Answered step by step

Verified Expert Solution

Question

1 Approved Answer

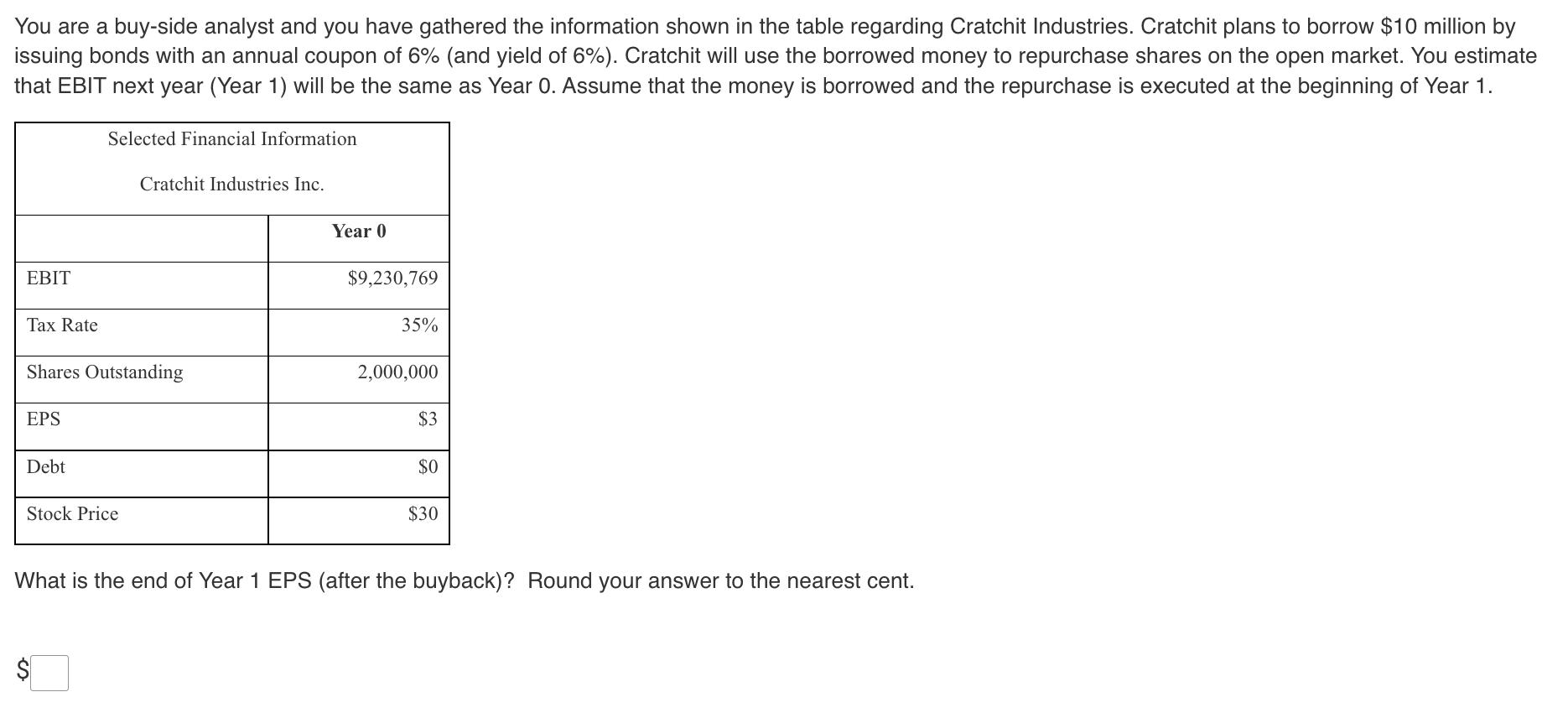

You are a buy-side analyst and you have gathered the information shown in the table regarding Cratchit Industries. Cratchit plans to borrow $10 million

You are a buy-side analyst and you have gathered the information shown in the table regarding Cratchit Industries. Cratchit plans to borrow $10 million by issuing bonds with an annual coupon of 6% (and yield of 6%). Cratchit will use the borrowed money to repurchase shares on the open market. You estimate that EBIT next year (Year 1) will be the same as Year 0. Assume that the money is borrowed and the repurchase is executed at the beginning of Year 1. Selected Financial Information Cratchit Industries Inc. EBIT Year 0 $9,230,769 Tax Rate 35% Shares Outstanding 2,000,000 EPS $3 $0 Debt Stock Price $30 What is the end of Year 1 EPS (after the buyback)? Round your answer to the nearest cent. S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the end of Year 1 EPS Earnings per Share after the share buyback we need to consider th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started