Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a bank loan manager and you have had two companies (Arrow and Root) come to your bank, each requesting a 6-month loan.

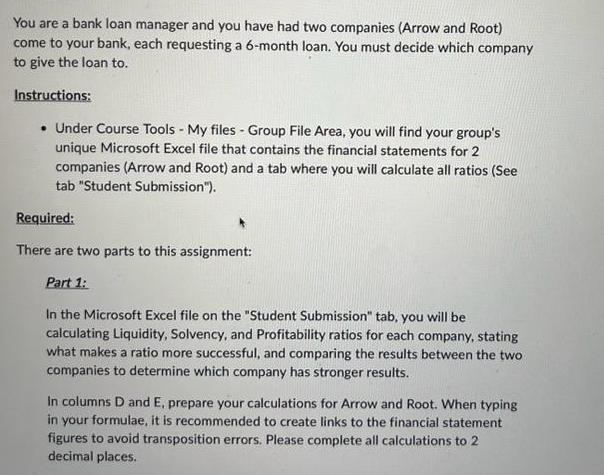

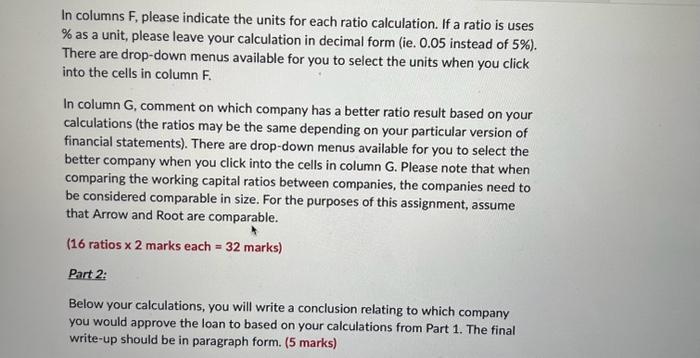

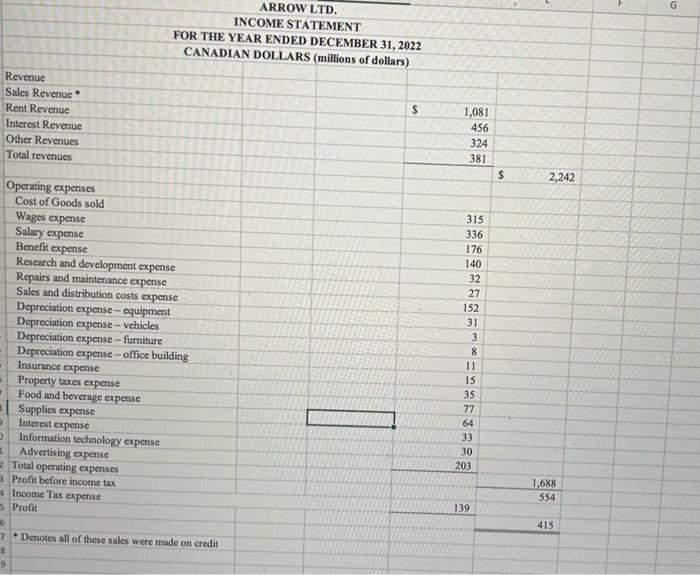

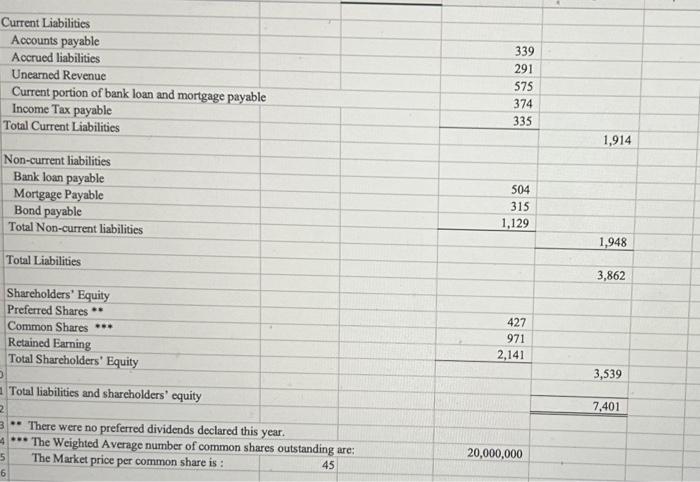

You are a bank loan manager and you have had two companies (Arrow and Root) come to your bank, each requesting a 6-month loan. You must decide which company to give the loan to. Instructions: Under Course Tools - My files - Group File Area, you will find your group's unique Microsoft Excel file that contains the financial statements for 2 companies (Arrow and Root) and a tab where you will calculate all ratios (See tab "Student Submission"). Required: There are two parts to this assignment: Part 1: In the Microsoft Excel file on the "Student Submission" tab, you will be calculating Liquidity, Solvency, and Profitability ratios for each company, stating what makes a ratio more successful, and comparing the results between the two companies to determine which company has stronger results. In columns D and E, prepare your calculations for Arrow and Root. When typing in your formulae, it is recommended to create links to the financial statement figures to avoid transposition errors. Please complete all calculations to 2 decimal places. In columns F, please indicate the units for each ratio calculation. If a ratio is uses % as a unit, please leave your calculation in decimal form (ie. 0.05 instead of 5%). There are drop-down menus available for you to select the units when you click into the cells in column F. In column G, comment on which company has a better ratio result based on your calculations (the ratios may be the same depending on your particular version of financial statements). There are drop-down menus available for you to select the better company when you click into the cells in column G. Please note that when comparing the working capital ratios between companies, the companies need to be considered comparable in size. For the purposes of this assignment, assume that Arrow and Root are comparable. (16 ratios x 2 marks each = 32 marks) Part 2: Below your calculations, you will write a conclusion relating to which company you would approve the loan to based on your calculations from Part 1. The final write-up should be in paragraph form. (5 marks) Revenue Sales Revenue Rent Revenue Interest Revenue Other Revenues Total revenues 3 Operating expenses Cost of Goods sold Wages expense Salary expense Benefit expense Research and development expense Repairs and maintenance expense Sales and distribution costs expense Depreciation expense-equipment Depreciation expense-vehicles Depreciation expense-furniture Depreciation expense-office building Insurance expense Property taxes expense Food and beverage expense 8 9 Supplies expense Interest expense 9 O 3 2 Total operating expenses 3 Profit before income tax 4 Income Tax expense 5 Profit ARROW LTD. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2022 CANADIAN DOLLARS (millions of dollars) Information technology expense Advertising expense 6 7 Denotes all of these sales were made on credit $ 1,081 456 324 381 315 336 176 140 32 27 152 31 3 8 11 15 35 77 64 33 30 203 139 $ 2,242 1,688 554 415 G 1 2 3 14 5 ASSETS 56 17 Current assets 48 Cash 49 Short-term investments 50 Accounts receivable 51 Inventory 52 Spare parts and supplies inventory 53 Prepaid Maintenance 54 Prepaid expenses 55 Total current assets 56 57 Investments 58 59 Property plant, and equipment 60 Land 61 62 63 64 65 Equipment Less: Accumulated depreciation Vehicles Less: Accumulated depreciation Furniture Less: Accumulated depreciation 6Total property, plant and equipment 20 71 Intangible assets 72 Trademark 73 Patient 74 Total intangible assets 75 Total Assets 66 67 68 ZER Office Building Less: Accumulated depreciation 76 77 Liabilities and Shareholders' Equity 78 ARROW LTD. STATEMENT OF FINANCIAL POSITION AS AT DECEMBER 31, 2022 CANADIAN DOLLARS (millions of dollars) + S 2,055 577 1,551 411 595 89 200 32 $ 1,927 866 390 93 86 384 41 65 1,478 1,140 506 168 74 26 $ 3,787 157 3,357 100 7,401 Current Liabilities Accounts payable Accrued liabilities Unearned Revenue Current portion of bank loan and mortgage payable Income Tax payable Total Current Liabilities Non-current liabilities Bank loan payable Mortgage Payable 4 5 6 Bond payable Total Non-current liabilities Total Liabilities Shareholders' Equity Preferred Shares ** Common Shares *** Retained Earning Total Shareholders' Equity Total liabilities and shareholders' equity There were no preferred dividends declared this year. ***The Weighted Average number of common shares outstanding are: The Market price per common share is : 45 339 291 575 374 335 504 315 1,129 427 971 2,141 20,000,000 1,914 1,948 3,862 3,539 7,401

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

For ARROW Liquidity Ratio Current Ratio Current AssetsCurrent Liabilities 30912144 144 1 Higher the better indicates shortterm liquidity Quick Ratio C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started