Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You anticipate a portion of these investments will be financed with fixed-rate mortgage debt, where the effective interest rate (ka = &) is expected

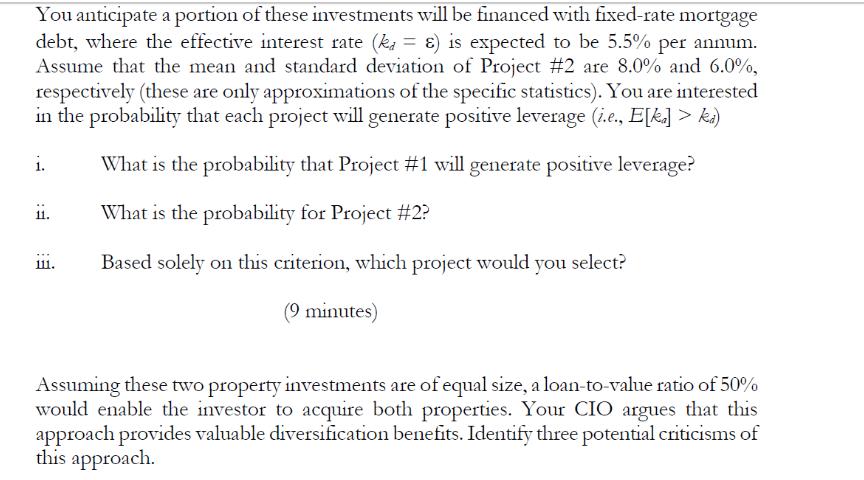

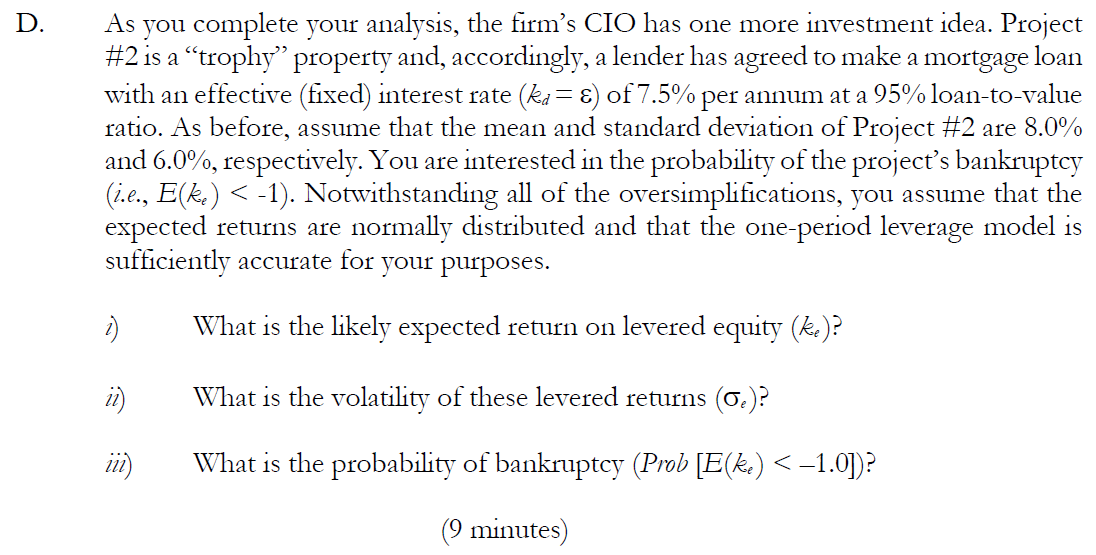

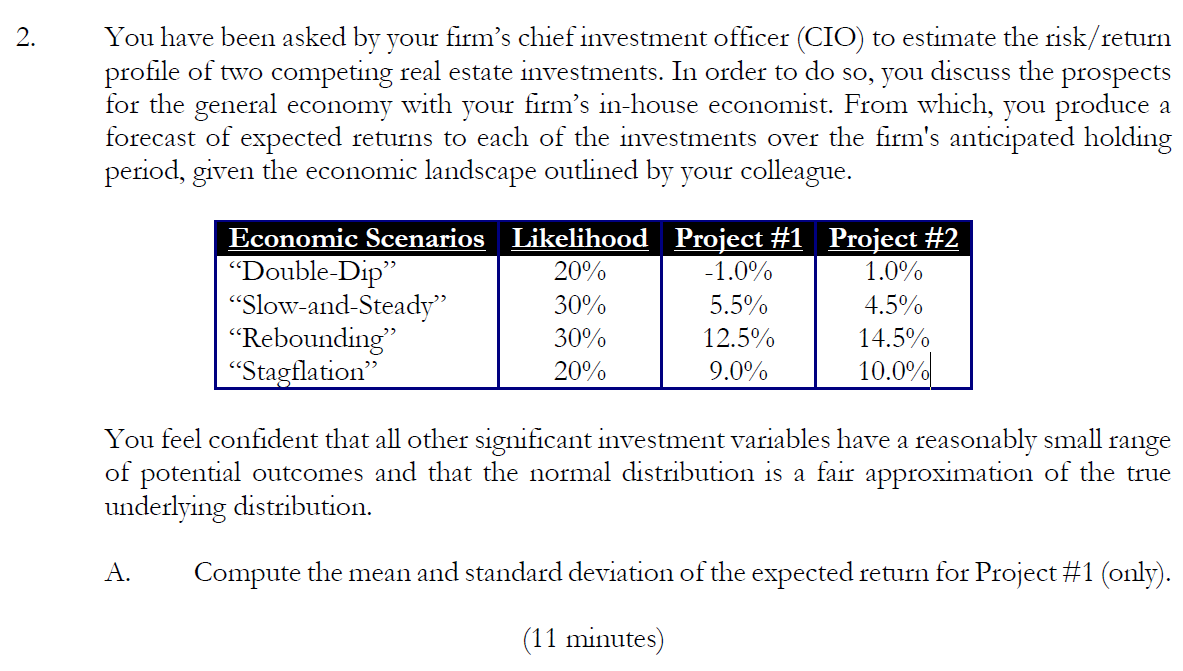

You anticipate a portion of these investments will be financed with fixed-rate mortgage debt, where the effective interest rate (ka = &) is expected to be 5.5% per annum. Assume that the mean and standard deviation of Project #2 are 8.0% and 6.0%, respectively (these are only approximations of the specific statistics). You are interested in the probability that each project will generate positive leverage (i.e., E[k] > ka) i. What is the probability that Project #1 will generate positive leverage? ii. What is the probability for Project #2? 111. Based solely on this criterion, which project would you select? (9 minutes) Assuming these two property investments are of equal size, a loan-to-value ratio of 50% would enable the investor to acquire both properties. Your CIO argues that this approach provides valuable diversification benefits. Identify three potential criticisms of this approach. D. As you complete your analysis, the firm's CIO has one more investment idea. Project #2 is a "trophy" property and, accordingly, a lender has agreed to make a mortgage loan with an effective (fixed) interest rate (ka = ) of 7.5% per annum at a 95% loan-to-value ratio. As before, assume that the mean and standard deviation of Project #2 are 8.0% and 6.0%, respectively. You are interested in the probability of the project's bankruptcy (i.e., E(ke) < -1). Notwithstanding all of the oversimplifications, you assume that the expected returns are normally distributed and that the one-period leverage model is sufficiently accurate for your purposes. What is the likely expected return on levered equity (ke)? ii) What is the volatility of these levered returns (.)? iii) What is the probability of bankruptcy (Prob [E(ke) < 1.0])? (9 minutes) 2. You have been asked by your firm's chief investment officer (CIO) to estimate the risk/return profile of two competing real estate investments. In order to do so, you discuss the prospects for the general economy with your firm's in-house economist. From which, you produce a forecast of expected returns to each of the investments over the firm's anticipated holding period, given the economic landscape outlined by your colleague. Economic Scenarios Likelihood Project #1 Project #2 "Double-Dip" Slow-and-Steady" "Rebounding" "Stagflation" 20% -1.0% 1.0% 30% 5.5% 4.5% 30% 12.5% 14.5% 20% 9.0% 10.0% range You feel confident that all other significant investment variables have a reasonably small of potential outcomes and that the normal distribution is a fair approximation of the true underlying distribution. A. Compute the mean and standard deviation of the expected return for Project #1 (only). (11 minutes)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started