Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You acquired 85 percent of the outstanding voting shares of Gleason, Inc., on December 31, 2018. You paid a total of $ 651,950 in

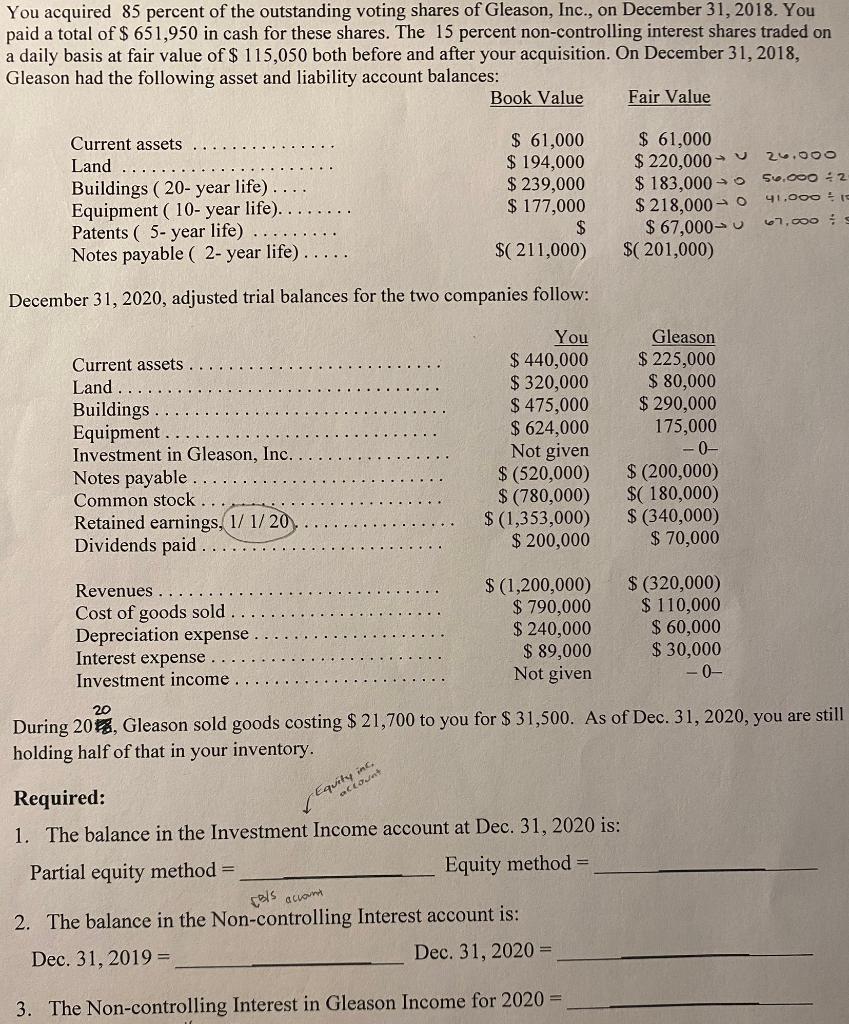

You acquired 85 percent of the outstanding voting shares of Gleason, Inc., on December 31, 2018. You paid a total of $ 651,950 in cash for these shares. The 15 percent non-controlling interest shares traded on a daily basis at fair value of $ 115,050 both before and after your acquisition. On December 31, 2018, Gleason had the following asset and liability account balances: Book Value Current assets Land $ 61,000 Buildings (20- year life). . . . Equipment (10-year life). Patents (5-year life) $ 194,000 $ 239,000 $177,000 $ Notes payable ( 2- year life)..... $(211,000) December 31, 2020, adjusted trial balances for the two companies follow: You $440,000 $ 320,000 $ 475,000 $ 624,000 Not given $ (520,000) $ (780,000) $ (1,353,000) $ 200,000 Current assets Land Buildings. Equipment. Investment in Gleason, Inc. Notes payable Common stock Retained earnings, 1/1/20 Dividends paid Revenues Cost of goods sold Depreciation expense. Interest expense Investment income $ (1,200,000) $790,000 $ 240,000 $ 89,000 Not given. inc, Equity unt Fair Value $ 61,000 $220,000 $183,000 $218,000 $ 67,000- $(201,000) Required: 1. The balance in the Investment Income account at Dec. 31, 2020 is: Partial equity method= Equity method= 2. The balance in the Non-controlling Interest account is: ce/s account Dec. 31, 2019 = Dec. 31, 2020 = 3. The Non-controlling Interest in Gleason Income for 2020 = Gleason $225,000 $80,000 $ 290,000 175,000 -0- $ (200,000) $(180,000) $ (340,000) $70,000 20 During 2018, Gleason sold goods costing $ 21,700 to you for $ 31,500. As of Dec. 31, 2020, you are still holding half of that in your inventory. $ (320,000) $ 110,000 $ 60,000 $30,000 -0- 26.000 56.000 2- 41.000 12 67,000 S

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

I Calculation of Balance in invetment account at 31st December 2020 Working Note Profit of Gleasons ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started