Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a conservative investor who is considering investing in BMRP Inc., a small widget company. You like the intrinsic valuation approach and want

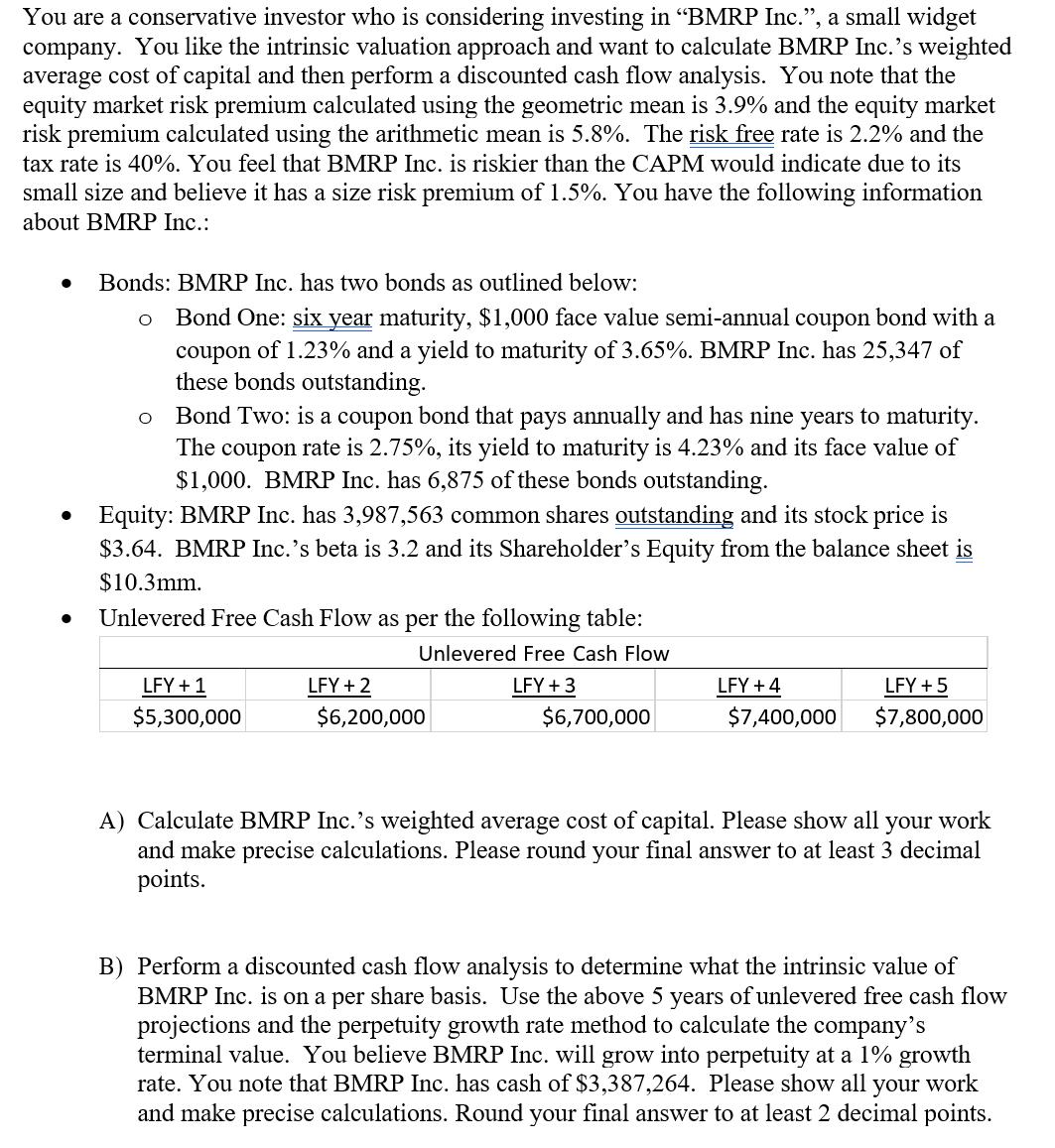

You are a conservative investor who is considering investing in "BMRP Inc.", a small widget company. You like the intrinsic valuation approach and want to calculate BMRP Inc.'s weighted average cost of capital and then perform a discounted cash flow analysis. You note that the equity market risk premium calculated using the geometric mean is 3.9% and the equity market risk premium calculated using the arithmetic mean is 5.8%. The risk free rate is 2.2% and the tax rate is 40%. You feel that BMRP Inc. is riskier than the CAPM would indicate due to its small size and believe it has a size risk premium of 1.5%. You have the following information about BMRP Inc.: Bonds: BMRP Inc. has two bonds as outlined below: Bond One: six year maturity, $1,000 face value semi-annual coupon bond with a coupon of 1.23% and a yield to maturity of 3.65%. BMRP Inc. has 25,347 of these bonds outstanding. O Bond Two: is a coupon bond that pays annually and has nine years to maturity. The coupon rate is 2.75%, its yield to maturity is 4.23% and its face value of $1,000. BMRP Inc. has 6,875 of these bonds outstanding. Equity: BMRP Inc. has 3,987,563 common shares outstanding and its stock price is $3.64. BMRP Inc.'s beta is 3.2 and its Shareholder's Equity from the balance sheet is $10.3mm. Unlevered Free Cash Flow as per the following table: Unlevered Free Cash Flow LFY+ 3 O LFY + 1 $5,300,000 LFY+2 $6,200,000 $6,700,000 LFY +4 $7,400,000 LFY + 5 $7,800,000 A) Calculate BMRP Inc.'s weighted average cost of capital. Please show all your work and make precise calculations. Please round your final answer to at least 3 decimal points. B) Perform a discounted cash flow analysis to determine what the intrinsic value of BMRP Inc. is on a per share basis. Use the above 5 years of unlevered free cash flow projections and the perpetuity growth rate method to calculate the company's terminal value. You believe BMRP Inc. will grow into perpetuity at a 1% growth rate. You note that BMRP Inc. has cash of $3,387,264. Please show all your work and make precise calculations. Round your final answer to at least 2 decimal points.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

A To calculate BMRP Incs weighted average cost of capital WACC we need to determine the cost of debt and the cost of equity 1 Cost of Debt We have two types of bonds Bond One Coupon 123 semiannual Yie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started