Answered step by step

Verified Expert Solution

Question

1 Approved Answer

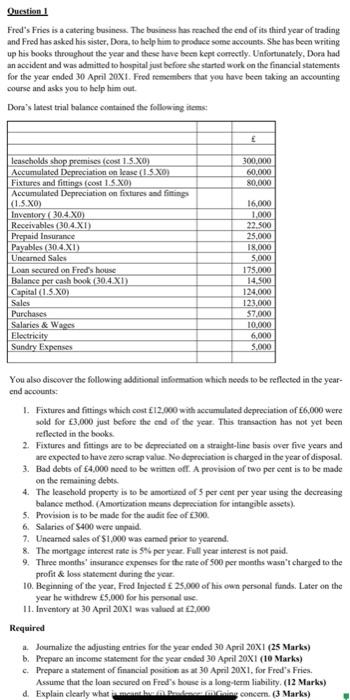

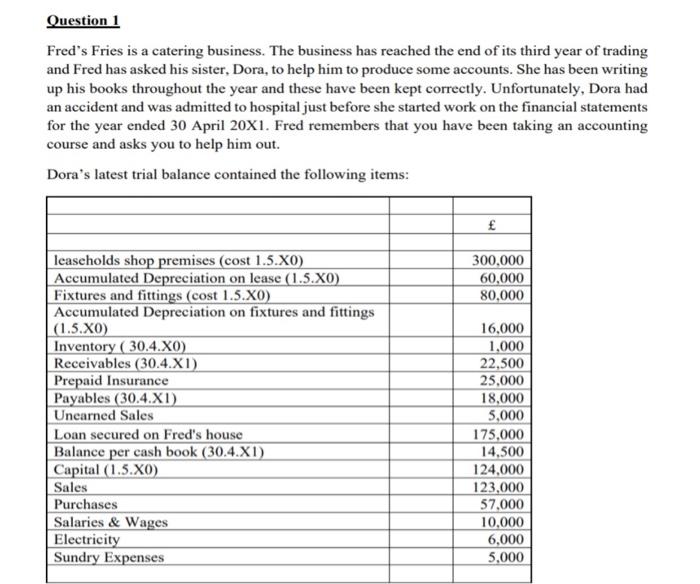

You also discover the following additional information which needs to be reflected in the year- end accounts: 1. Fixtures and fittings which cost 12,000 with

You also discover the following additional information which needs to be reflected in the year- end accounts:

1. Fixtures and fittings which cost 12,000 with accumulated depreciation of 6,000 were sold for 3,000 just before the end of the year. This transaction has not yet been reflected in the books.

2. Fixtures and fittings are to be depreciated on a straight-line basis over five years and are expected to have zero scrap value. No depreciation is charged in the year of disposal.

3. Bad debts of 4,000 need to be written off. A provision of two per cent is to be made

on the remaining debts.

4. The leasehold property is to be amortized of 5 per cent per year using the decreasing

balance method. (Amortization means depreciation for intangible assets).

5. Provision is to be made for the audit fee of 300.

6. Salaries of $400 were unpaid.

7. Unearned sales of $1,000 was earned prior to yearend.

8. The mortgage interest rate is 5% per year. Full year interest is not paid.

9. Three months insurance expenses for the rate of 500 per months wasnt charged to the

profit & loss statement during the year.

10. Beginning of the year, Fred Injected 25,000 of his own personal funds. Later on the

year he withdrew 5,000 for his personal use.

11. Inventory at 30 April 20X1 was valued at 2,000

Required

a. Journalize the adjusting entries for the year ended 30 April 20X1 (25 Marks)

b. Prepare an income statement for the year ended 30 April 20X1 (10 Marks)

c. Prepare a statement of financial position as at 30 April 20X1, for Freds Fries.

Assume that the loan secured on Freds house is a long-term liability. (12 Marks)

d. Explain clearly what is meant by: (i) Prudence; (ii)Going concern. (3 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started