Question

You are a consultant assisting the CEO of Hyland Corp with the financial management of his firm. In the past five years, Hyland has seen

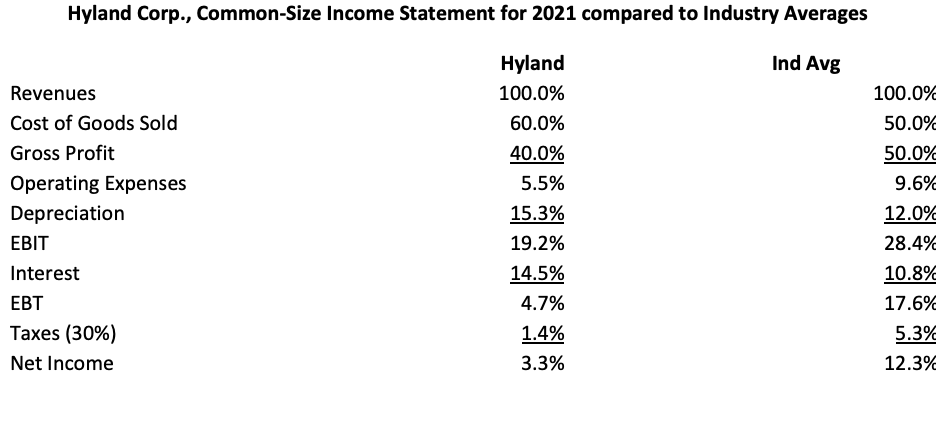

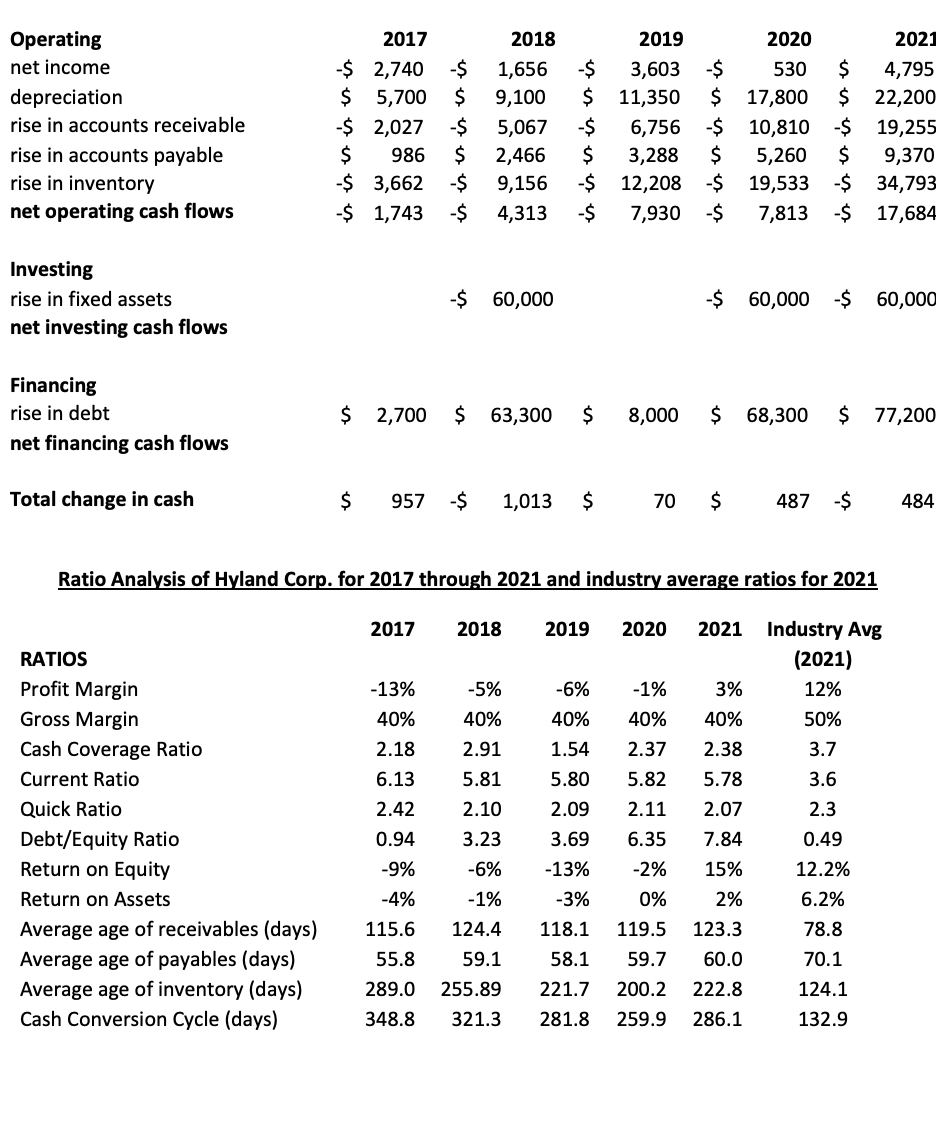

You are a consultant assisting the CEO of Hyland Corp with the financial management of his firm. In the past five years, Hyland has seen explosive growth in the market for its only product, Product-X, which is relatively new to the market. It has received wide-spread consumer acceptance and the overall market for the product is on the rise. Hyland has a dominant share of the market due to its intensive marketing efforts which have included holding large amounts in inventory for people to check out in-store, a selling price 20% below the average price of competitors ($100 compared to $120), and loose credit terms which have allowed people to pay for their purchases more slowly than their competitors require. As a result of this, sales have grown at an average rate of nearly 60% a year for the past 5 years. Unfortunately, this sales growth has required several expensive expansions to the companys production plant. For every 400,000 units to be produced in a year requires $60,000,000 in fixed assets - which can be installed and activated very rapidly. In order to cement its market position, Hylands policy has been to increase its production capacity in each year in which demand has exceeded its ability to supply, leading to expansions in 2018, 2020, and again in 2021. This has led to concurrently expanding debt and rising interest expenses. Hylands CEO is perplexed by the firms poor performance. Yesterday he said, I dont understand how were falling so far beyond the competition with such phenomenal sales growth! Were the dominant firm in the market but our competitors have managed to turn a profit consistently while we only had positive earnings this past year (2021) and even then, only a 3.3% profit margin! (note: competitors earned 12.3%). Hyland makes one of the very best products on the market and our operating expenses are FAR lower than the competition. Im really not sure why we arent more profitable than them. Furthermore, he explained, We are experiencing a serious cash crunch right now. The investors who supplied our long-term debt are concerned that we havent posted a single year with positive cash flows from operations since we opened our doors. Although we were able to borrow another $77 million throughout 2021, lenders are talking about raising our interest rates and cutting us off from further financing unless we can turn Hyland around somehow in 2022. There is a lot of growth left in this market and were going to need even more capacity before the year is up in order to fulfill all the orders that keep coming in. Im really not even sure what the problem is, let alone how to fix it! The CEO has supplied you with a common-size income statement comparing Hyland to the industry average, 5 years of cash flow statements, and 2021 financial ratios for both the firm and industry.

QUESTION 1

What areas of concern would you identify in Hylands 2021 financial performance relative to its industry average? Be specific about the metrics you are referring to and why you think they suggest a problem

QUESTION 2

Briefly, what policies should management pursue to correct for these issues? (1 sentence per problem)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started