Answered step by step

Verified Expert Solution

Question

1 Approved Answer

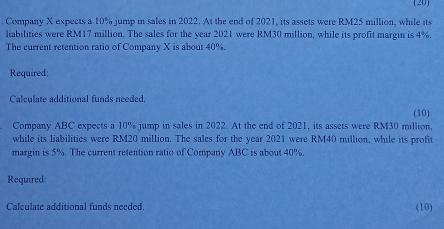

Company X expects a 10% jump in sales in 2022. At the end of 2021, its assets were RM25 million, while its Itabilities were

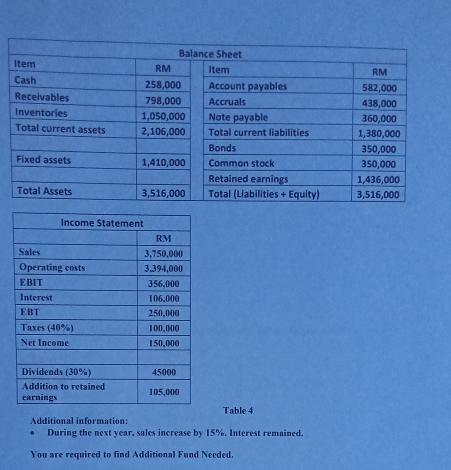

Company X expects a 10% jump in sales in 2022. At the end of 2021, its assets were RM25 million, while its Itabilities were RM17 million. The sales for the year 2021 were RM30 million, while its profit margin is 4%. The current retention ratio of Company X is about 40%. Required; Calculate additional funds needed. (10) Company ABC expects a 10% jump in sales in 2022 At the end of 2021, its assets were RM30 million, while its liabilities were RM20 million. The sales for the year 2021 were RM40 million, while its profit margin is 5% The current retention ratio of Company ABC is about 40%. Required: Calculate additional funds needed. (10) Item Cash Receivables Inventories Total current assets Fixed assets Total Assets Sales Operating costs EBIT Interest EBT Taxes (40%) Net Income Dividends (30%) Addition to retained earnings Balance Sheet Item Account payables Accruals RM 258,000 798,000 1,050,000 2,106,000 Income Statement 1,410,000 3,516,000 RM 3,750,000 3.394,000 356,000 106.000 250,000 100,000 150,000 45000 105,000 Note payable Total current liabilities Bonds Common stock Retained earnings Total (Liabilities+ Equity) Table 4 Additional information: During the next year, sales increase by 15%. Interest remained. You are required to find Additional Fund Needed. RM 582,000 438,000 360,000 1,380,000 350,000 350,000 1,436,000 3,516,000

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the additional funds needed we need to determine the increase in assets and liabilities resulting from the 10 jump in sales For Company X Sales in 2021 RM30 million Expected sale...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started