Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a consultant to XY Corporation. The firm seeks your advice for the elaboration of a hedging strategy against interest rate risk. Four

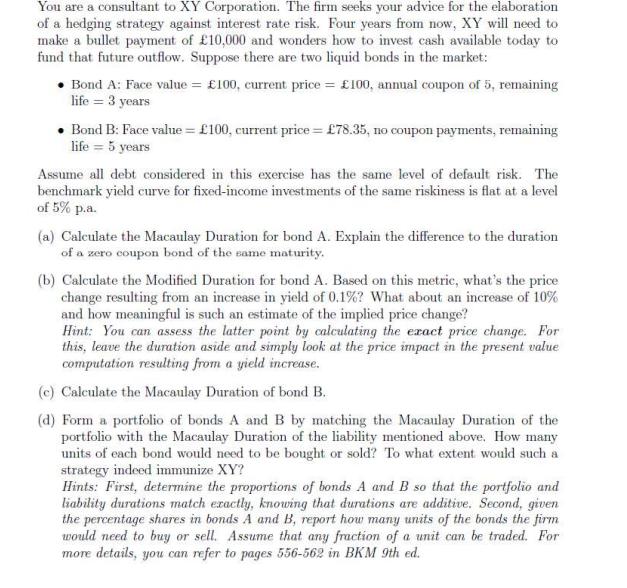

You are a consultant to XY Corporation. The firm seeks your advice for the elaboration of a hedging strategy against interest rate risk. Four years from now, XY will need to make a bullet payment of 10,000 and wonders how to invest cash available today to fund that future outflow. Suppose there are two liquid bonds in the market: Bond A: Face value = 100, current price = 100, annual coupon of 5, remaining life = 3 years Bond B: Face value = 100, current price 78.35, no coupon payments, remaining life = 5 years Assume all debt considered in this exercise has the same level of default risk. The benchmark yield curve for fixed-income investments of the same riskiness is flat at a level of 5% p.a. (a) Calculate the Macaulay Duration for bond A. Explain the difference to the duration of a zero coupon bond of the same maturity. (b) Calculate the Modified Duration for bond A. Based on this metric, what's the price change resulting from an increase in yield of 0.1%? What about an increase of 10% and how meaningful is such an estimate of the implied price change? Hint: You can assess the latter point by calculating the exact price change. For this, leave the duration aside and simply look at the price impact in the present value computation resulting from a yield increase. (c) Calculate the Macaulay Duration of bond B. (d) Form a portfolio of bonds A and B by matching the Macaulay Duration of the portfolio with the Macaulay Duration of the liability mentioned above. How many units of each bond would need to be bought or sold? To what extent would such a strategy indeed immunize XY? Hints: First, determine the proportions of bonds A and B so that the portfolio and liability durations match exactly, knowing that durations are additive. Second, given the percentage shares in bonds A and B, report how many units of the bonds the firm would need to buy or sell. Assume that any fraction of a unit can be traded. For more details, you can refer to pages 556-562 in BKM 9th ed.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer aThe Macaulay Duration for Bond A can be calculated as follows Duration Coupon Payment x 1 Face Value Coupon Payment 1 YTM1 Coupon Payment x 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started