018 Book value of truck at 12/31/2018 Total cost Accumulated depreciation Book value 12/31/2018 Required 1A Required 1C Yoshi Company completed the following transactions and events Invalving its delvery trucks 2016 1 Paid $20,515 cash plus $1,485 in sales tax for a new delivery truck estinated to have a life and a $2,eee salvage value. Delivery truck costs are recorded in the Trucks account. Jan. five-year Dec. 31 Recorded annual straight-line depreciation on the truck. 2017 Dec. 31 Due to new infornation obtained earlier in the year, the truck's estinated useful life was changed fron five to four years, and the estinated salvage value was increased to $2,480. Recorded annual straight-line depreciation an the truck. 2018 Dec. 31 Recorded annual straight-line depreciation on the truck. Dec. 31 Sold the truck for $5,300 cash. Required: 1-a. Calculate depreciation for year 2017. 1-b. Calculate book value and gain (loas) for sale of Truck on December, 2018. c. Prepare jourmal entries to record these transsctions and events. Complete this question by entering your answers i in the tabs below. Required 1A Required 18 Ruired 1C Prepare jouma entries to record these transactions and events Va tranachon lt Journal entry worksheet 4 Record the total cost af the new delivery truck Note: Er dusts balore credts Dele Debit General Journa Credt Jan 01, 2016 Hecent antry Ce try Vw geend uma Youhl Company completed the followtng transactions and events Invahving ts delvery trucks 2016 1 Paid $20,515S cash plus $1, 485 in sales tax for a new delivery truck estinated to have a five-year life and a $2,00e salvage value. Delivery truck costs are recorded in the Trucks account. Jan. Dec. 31 Recorded annual straight-line depreciation on the truck 2017 Dec. 31 Due to new information obtained earlier in the year, the truck's estinated useful life was changed fron five to four years, and the estinated salvage value was increased to $2,400. Recorded annual straight-line depreciation an the truck. 2018 Dec. 31 Recorded annual straight-line depreciation on the truck. Dec. 31 Sold the truck for $5,300 cash. Required: to Calculate deprecistion for year 2017 1b. Calculate book value and gain (loas) for sale of Truck on December, 2018 Prepare joumal entries to record these transactions and events Complete this question by entering your answers in the tabs below oquired 1A tagired 18Rqued SC Prepare journal ontries to record these transactions and evernts on lt t Journal entry worksheet Record the yea-nd adjuszing entry for the depreciation expense of the dellvery truck Note: r dubits boo edts Debit Credt Geel Joumst Del Dec 31, 2015 r y Macand atry Yosht Company completed the folloatng trensactions and events Involving its delvery trucks 2016 1 Paid $20,515 cash plus $1,485 in sales tax for a new delivery truck estinated to havea five-year life and a $2,000 salvage value. Delivery truck costs are recorded in the Trucks account. Jan, Dec. 31 Recorded annual straight-line depreciation on the truck. 2017 Dec. 31 Due to new information obtained earlier in the year, the truck"s estinated useful life was changed fron five to four years, and the estinated salvage value was increased to $2,480. Recorded annual straight-line depreciation an the truck 2018 Dec. 31 Recorded annual straight-line depreciation on the truck. Dec. 31 Sold the truck for $5, 300 cash. Required: 1a. Calculate deprecietion for year 2017 1-b. Calculate book value and gain (loss) for sale of Truck on December, 2018. Prepare jounal entries to record these transactions and events Complete this question by entering your answers in the tabs below. Ruid 1A Rquired 18 ud sc Propare journal antries to record these transactions and averts V tra on lt Journal entry worksheet 1 25 4 Record the year-end adjing entry for the depraciation experse of the delivery truck. No: Er dubits boe edts Debit Credt Dele General Jourma Dec 31, 2017 u Mecard ny Vw Cantry Required 10 Yoshi Compeny completed the following tranuactions and eventa Invalving ts delvery trucks 2016 1 Paid $20,515 cash plus $1,485 in sales tax for a new delivery truck estinated to have a five-year life and a $2,000 salvage value. Delivery truck costs are recorded in the Trucks account.. Jan. Dec. 31 Recorded annual straight-line depreciation on the truck. 2017 Dec. 31 Due to new information obtained earlier in the year, the truck's estinated useful life was changed fron five to four years, and the estinated salvage value was increased to $2,480. Recorded annual straight-line depreciation an the truck. 2018 Dec. 31 Recorded annual straight-line depreciation Dec. 31 Sold the truck for $5,300 cash on the truck Requlred: 1a. Calculate deprecistion for year 2017. 1-b. Calculate book value and gain (loas) for sale of Truck on December, 2018. 1c. Prepare jounal entrles to record these transsctions and events. Complete this question by entering your answers in the tabs below. Required 1A Raquired 18 Required SC Prepare jounal entries to record these transactions and events V tramcon t Journal entry worksheet 1 2 3 Record the year-end adjusting entry for the depreciation expense of the delivery truck Note: Er dubits bdor dis Dele Debit Oeneral Jourmal Credt Dec 31, 2018 Hacond anry Cer trys Vi mal Requred 18 Yoshi Company completed the followtng transactions and eventa Invalving its delvery trucks 2016 Jan. 1 Paid $28,515 cash plus $1,485 in sales tax for a new delivery truck estinated to have a five-year life and a $2,eee salvage value. Delivery truck costs are recorded in the Trucks account. Dec. 31 Recorded annual straight-line depreciation on the truck. 2017 Dec. 31 Due to new information obtained earlier in the year, the truck's estinated useful life was changed fron five to four years, and the estinated salvage value was increased to $2, 480. Recorded annual straight-line depreciation on the truck. 2018 Dec. 31 Recorded annual straight-line depreciation on the truck. Dec. 31 Sold the truck for $5,30e cash. Required: 1a Calculate depreciation for year 2017. 1-b. Calculate book value and gain (loss) for sale of Truck on December, 2018. k. Prepare joumal entrles to record these transsctions and everts Complete this question by entering your answers in the tabs below. Raquired SA Raqured 1 Required 3C Propare jourma entries to record these transactions and events V ta chon trt Journal entry worksheet 2 4 Record the sale of the delivery truck for 5,300 cash NotEr dubits b adts Dele General Joama Debit Credt Dec 31,2018 Med any um V