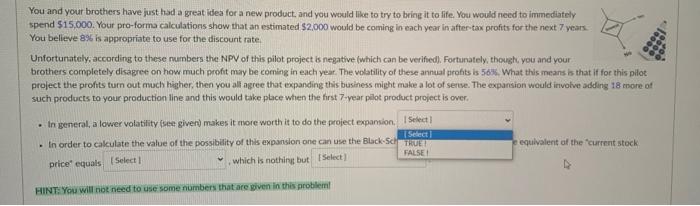

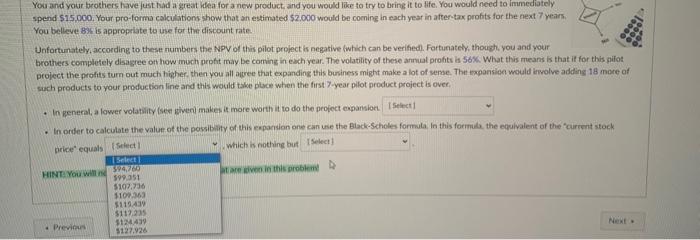

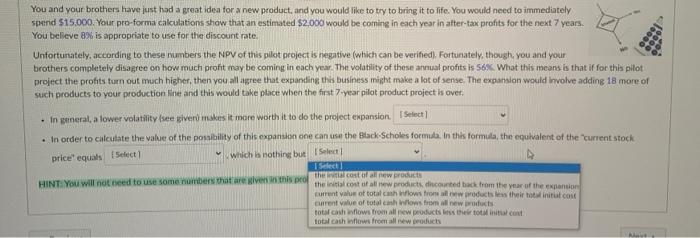

You and your brothers have just had a great idea for a new product and you would like to try to bring it to life. You would need to immediately spend $15,000. Your pro-forma calculations show that an estimated $2,000 would be coming in each year in after-tax profits for the next 7 years. You believe 8% is appropriate to use for the discount rate. Unfortunately; according to these numbers the NPV of this pilot project is negative (which can be verified). Fortunately, thoush, you and your brothers completely disagree on how much profit may lie coming in each year. The volatility of these annual profits is 563 . What this means is that if for this pilot project the profits tum out much higher, then you all agree that expanding this business might make a lot of serse. The expansion would invohve adding 18 more of such products to your production line and this would take place when the first 7 -vear pilot product project is over. - In general, a lower volatility (seee given) makes it more worth it to do the project expansion. - In order to calculate the value of the possibility of this expansion one can use the Black:-5d equivalent af the "current stock price' equals which is nothirgt but HINT: You will not need to use some numbers that are given in this probleml You and your brothers hrve just had a great lifea for a new product. and you would like to try to bring it to fife. You would need to immediately spend 515,000 , Your pro-forma calculations show that an estimated $2.000 would be cocning in each year in after-tax profits for the next 7 years. You belleve 8 , is is appropiate to use for ther discount rate. Unfortunately, according to these numbers the NPV of this pilot project is negative fwhich can be verified. Fortunately, though, you and your brothers completely disagree oft how much profit may be coming in exch year. The volatility of these anruat profits is 56. What this rueans is that if for this pifot project the profits turn out much higher, then you all aivee that expanding this buriness might make a lot of serse. The tropansice would irwolve adding 18 more of such products to your production line and this would tawe place when the first 7 -year pilot product project is over. - In general, a lower volatily (seed isiven) makes it more worth it to do the profect eupansiort. - In order to calculate the value of the possibuity of this reparion one can use the Black-5choles formuta. In this formula. the equivalent of the "cuirrent stock price" equals which is nothing buf HiNT: You with ind thare giver in this probleme You and your brothers have iust had a great idea for a new product, and you would like to try to bring it to life. You would need to immediately spend $15,000. Your pro-forma calculations show that an estimated $2,000 would be coming in each year in atter-tax profits for the next 7 years. You believe 8 is is appropriate to use for the discount rate. Unfortunately, according to these numbers the NPY of this pilat project is negative (which can be verified). Fortunately, though, you and your brothers completely disagree on how much profit may be coming in each year. The volatility of these annual profits is 56 . What this means is that if for this pillot project the profits turn out much higher, then you all agree that expanding this business might make a lat of sense. The expansion would involve adding 18 more of suich products to your production eine and this would take phoe when the first 7 -year pilot product project is over. - In grineral, a lower volatility fsee giveri makes it more worth it to do the project expansion. - In order to calculate the value of the posiaility of this cxparsion one can usi the Black:Scholes formula. In this formula, the equivalent of the "current stock. price' equals Which is nothing but HINT You will not theed to use some numbers that are giveon in this prof th canrent quive of total canc iflons trim al new profucis: total cash whows froen all exw peoducts