Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a Chief Executive Officer of the ACME Corporation. The firm plans to replace new machines to improve the production system costing $2,047,000.

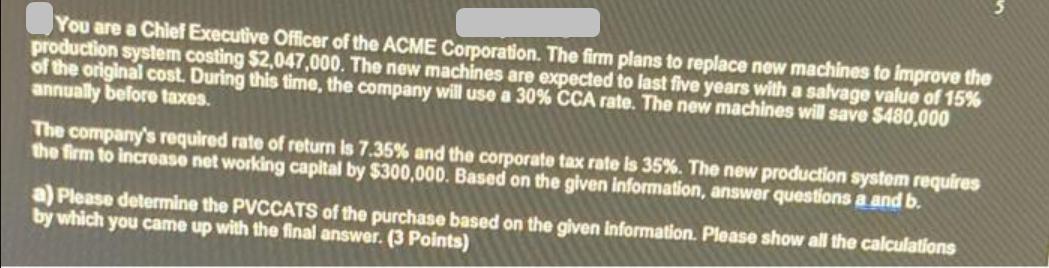

You are a Chief Executive Officer of the ACME Corporation. The firm plans to replace new machines to improve the production system costing $2,047,000. The new machines are expected to last five years with a salvage value of 15% of the original cost. During this time, the company will use a 30% CCA rate. The new machines will save $480,000 annually before taxes. The company's required rate of return is 7.35% and the corporate tax rate is 35%. The new production system requires the firm to increase net working capital by $300,000. Based on the given information, answer questions a and b. a) Please determine the PVCCATS of the purchase based on the given information. Please show all the calculations by which you came up with the final answer. (3 Points) You are a Chief Executive Officer of the ACME Corporation. The firm plans to replace new machines to improve the production system costing $2,047,000. The new machines are expected to last five years with a salvage value of 15% of the original cost. During this time, the company will use a 30% CCA rate. The new machines will save $480,000 annually before taxes. The company's required rate of return is 7.35% and the corporate tax rate is 35%. The new production system requires the firm to increase net working capital by $300,000. Based on the given information, answer questions a and b. a) Please determine the PVCCATS of the purchase based on the given information. Please show all the calculations by which you came up with the final answer. (3 Points)

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To determine the Present Value of Cash Costs After Tax PVCCATS for the machine purchase we need to calculate the net cash flows for each year and then ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started