Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a Credit analyst for ABC Bank, and the bank is considering a loan in the amount of $1 million to Humpty Dumpty

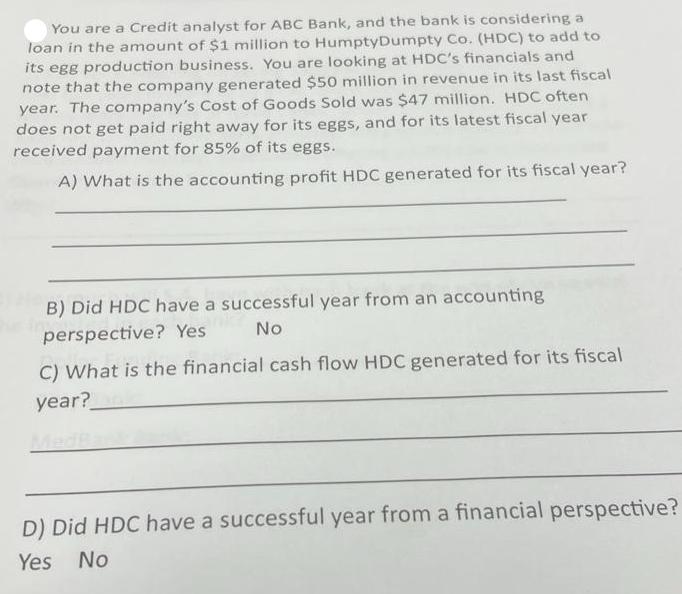

You are a Credit analyst for ABC Bank, and the bank is considering a loan in the amount of $1 million to Humpty Dumpty Co. (HDC) to add to its egg production business. You are looking at HDC's financials and note that the company generated $50 million in revenue in its last fiscal year. The company's Cost of Goods Sold was $47 million. HDC often does not get paid right away for its eggs, and for its latest fiscal year received payment for 85% of its eggs. A) What is the accounting profit HDC generated for its fiscal year? B) Did HDC have a successful year from an accounting perspective? Yes No C) What is the financial cash flow HDC generated for its fiscal year? D) Did HDC have a successful year from a financial perspective? Yes No E) If the current earnings/cash flow pattern continues, what do you think will happen to HDC?_

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Accounting Profit Accounting ProfitRevenueCost of Goods ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started