Question

You are a business analyst with a medium consumer electronics company. Your company is well respected and have sufficient capital to take risk into venturing

You are a business analyst with a medium consumer electronics company. Your company is well respected and have sufficient capital to take risk into venturing into new segments. However, big failures can make its stock prices volatile which are not great for the company or its shareholders. The company is seeking to build a brand new product, HoloTV. This TV is specially built, so that the image from the TV is projected out and the images/characters appears to be outside the screen, to create "real" experience. Nothing of this exists today. Assume the market price is set to be $6500.

(a) Develop a SWOT analysis for this product. Identify at least 3 strengths/opportunities/weakness/threat.

(b) For each of the strengths/opportunities/weakness/threat listed in (a), list the corresponding KRIs. Choose 1 KRI for strength, 1 KRI for weakness, 1 for threat, 1 for opportunity.

(c) Assume 3D TV is the closest product to HoloTV. The yearly sales are as follows: (840, 1470, 2110, 4000, 7590, 10950, 10530, 9470, 7790, 5890). Using a Bass model ( https://www.lindo.com/lsmodels/Controller/doSelect.php?action=2&name=BassModel.xls (Links to an external site.)

Estimate how many HoloTV your company will sell in the first year. NOTE: the data provided is for 3D TV. You would like to see at what M, p, q combination gives the minimum difference in forecast and actual sales for 3DTV for Year 1. Once you have determined it, you have to make some assumption about HoloTV and how it compares to 3D TV. Using these assumptions you need to extrapolate to estimate the number of HoloTV sales in Year 1. There is NO correct answer. I am MOST interested to see (i) what assumption you made to set the M value, (b) what assumptions you made to come up with your estimate of year 1 sales for HoloTV. Be concise and to the point - list your assumption and rational.

(d) Assume, you are launching HoloTV next week. List at least 5 KPIs that you will like to track for your product and why?

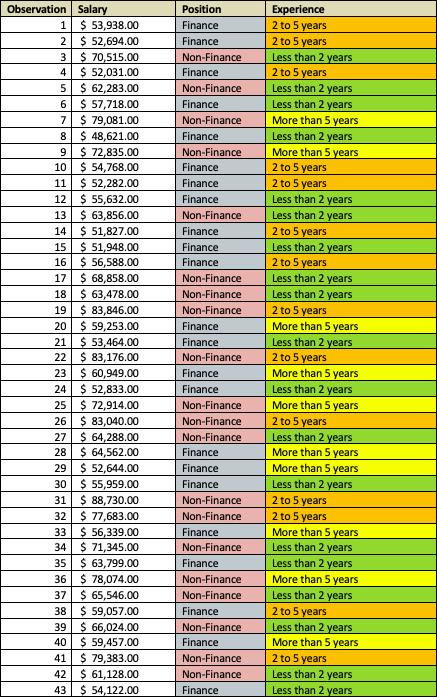

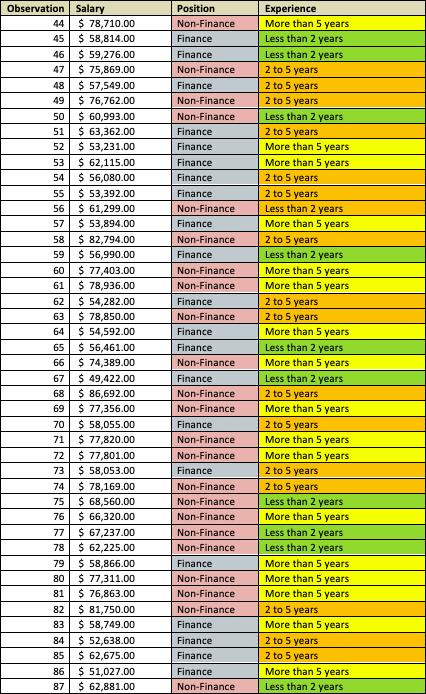

Observation Salary 1 $ 53,938.00 2 $ 52,694.00 3 $ 70,515.00 4 $ 52,031.00 5 $ 62,283.00 6 $ 57,718.00 7 $ 79,081.00 8 $ 48,621.00 9 $ 72,835.00 10 $ 54,768.00 11 $ 52,282.00 12 $ 55,632.00 13 $ 63,856.00 $ 51,827.00 15 $51,948.00 16 $ 56,588.00 17 $ 68,858.00 18 $ 63,478.00 19 $ 83,846.00 20 $ 59,253.00 21 $ 53,464.00 22 $ 83,176.00 23 $ 60,949.00 24 $ 52,833.00 25 $72,914.00 26 $83,040.00 27 $ 64,288.00 28 $ 64,562.00 29 $ 52,644.00 30 $ 55,959.00 31 $ 88,730.00 32 $ 77,683.00 33 $ 56,339.00 34 $ 71,345.00 35 $ 63,799.00 36 $78,074.00 37 $ 65,546.00 38 $ 59,057.00 39 $ 66,024.00 40 $ 59,457.00 41 $ 79,383.00 42 $ 61,128.00 43 $ 54,122.00 Position Finance Finance Non-Finance Finance. Non-Finance Finance. Non-Finance Finance Non-Finance Finance Finance Finance Non-Finance Finance Finance Finance Non-Finance Non-Finance Non-Finance Finance Finance Non-Finance Finance Finance Non-Finance Non-Finance Non-Finance Finance Finance Finance Non-Finance Non-Finance Finance Non-Finance Finance Non-Finance Non-Finance Finance Non-Finance Finance Non-Finance Non-Finance Finance Experience years 2 to 5 2 to 5 years Less than 2 years 2 to 5 years Less than 2 years Less than 2 years More than 5 years Less than 2 years More than 5 years 2 to 5 years 2 to 5 years Less than 2 years Less than 2 years 2 to 5 years Less than 2 years 2 to 5 years Less than 2 years Less than 2 years 2 to 5 years More than 5 years Less than 2 years 2 to 5 years More than 5 years Less than 2 years More than 5 years 2 to 5 years Less than 2 years More than 5 years More than 5 years Less than 2 years 2 to 5 years 2 to 5 years More than 5 years Less than 2 years Less than 2 years More than 5 years Less than 2 years 2 to 5 years Less than 2 years More than 5 years 2 to 5 years Less than 2 years Less than 2 years

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

It appears there has been a mixup The images youve provided contain data related to salaries positions and experience which seem unrelated to the question at hand about launching a new product HoloTV ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started