Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are 29 years old and willing to invest $1,750 every other month for the next 15 years. You prefer a conservative-to-moderate investment strategy

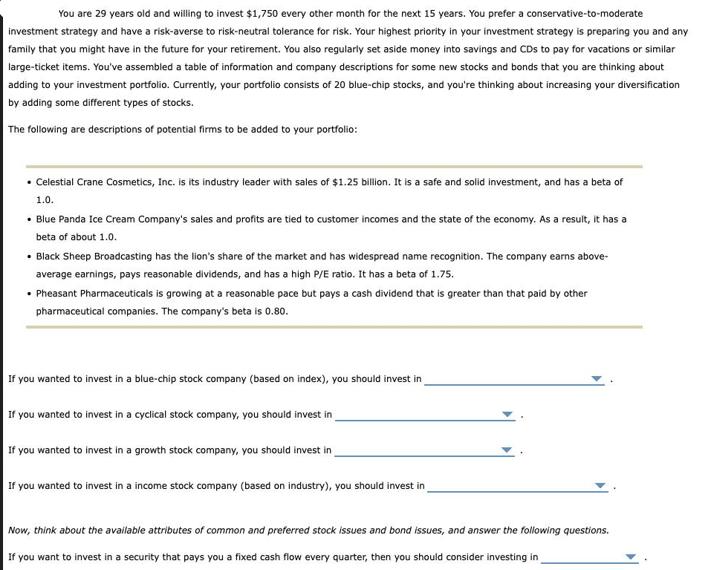

You are 29 years old and willing to invest $1,750 every other month for the next 15 years. You prefer a conservative-to-moderate investment strategy and have a risk-averse to risk-neutral tolerance for risk. Your highest priority in your investment strategy is preparing you and any family that you might have in the future for your retirement. You also regularly set aside money into savings and CDs to pay for vacations or similar large-ticket items. You've assembled a table of information and company descriptions for some new stocks and bonds that you are thinking about adding to your investment portfolio. Currently, your portfolio consists of 20 blue-chip stocks, and you're thinking about increasing your diversification by adding some different types of stocks. The following are descriptions of potential firms to be added to your portfolio: . Celestial Crane Cosmetics, Inc. is its industry leader with sales of $1.25 billion. It is a safe and solid investment, and has a beta of 1.0. Blue Panda Ice Cream Company's sales and profits are tied to customer incomes and the state of the economy. As a result, it has a beta of about 1.0. Black Sheep Broadcasting has the lion's share of the market and has widespread name recognition. The company earns above- average earnings, pays reasonable dividends, and has a high P/E ratio. It has a beta of 1.75. Pheasant Pharmaceuticals is growing at a reasonable pace but pays a cash dividend that is greater than that paid by other pharmaceutical companies. The company's beta is 0.80. If you wanted to invest in a blue-chip stock company (based on index), you should invest in If you wanted to invest in a cyclical stock company, you should invest in If you wanted to invest in a growth stock company, you should invest in If you wanted to invest in a income stock company (based on industry), you should invest in Now, think about the available attributes of common and preferred stock issues and bond issues, and answer the following questions. If you want to invest in a security that pays you a fixed cash flow every quarter, then you should consider investing in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 If you wanted to invest in a bluechip stock company based on index you should invest in Celestial ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started