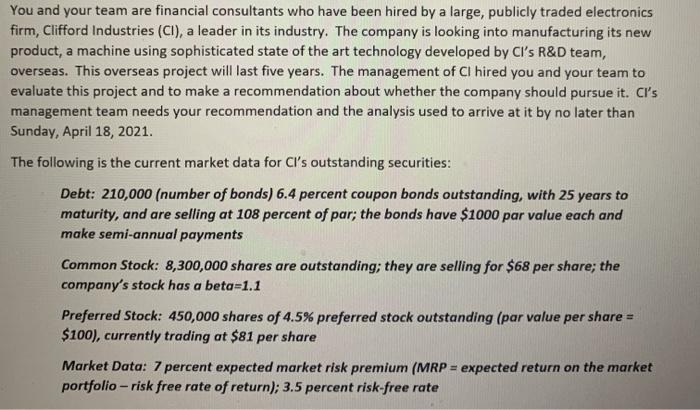

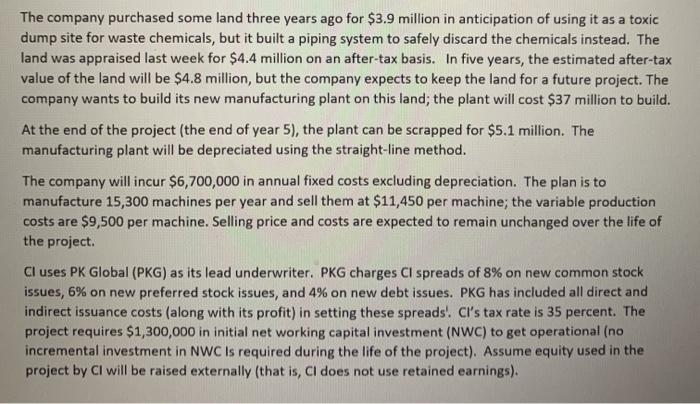

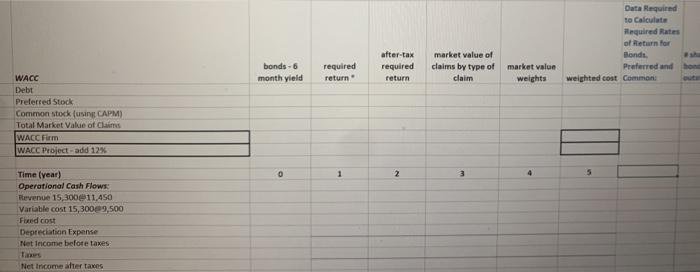

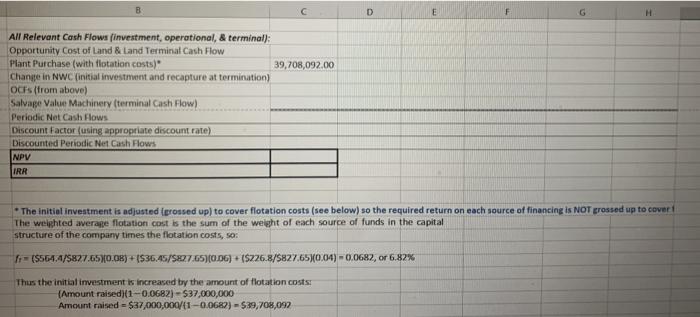

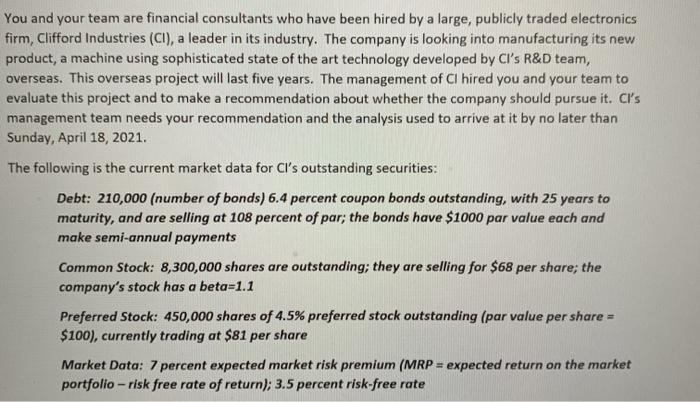

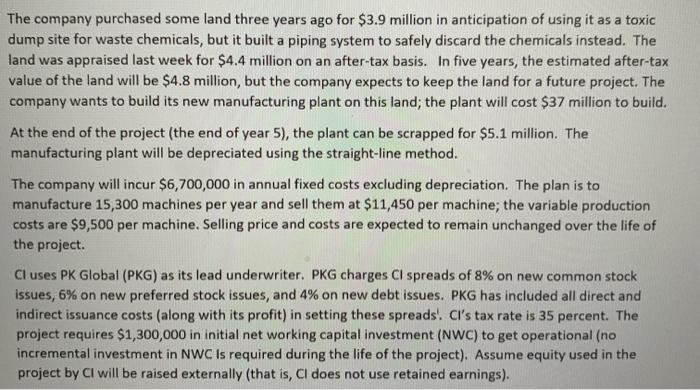

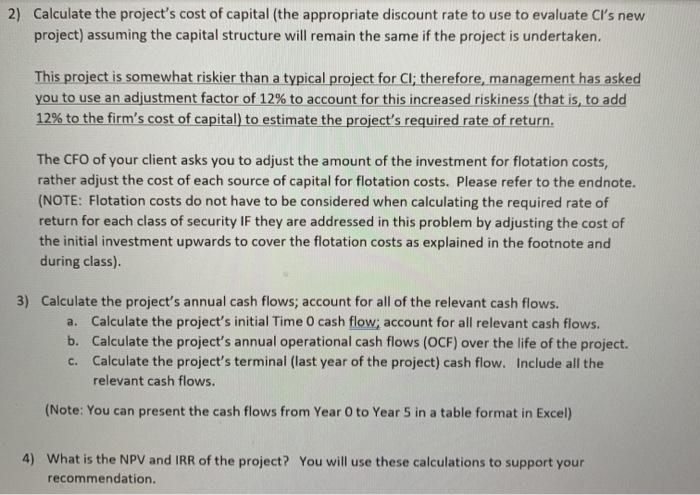

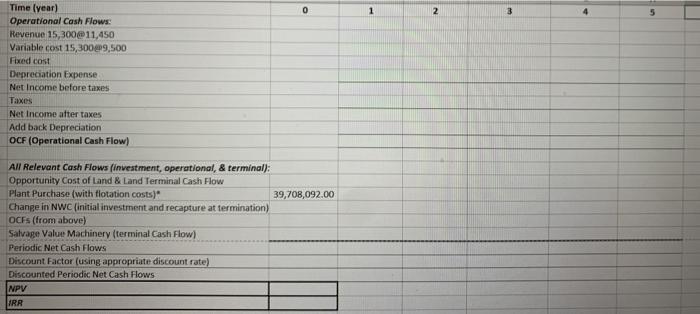

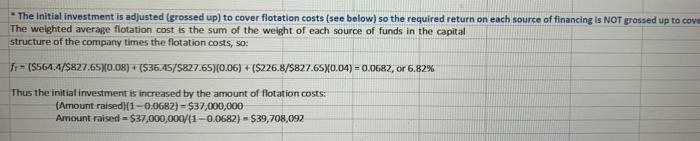

You and your team are financial consultants who have been hired by a large, publicly traded electronics firm, Clifford Industries (CI), a leader in its industry. The company is looking into manufacturing its new product, a machine using sophisticated state of the art technology developed by Cl's R&D team, overseas. This overseas project will last five years. The management of CI hired you and your team to evaluate this project and to make a recommendation about whether the company should pursue it. Cl's management team needs your recommendation and the analysis used to arrive at it by no later than Sunday, April 18, 2021. The following is the current market data for Cl's outstanding securities: Debt: 210,000 (number of bonds) 6.4 percent coupon bonds outstanding, with 25 years to maturity, and are selling at 108 percent of par; the bonds have $1000 par value each and make semi-annual payments Common Stock: 8,300,000 shares are outstanding; they are selling for $68 per share; the company's stock has a beta=1.1 Preferred Stock: 450,000 shares of 4.5% preferred stock outstanding (par value per share = $100), currently trading at $81 per share Market Data: 7 percent expected market risk premium (MRP = expected return on the market portfolio - risk free rate of return); 3.5 percent risk-free rate The company purchased some land three years ago for $3.9 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. The land was appraised last week for $4.4 million on an after-tax basis. In five years, the estimated after-tax value of the land will be $4.8 million, but the company expects to keep the land for a future project. The company wants to build its new manufacturing plant on this land; the plant will cost $37 million to build. At the end of the project (the end of year 5), the plant can be scrapped for $5.1 million. The manufacturing plant will be depreciated using the straight-line method. The company will incur $6,700,000 in annual fixed costs excluding depreciation. The plan is to manufacture 15,300 machines per year and sell them at $11,450 per machine; the variable production costs are $9,500 per machine. Selling price and costs are expected to remain unchanged over the life of the project. Cl uses PK Global (PKG) as its lead underwriter. PKG charges Cl spreads of 8% on new common stock issues, 6% on new preferred stock issues, and 4% on new debt issues. PKG has included all direct and indirect issuance costs (along with its profit) in setting these spreads! Cl's tax rate is 35 percent. The project requires $1,300,000 in initial net working capital investment (NWC) to get operational (no incremental investment in NWC is required during the life of the project). Assume equity used in the project by Ci will be raised externally (that is, Cl does not use retained earnings). Data Required to Calculate Required Rates of Return for Bondt. Preferred and weighted cost common bonds - 6 month yield required return after-tax required return market value of claims by type of claim market value weights WACC Debt Preferred Stock Common stock (using CAPM) Total Market value of Claims WACC Firm WACCProject-add 12% 0 1 2 3 4 Time (year) Operational Cash Flows Revenue 15,30011.450 Variable cost 15,300e9,500 Fixed cost Depreciation Expense Net Income before taxes Net Income after taxes B D H All Relevant Cash Flows (investment, operational, & terminal): Opportunity Cost of Land & Land Terminal Cash Flow Plant Purchase (with flotation costs) 39,708,092.00 Change in NWC initial investment and recapture at termination) OCES (from above) Salvage Value Machinery (terminal Cash Flow) Periodic Net Cash Flows Discount Factor (using appropriate discount rate) Discounted Periodic Net Cash Flows NPV IRR The initial investment is adjusted (prossed up) to cover flotation costs (see below) so the required return on each source of financing is NOT grossed up to cover The weighted average flotation cost is the sum of the weight of each source of funds in the capital structure of the company times the flotation costs, so Fr(5564.4/5827.6530.08) +1536.45/5827.5)(0.06) + (5226.8/5827.650,04) - 0.0682, or 6.82% Thus the initial investment is increased by the amount of flotation costs (Amount raised)(1-0.0682) -537,000,000 Amount raised - $37,000,000/41 -0.0687) - $39,708,092 You and your team are financial consultants who have been hired by a large, publicly traded electronics firm, Clifford Industries (CI), a leader in its industry. The company is looking into manufacturing its new product, a machine using sophisticated state of the art technology developed by CI's R&D team, overseas. This overseas project will last five years. The management of Ci hired you and your team to evaluate this project and to make a recommendation about whether the company should pursue it. Cl's management team needs your recommendation and the analysis used to arrive at it by no later than Sunday, April 18, 2021. The following is the current market data for Cl's outstanding securities: Debt: 210,000 (number of bonds) 6.4 percent coupon bonds outstanding, with 25 years to maturity, and are selling at 108 percent of par; the bonds have $1000 par value each and make semi-annual payments Common Stock: 8,300,000 shares are outstanding; they are selling for $68 per share; the company's stock has a beta=1.1 Preferred Stock: 450,000 shares of 4.5% preferred stock outstanding (par value per share = $100), currently trading at $81 per share Market Data: 7 percent expected market risk premium (MRP = expected return on the market portfolio - risk free rate of return); 3.5 percent risk-free rate The company purchased some land three years ago for $3.9 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. The land was appraised last week for $4.4 million on an after-tax basis. In five years, the estimated after-tax value of the land will be $4.8 million, but the company expects to keep the land for a future project. The company wants to build its new manufacturing plant on this land; the plant will cost $37 million to build. At the end of the project (the end of year 5), the plant can be scrapped for $5.1 million. The manufacturing plant will be depreciated using the straight-line method. The company will incur $6,700,000 in annual fixed costs excluding depreciation. The plan is to manufacture 15,300 machines per year and sell them at $11,450 per machine; the variable production costs are $9,500 per machine. Selling price and costs are expected to remain unchanged over the life of the project. Cl uses PK Global (PKG) as its lead underwriter. PKG charges Cl spreads of 8% on new common stock issues, 6% on new preferred stock issues, and 4% on new debt issues. PKG has included all direct and indirect issuance costs (along with its profit) in setting these spreads'. Cl's tax rate is 35 percent. The project requires $1,300,000 in initial net working capital investment (NWC) to get operational (no incremental investment in NWC is required during the life of the project). Assume equity used in the project by Ci will be raised externally (that is, Cl does not use retained earnings). 2) Calculate the project's cost of capital (the appropriate discount rate to use to evaluate Cl's new project) assuming the capital structure will remain the same if the project is undertaken. This project is somewhat riskier than a typical project for Cl; therefore, management has asked you to use an adjustment factor of 12% to account for this increased riskiness (that is, to add 12% to the firm's cost of capital) to estimate the project's required rate of return. The CFO of your client asks you to adjust the amount of the investment for flotation costs, rather adjust the cost of each source of capital for flotation costs. Please refer to the endnote. (NOTE: Flotation costs do not have to be considered when calculating the required rate of return for each class of security If they are addressed in this problem by adjusting the cost of the initial investment upwards to cover the flotation costs as explained in the footnote and during class). 3) Calculate the project's annual cash flows; account for all of the relevant cash flows. a. Calculate the project's initial Time 0 cash flow; account for all relevant cash flows. b. Calculate the project's annual operational cash flows (OCF) over the life of the project. C. Calculate the project's terminal (last year of the project) cash flow. Include all the relevant cash flows. (Note: You can present the cash flows from Year Oto Year 5 in a table format in Excel) 4) What is the NPV and IRR of the project? You will use these calculations to support your recommendation. 0 2 3 4 Time (year) Operational Cash Flows: Revenue 15,300@11,450 Variable cost 15,30049,500 Fixed cost Depreciation Expense Net Income before taxes Taxes Net Income after taxes Add back Depreciation OCF (Operational Cash Flow) All Relevant Cash Flows (investment, operational, & terminal): Opportunity Cost of Land & Land Terminal Cash Flow Plant Purchase (with flotation costs) 39,708,092.00 Change in NWC (initial investment and recapture at termination) OCFs (from above) Salvage Value Machinery (terminal Cash Flow Periodic Net Cash Flows Discount Factor (using appropriate discount rate) Discounted Periodic Net Cash Flows NPV IRR The Initial investment is adjusted (grossed up) to cover flotation costs (see below) so the required return on each source of financing is NOT grossed up to cover The weighted average flotation cost is the sum of the weight of each source of funds in the capital structure of the company times the flotation costs, so: f = ($564.4/$827.6530.08) * ($36.45/5827.65)(0.06) + ($226.8/5827.65X0.04) = 0.0682, or 6.82% Thus the initial investment is increased by the amount of flotation costs: (Amount raised)(1-0.0682) - $37,000,000 Amount raised = $37,000,000/(1-0,0682) - $39,708,092 You and your team are financial consultants who have been hired by a large, publicly traded electronics firm, Clifford Industries (CI), a leader in its industry. The company is looking into manufacturing its new product, a machine using sophisticated state of the art technology developed by Cl's R&D team, overseas. This overseas project will last five years. The management of CI hired you and your team to evaluate this project and to make a recommendation about whether the company should pursue it. Cl's management team needs your recommendation and the analysis used to arrive at it by no later than Sunday, April 18, 2021. The following is the current market data for Cl's outstanding securities: Debt: 210,000 (number of bonds) 6.4 percent coupon bonds outstanding, with 25 years to maturity, and are selling at 108 percent of par; the bonds have $1000 par value each and make semi-annual payments Common Stock: 8,300,000 shares are outstanding; they are selling for $68 per share; the company's stock has a beta=1.1 Preferred Stock: 450,000 shares of 4.5% preferred stock outstanding (par value per share = $100), currently trading at $81 per share Market Data: 7 percent expected market risk premium (MRP = expected return on the market portfolio - risk free rate of return); 3.5 percent risk-free rate The company purchased some land three years ago for $3.9 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. The land was appraised last week for $4.4 million on an after-tax basis. In five years, the estimated after-tax value of the land will be $4.8 million, but the company expects to keep the land for a future project. The company wants to build its new manufacturing plant on this land; the plant will cost $37 million to build. At the end of the project (the end of year 5), the plant can be scrapped for $5.1 million. The manufacturing plant will be depreciated using the straight-line method. The company will incur $6,700,000 in annual fixed costs excluding depreciation. The plan is to manufacture 15,300 machines per year and sell them at $11,450 per machine; the variable production costs are $9,500 per machine. Selling price and costs are expected to remain unchanged over the life of the project. Cl uses PK Global (PKG) as its lead underwriter. PKG charges Cl spreads of 8% on new common stock issues, 6% on new preferred stock issues, and 4% on new debt issues. PKG has included all direct and indirect issuance costs (along with its profit) in setting these spreads! Cl's tax rate is 35 percent. The project requires $1,300,000 in initial net working capital investment (NWC) to get operational (no incremental investment in NWC is required during the life of the project). Assume equity used in the project by Ci will be raised externally (that is, Cl does not use retained earnings). Data Required to Calculate Required Rates of Return for Bondt. Preferred and weighted cost common bonds - 6 month yield required return after-tax required return market value of claims by type of claim market value weights WACC Debt Preferred Stock Common stock (using CAPM) Total Market value of Claims WACC Firm WACCProject-add 12% 0 1 2 3 4 Time (year) Operational Cash Flows Revenue 15,30011.450 Variable cost 15,300e9,500 Fixed cost Depreciation Expense Net Income before taxes Net Income after taxes B D H All Relevant Cash Flows (investment, operational, & terminal): Opportunity Cost of Land & Land Terminal Cash Flow Plant Purchase (with flotation costs) 39,708,092.00 Change in NWC initial investment and recapture at termination) OCES (from above) Salvage Value Machinery (terminal Cash Flow) Periodic Net Cash Flows Discount Factor (using appropriate discount rate) Discounted Periodic Net Cash Flows NPV IRR The initial investment is adjusted (prossed up) to cover flotation costs (see below) so the required return on each source of financing is NOT grossed up to cover The weighted average flotation cost is the sum of the weight of each source of funds in the capital structure of the company times the flotation costs, so Fr(5564.4/5827.6530.08) +1536.45/5827.5)(0.06) + (5226.8/5827.650,04) - 0.0682, or 6.82% Thus the initial investment is increased by the amount of flotation costs (Amount raised)(1-0.0682) -537,000,000 Amount raised - $37,000,000/41 -0.0687) - $39,708,092 You and your team are financial consultants who have been hired by a large, publicly traded electronics firm, Clifford Industries (CI), a leader in its industry. The company is looking into manufacturing its new product, a machine using sophisticated state of the art technology developed by CI's R&D team, overseas. This overseas project will last five years. The management of Ci hired you and your team to evaluate this project and to make a recommendation about whether the company should pursue it. Cl's management team needs your recommendation and the analysis used to arrive at it by no later than Sunday, April 18, 2021. The following is the current market data for Cl's outstanding securities: Debt: 210,000 (number of bonds) 6.4 percent coupon bonds outstanding, with 25 years to maturity, and are selling at 108 percent of par; the bonds have $1000 par value each and make semi-annual payments Common Stock: 8,300,000 shares are outstanding; they are selling for $68 per share; the company's stock has a beta=1.1 Preferred Stock: 450,000 shares of 4.5% preferred stock outstanding (par value per share = $100), currently trading at $81 per share Market Data: 7 percent expected market risk premium (MRP = expected return on the market portfolio - risk free rate of return); 3.5 percent risk-free rate The company purchased some land three years ago for $3.9 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. The land was appraised last week for $4.4 million on an after-tax basis. In five years, the estimated after-tax value of the land will be $4.8 million, but the company expects to keep the land for a future project. The company wants to build its new manufacturing plant on this land; the plant will cost $37 million to build. At the end of the project (the end of year 5), the plant can be scrapped for $5.1 million. The manufacturing plant will be depreciated using the straight-line method. The company will incur $6,700,000 in annual fixed costs excluding depreciation. The plan is to manufacture 15,300 machines per year and sell them at $11,450 per machine; the variable production costs are $9,500 per machine. Selling price and costs are expected to remain unchanged over the life of the project. Cl uses PK Global (PKG) as its lead underwriter. PKG charges Cl spreads of 8% on new common stock issues, 6% on new preferred stock issues, and 4% on new debt issues. PKG has included all direct and indirect issuance costs (along with its profit) in setting these spreads'. Cl's tax rate is 35 percent. The project requires $1,300,000 in initial net working capital investment (NWC) to get operational (no incremental investment in NWC is required during the life of the project). Assume equity used in the project by Ci will be raised externally (that is, Cl does not use retained earnings). 2) Calculate the project's cost of capital (the appropriate discount rate to use to evaluate Cl's new project) assuming the capital structure will remain the same if the project is undertaken. This project is somewhat riskier than a typical project for Cl; therefore, management has asked you to use an adjustment factor of 12% to account for this increased riskiness (that is, to add 12% to the firm's cost of capital) to estimate the project's required rate of return. The CFO of your client asks you to adjust the amount of the investment for flotation costs, rather adjust the cost of each source of capital for flotation costs. Please refer to the endnote. (NOTE: Flotation costs do not have to be considered when calculating the required rate of return for each class of security If they are addressed in this problem by adjusting the cost of the initial investment upwards to cover the flotation costs as explained in the footnote and during class). 3) Calculate the project's annual cash flows; account for all of the relevant cash flows. a. Calculate the project's initial Time 0 cash flow; account for all relevant cash flows. b. Calculate the project's annual operational cash flows (OCF) over the life of the project. C. Calculate the project's terminal (last year of the project) cash flow. Include all the relevant cash flows. (Note: You can present the cash flows from Year Oto Year 5 in a table format in Excel) 4) What is the NPV and IRR of the project? You will use these calculations to support your recommendation. 0 2 3 4 Time (year) Operational Cash Flows: Revenue 15,300@11,450 Variable cost 15,30049,500 Fixed cost Depreciation Expense Net Income before taxes Taxes Net Income after taxes Add back Depreciation OCF (Operational Cash Flow) All Relevant Cash Flows (investment, operational, & terminal): Opportunity Cost of Land & Land Terminal Cash Flow Plant Purchase (with flotation costs) 39,708,092.00 Change in NWC (initial investment and recapture at termination) OCFs (from above) Salvage Value Machinery (terminal Cash Flow Periodic Net Cash Flows Discount Factor (using appropriate discount rate) Discounted Periodic Net Cash Flows NPV IRR The Initial investment is adjusted (grossed up) to cover flotation costs (see below) so the required return on each source of financing is NOT grossed up to cover The weighted average flotation cost is the sum of the weight of each source of funds in the capital structure of the company times the flotation costs, so: f = ($564.4/$827.6530.08) * ($36.45/5827.65)(0.06) + ($226.8/5827.65X0.04) = 0.0682, or 6.82% Thus the initial investment is increased by the amount of flotation costs: (Amount raised)(1-0.0682) - $37,000,000 Amount raised = $37,000,000/(1-0,0682) - $39,708,092