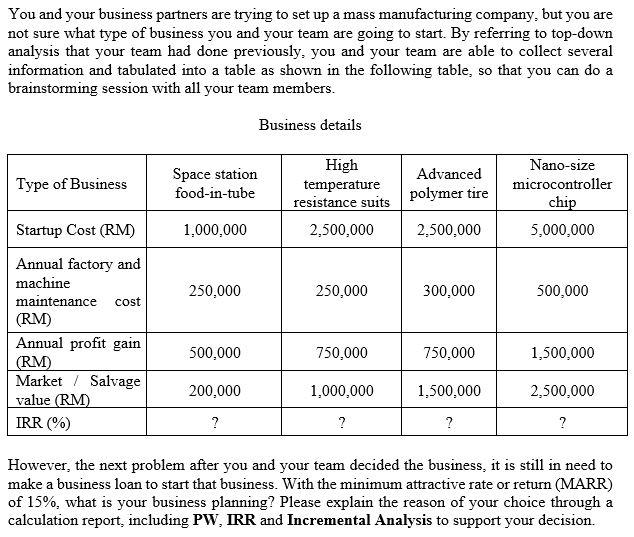

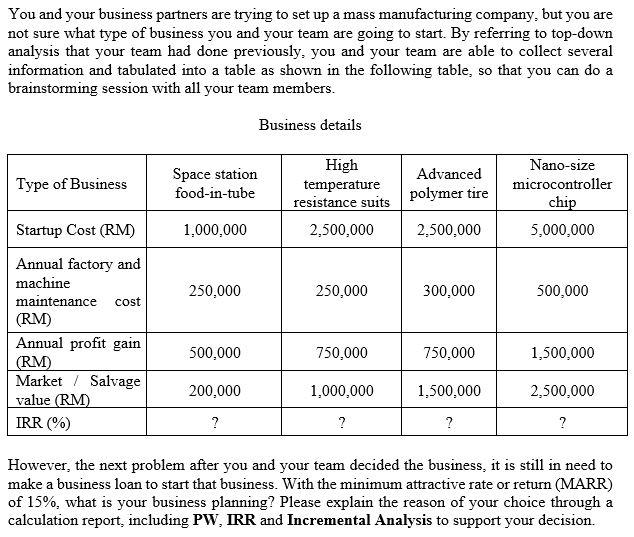

You and your business partners are trying to set up a mass manufacturing company, but you are not sure what type of business you and your team are going to start. By referring to top-down analysis that your team had done previously, you and your team are able to collect several information and tabulated into a table as shown in the following table, so that you can do a brainstorming session with all your team members. Business details Space station Type of Business High temperature resistance suits Advanced polymer tire Nano-size microcontroller chip food-in-tube Startup Cost (RM) 1,000,000 2,500,000 2,500,000 5,000,000 Annual factory and machine 250,000 250,000 300,000 500,000 maintenance cost (RM) Annual profit gain 500,000 750,000 750,000 1,500,000 (RM) Market Salvage 200,000 1,000,000 1,500,000 2,500,000 value (RM) IRR (%) ? ? ? ? However, the next problem after you and your team decided the business, it is still in need to make a business loan to start that business. With the minimum attractive rate or return (MARR) of 15%, what is your business planning? Please explain the reason of your choice through a calculation report, including PW, IRR and Incremental Analysis to support your decision. You and your business partners are trying to set up a mass manufacturing company, but you are not sure what type of business you and your team are going to start. By referring to top-down analysis that your team had done previously, you and your team are able to collect several information and tabulated into a table as shown in the following table, so that you can do a brainstorming session with all your team members. Business details Space station Type of Business High temperature resistance suits Advanced polymer tire Nano-size microcontroller chip food-in-tube Startup Cost (RM) 1,000,000 2,500,000 2,500,000 5,000,000 Annual factory and machine 250,000 250,000 300,000 500,000 maintenance cost (RM) Annual profit gain 500,000 750,000 750,000 1,500,000 (RM) Market Salvage 200,000 1,000,000 1,500,000 2,500,000 value (RM) IRR (%) ? ? ? ? However, the next problem after you and your team decided the business, it is still in need to make a business loan to start that business. With the minimum attractive rate or return (MARR) of 15%, what is your business planning? Please explain the reason of your choice through a calculation report, including PW, IRR and Incremental Analysis to support your decision