Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a corporate treasurer and have excess funds that you will not need until summer. You are thinking of parking it in Treasury Bills

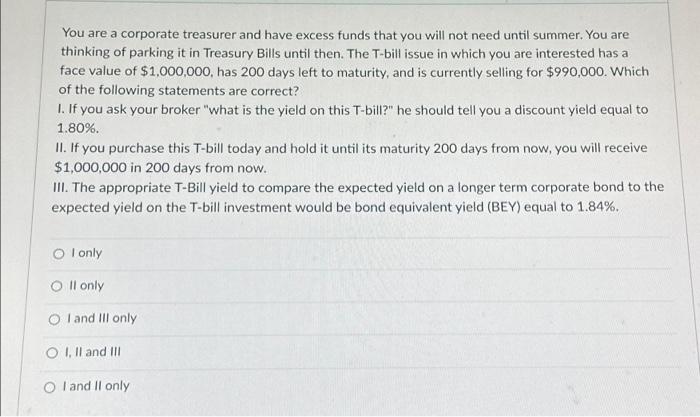

You are a corporate treasurer and have excess funds that you will not need until summer. You are thinking of parking it in Treasury Bills until then. The T-bill issue in which you are interested has a face value of $1,000,000, has 200 days left to maturity, and is currently selling for $990,000. Which of the following statements are correct? 1. If you ask your broker "what is the yield on this T-bill?" he should tell you a discount yield equal to 1.80%. II. If you purchase this T-bill today and hold it until its maturity 200 days from now, you will receive $1,000,000 in 200 days from now. III. The appropriate T-Bill yield to compare the expected yield on a longer term corporate bond to the expected yield on the T-bill investment would be bond equivalent yield (BEY) equal to 1.84%. OI only O II only O I and III only O I, II and III O I and II only

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started