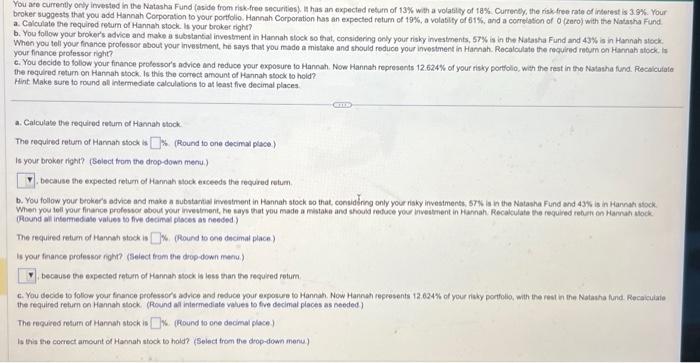

You ace currently ony invested in the Natasha Fund (aside from riskfree securitiesk it has an expected return of 13% with a volatily of 18%. Currerely, the risk free rate of irterest is 3.9%. Your. broker suggests that you add Hannah Corporation to your portflio. Hannah Corporation has an expected return of 19%, a volabily of 61%, and a correlasion of of (zerof with the Natasha Fund. a. Calculate the required tetum of Hannah stock. is your broker right? b. You follow your brober's advice and make a substantial investment in Harnah stock so that, considering only your risky investments, 57% is in the Natasha Fund and 43% is in Hannah atock. When you tell your finance professor about your investmont, he says that you mado a mistake and should roduco your investmert in Harnah. Rocaloulate the required nebum on Hannah atock. Is your finance professor night? c. You decide to follow your finance protessor's advice and reduce your exposure to Hannah. Now Hannah represents 12.624% of your risky porttolio, with the rest in the Natasha funa. Recalcutate the required return on Hannah stock. Is this the correct amount of Hannah stock to hold? Hint Make sure to round at intermediste calculations to at least five decimal places. a. Calculate the required retum of Hannah stock: The required retum of Harnan stock is is. (Round to one decimal pisce) Is your broker right? (Bolect from the drop-down menu.) because the expected return of Harnah sock eaceeds the required rotum. b. You follow your beoker's advice and make a substamal investment in Hannah stock so that, considining only your riaky investmenth, s7s is in the Natasha Fund and 43% is in Harnah ulock. When you leil your finance professor about your invetiment, he says that you made a miktake and should reduce your investrnent in Hamah. Recalculate the reguired rehart on Harmah ulock. (Round all intemedase values to five decimal ploces as needed? The required retum of Hannah stock is \$. (Round to cone dncimal place) is your feance professor fight? (Select trom the dop down menu.) because the expected robern of Hannah sock is less than the requied roturn. c. You decide to folowe your frnance protessors advice and reduce your erpowes to Hannan. Now Hanneh reprosents 12.624% of your risky portolio, with the rest in the Nataatha fund. Recakuiale the required return on Harnah stock. (Round al intermediate values to five decimal places as needed) The requeed retum of Hannah steck is IS. (Round to one decimal place) Is tha she correct amount of Harnah stock bo hold? (Select from the drop-iown menu)