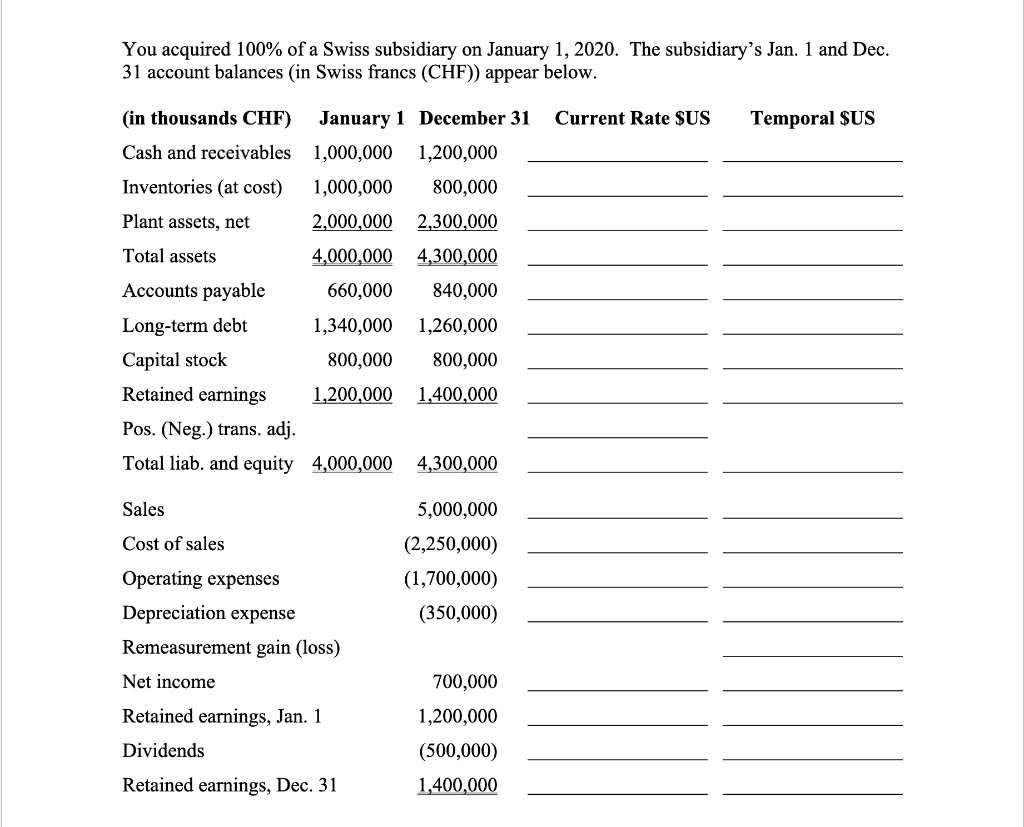

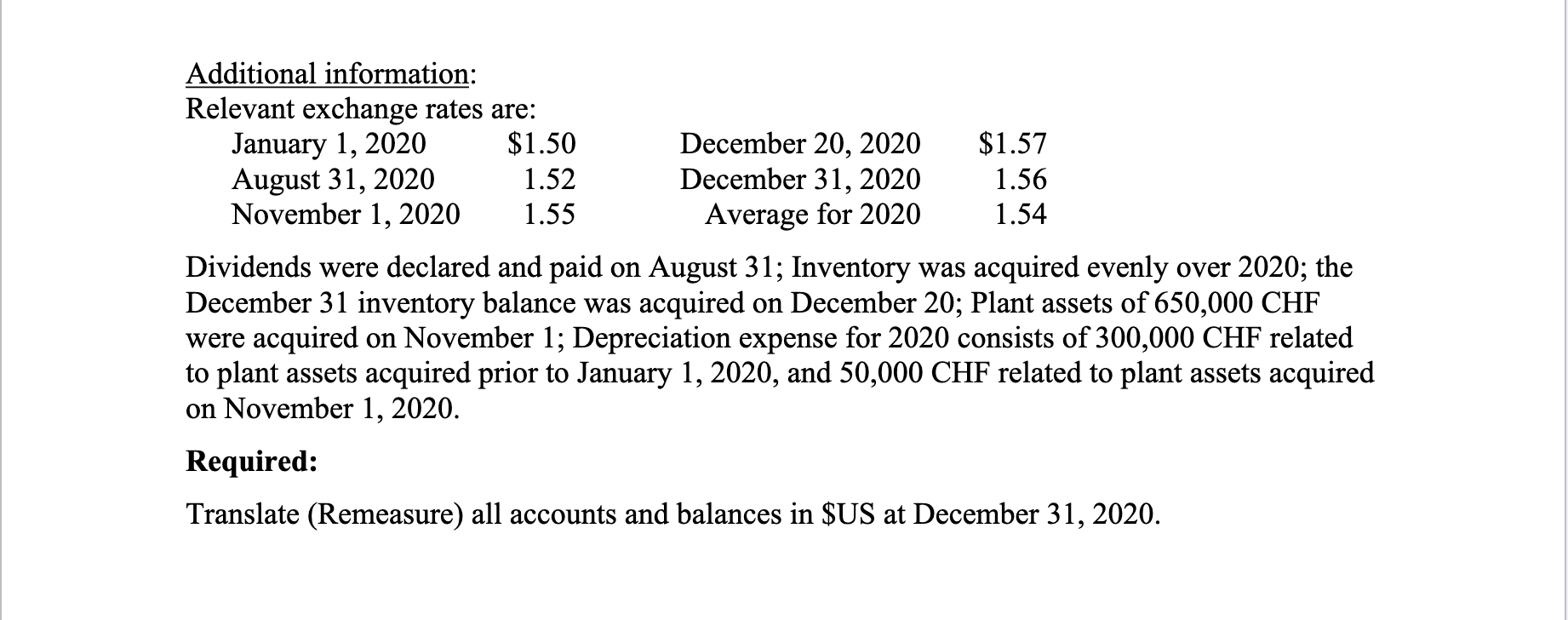

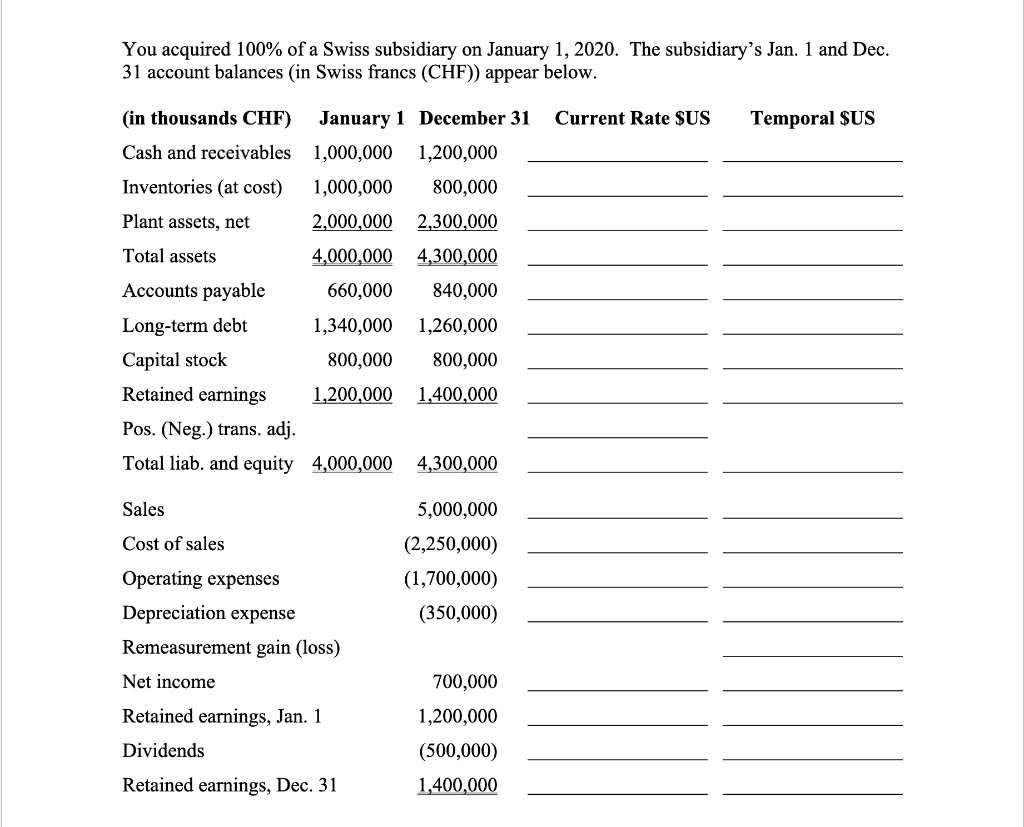

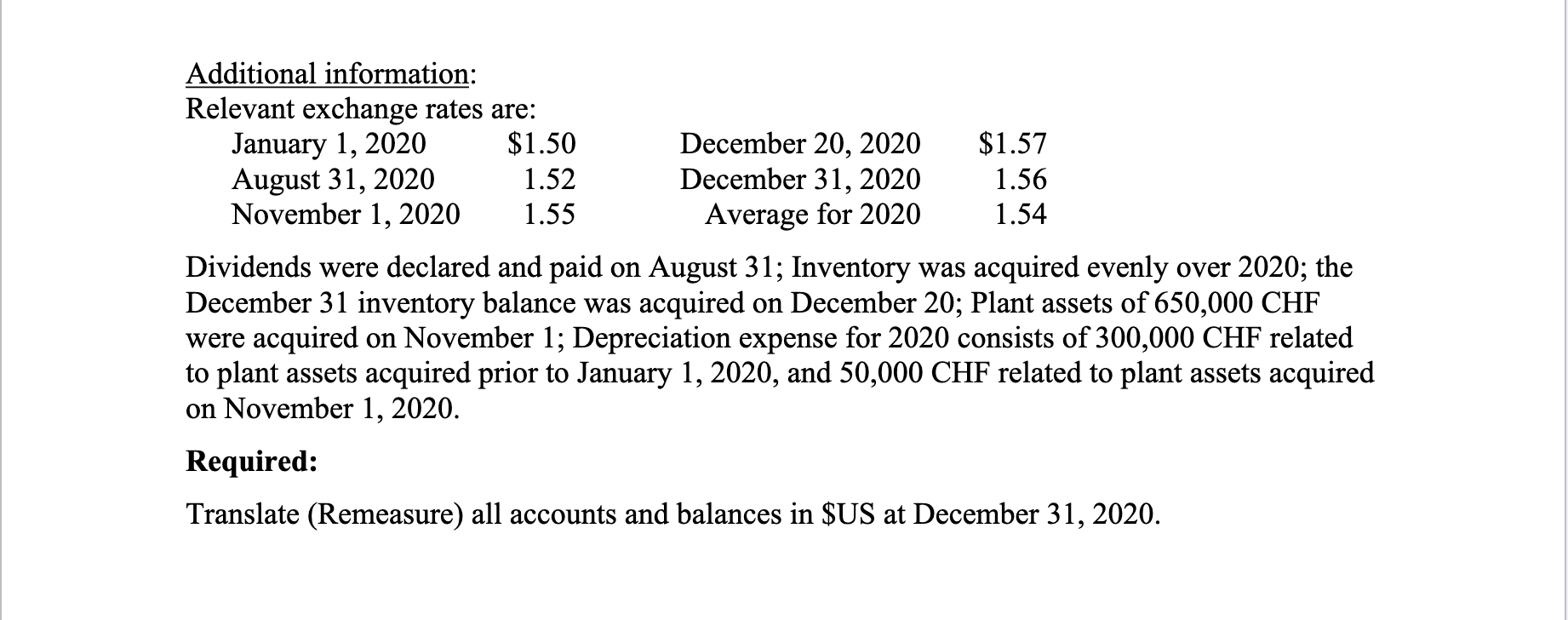

You acquired 100% of a Swiss subsidiary on January 1, 2020. The subsidiary's Jan. 1 and Dec. 31 account balances in Swiss francs (CHF)) appear below. Current Rate $US Temporal $US (in thousands CHF) Cash and receivables Inventories (at cost) Plant assets, net Total assets January 1 December 31 1,000,000 1,200,000 1,000,000 800,000 2,000,000 2,300,000 4,000,000 4,300,000 660,000 840,000 1,340,000 1,260,000 800,000 800,000 1,200,000 1,400,000 Accounts payable Long-term debt Capital stock Retained earnings Pos. (Neg.) trans. adj. Total liab. and equity 4,000,000 4,300,000 Sales 5,000,000 (2,250,000) (1,700,000) (350,000) Cost of sales Operating expenses Depreciation expense Remeasurement gain (loss) Net income Retained earnings, Jan. 1 700,000 1,200,000 (500,000) 1,400,000 Dividends Retained earnings, Dec. 31 Additional information: Relevant exchange rates are: January 1, 2020 $1.50 December 20, 2020 $1.57 August 31, 2020 1.52 December 31, 2020 1.56 November 1, 2020 1.55 Average for 2020 1.54 Dividends were declared and paid on August 31; Inventory was acquired evenly over 2020; the December 31 inventory balance was acquired on December 20; Plant assets of 650,000 CHF were acquired on November 1; Depreciation expense for 2020 consists of 300,000 CHF related to plant assets acquired prior to January 1, 2020, and 50,000 CHF related to plant assets acquired on November 1, 2020. Required: Translate (Remeasure) all accounts and balances in $US at December 31, 2020. You acquired 100% of a Swiss subsidiary on January 1, 2020. The subsidiary's Jan. 1 and Dec. 31 account balances in Swiss francs (CHF)) appear below. Current Rate $US Temporal $US (in thousands CHF) Cash and receivables Inventories (at cost) Plant assets, net Total assets January 1 December 31 1,000,000 1,200,000 1,000,000 800,000 2,000,000 2,300,000 4,000,000 4,300,000 660,000 840,000 1,340,000 1,260,000 800,000 800,000 1,200,000 1,400,000 Accounts payable Long-term debt Capital stock Retained earnings Pos. (Neg.) trans. adj. Total liab. and equity 4,000,000 4,300,000 Sales 5,000,000 (2,250,000) (1,700,000) (350,000) Cost of sales Operating expenses Depreciation expense Remeasurement gain (loss) Net income Retained earnings, Jan. 1 700,000 1,200,000 (500,000) 1,400,000 Dividends Retained earnings, Dec. 31 Additional information: Relevant exchange rates are: January 1, 2020 $1.50 December 20, 2020 $1.57 August 31, 2020 1.52 December 31, 2020 1.56 November 1, 2020 1.55 Average for 2020 1.54 Dividends were declared and paid on August 31; Inventory was acquired evenly over 2020; the December 31 inventory balance was acquired on December 20; Plant assets of 650,000 CHF were acquired on November 1; Depreciation expense for 2020 consists of 300,000 CHF related to plant assets acquired prior to January 1, 2020, and 50,000 CHF related to plant assets acquired on November 1, 2020. Required: Translate (Remeasure) all accounts and balances in $US at December 31, 2020