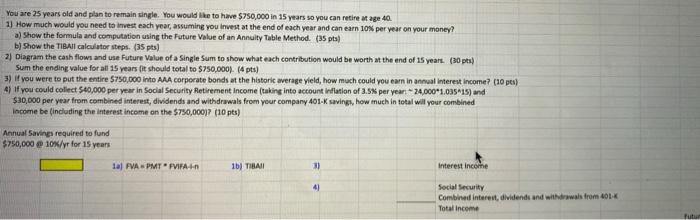

You are 25 years old and plan to remain single. You would like to have $750,000 in 15 years so you can retire at age 40 11 How much would you need to invest each year, assuming you invest at the end of each year and can earn 10per year on your money? a) Show the formula and computation using the Future Value of an Annuity Table Method. (35 pts) b) Show the TIBAll calculator steps (35 pts) 2) Diagram the cash flows and use Future Value of a Single Sum to show what each contribution would be worth at the end of 15 years. (10) Sum the ending value for all 15 years it should total to $750,000). (4 pts) 3) If you were to put the entire $750,000 into AAA corporate bonds at the historie average yield, how much could you earn in annual interest income? (10) 4) If you could collect 540,000 per year in Social Security Retirement Income taking into account Wlation of 3.5% per year - 24,000 1,035*15) and $30,000 per year from combined interest, dividends and withdrawals from your company 401K savings, how much in total will your combined Income be (including the interest income on the $750,000? (10 pts) Annual Savings required to fund $750,000 10%/yr for 15 years laj FVA - PMTFVIFAA 16 TIBA Interest income 41 Social Security Combined interest, dividends and withdrawals from 401K Total income tutun 1 06 11 12 12 1 E M 3 5 6 . 10 EL 14 15 You are 25 years old and plan to remain single. You would like to have $750,000 in 15 years so you can retire at age 40 11 How much would you need to invest each year, assuming you invest at the end of each year and can earn 10per year on your money? a) Show the formula and computation using the Future Value of an Annuity Table Method. (35 pts) b) Show the TIBAll calculator steps (35 pts) 2) Diagram the cash flows and use Future Value of a Single Sum to show what each contribution would be worth at the end of 15 years. (10) Sum the ending value for all 15 years it should total to $750,000). (4 pts) 3) If you were to put the entire $750,000 into AAA corporate bonds at the historie average yield, how much could you earn in annual interest income? (10) 4) If you could collect 540,000 per year in Social Security Retirement Income taking into account Wlation of 3.5% per year - 24,000 1,035*15) and $30,000 per year from combined interest, dividends and withdrawals from your company 401K savings, how much in total will your combined Income be (including the interest income on the $750,000? (10 pts) Annual Savings required to fund $750,000 10%/yr for 15 years laj FVA - PMTFVIFAA 16 TIBA Interest income 41 Social Security Combined interest, dividends and withdrawals from 401K Total income tutun 1 06 11 12 12 1 E M 3 5 6 . 10 EL 14 15