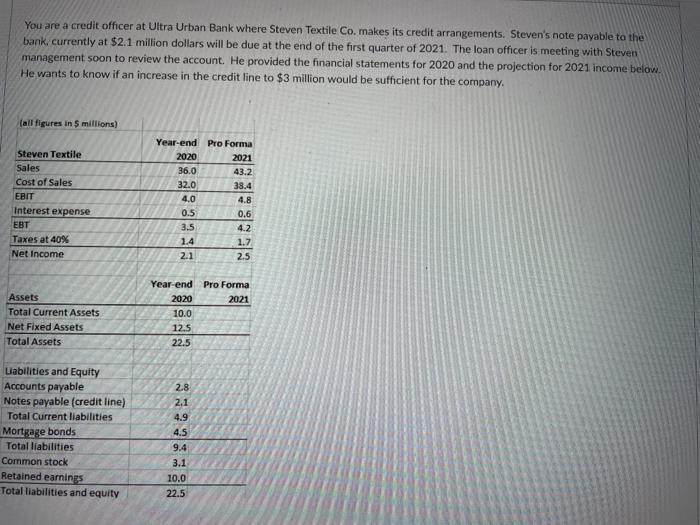

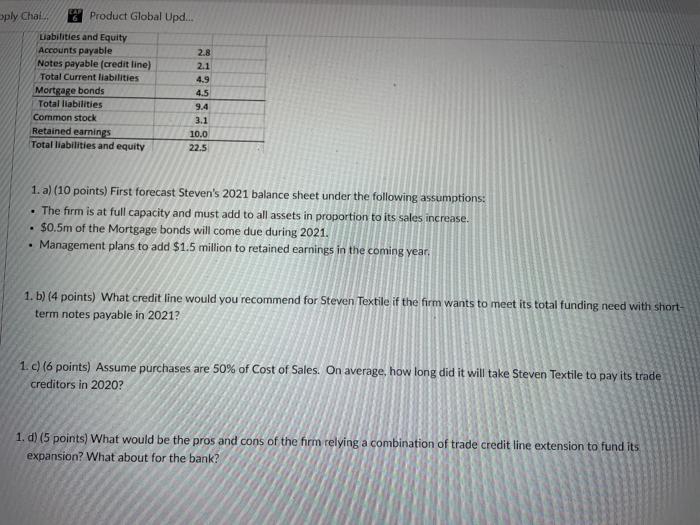

You are a credit officer at Ultra Urban Bank where Steven Textile Co. makes its credit arrangements. Steven's note payable to the bank, currently at $2.1 million dollars will be due at the end of the first quarter of 2021. The loan officer is meeting with Steven management soon to review the account. He provided the financial statements for 2020 and the projection for 2021 income below. He wants to know if an increase in the credit line to $3 million would be sufficient for the company. (all figures in 5 millions) Steven Textile Sales Cost of Sales EBIT Interest expense EBT Taxes at 40% Net Income Year-end Pro Forma 2020 2021 36.0 43.2 32.0 38.4 4.0 4.8 0.5 0.6 3.5 4.2 1.4 2.1 2.5 2.2 Assets Total Current Assets Net Fixed Assets Total Assets Year-end Pro Forma 2020 2021 10.0 12.5 22.5 2.8 2.1 Liabilities and Equity Accounts payable Notes payable (credit line) Total Current liabilities Mortgage bonds Total liabilities Common stock Retained earnings Total liabilities and equity 4.9 4.5 9.4 3.1 10.0 22.5 Oply Chai Product Global Upd... Labilities and Equity Accounts payable 2.8 Notes payable (credit line) 2.1 Total Current liabilities 4.9 Mortgage bonds 4.5 Total liabilities 9.4 Common stock 3.1 Retained earnings 10.0 Total liabilities and equity 22.5 1. a) (10 points) First forecast Steven's 2021 balance sheet under the following assumptions: . The firm is at full capacity and must add to all assets in proportion to its sales increase. $0.5m of the Mortgage bonds will come due during 2021. Management plans to add $1.5 million to retained earnings in the coming year, 1. b)(4 points) What credit line would you recommend for Steven Textile if the firm wants to meet its total funding need with short- term notes payable in 2021? 1.c) (6 points) Assume purchases are 50% of Cost of Sales. On average, how long did it will take Steven Textile to pay its trade Creditors in 2020? 1. d) (5 points) What would be the pros and cons of the firm relying a combination of trade credit line extension to fund its expansion? What about for the bank? You are a credit officer at Ultra Urban Bank where Steven Textile Co. makes its credit arrangements. Steven's note payable to the bank, currently at $2.1 million dollars will be due at the end of the first quarter of 2021. The loan officer is meeting with Steven management soon to review the account. He provided the financial statements for 2020 and the projection for 2021 income below. He wants to know if an increase in the credit line to $3 million would be sufficient for the company. (all figures in 5 millions) Steven Textile Sales Cost of Sales EBIT Interest expense EBT Taxes at 40% Net Income Year-end Pro Forma 2020 2021 36.0 43.2 32.0 38.4 4.0 4.8 0.5 0.6 3.5 4.2 1.4 2.1 2.5 2.2 Assets Total Current Assets Net Fixed Assets Total Assets Year-end Pro Forma 2020 2021 10.0 12.5 22.5 2.8 2.1 Liabilities and Equity Accounts payable Notes payable (credit line) Total Current liabilities Mortgage bonds Total liabilities Common stock Retained earnings Total liabilities and equity 4.9 4.5 9.4 3.1 10.0 22.5 Oply Chai Product Global Upd... Labilities and Equity Accounts payable 2.8 Notes payable (credit line) 2.1 Total Current liabilities 4.9 Mortgage bonds 4.5 Total liabilities 9.4 Common stock 3.1 Retained earnings 10.0 Total liabilities and equity 22.5 1. a) (10 points) First forecast Steven's 2021 balance sheet under the following assumptions: . The firm is at full capacity and must add to all assets in proportion to its sales increase. $0.5m of the Mortgage bonds will come due during 2021. Management plans to add $1.5 million to retained earnings in the coming year, 1. b)(4 points) What credit line would you recommend for Steven Textile if the firm wants to meet its total funding need with short- term notes payable in 2021? 1.c) (6 points) Assume purchases are 50% of Cost of Sales. On average, how long did it will take Steven Textile to pay its trade Creditors in 2020? 1. d) (5 points) What would be the pros and cons of the firm relying a combination of trade credit line extension to fund its expansion? What about for the bank