You are a credit risk manager in an asset management company. As a result of reviewing US banks preliminary 2016 financial results, yesterday you initiated several internal credit rating downgrades. This morning the overnight counterparty credit risk report shows a limit overage for Regions Financial Corporation (RFC). What actions should you take?

- List the actions you should take and their intended results (I provided you the first example

- example:

| action: Notify the Chief Risk Officer, all traders and fund managers that RFC is over its credit limit and why. Intended result: Alert the traders, fund managers and CRO to the deterioration in RFCs creditworthiness Prevent any new trades from taking place until RFC is back within limits |

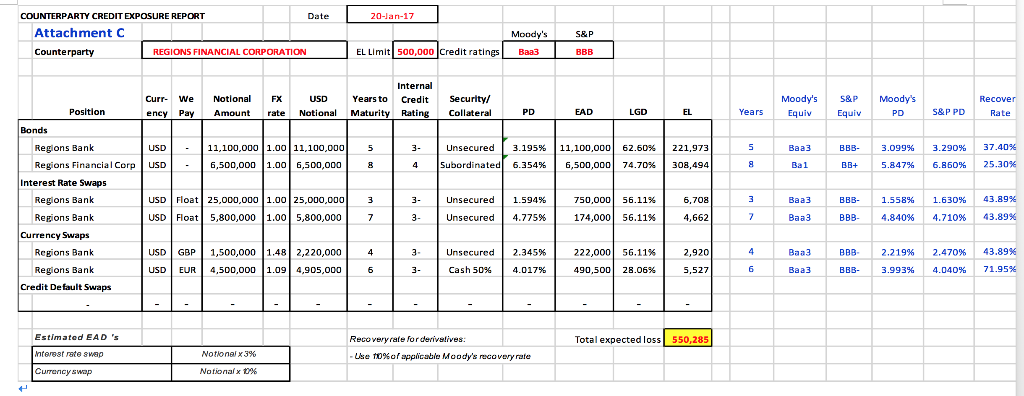

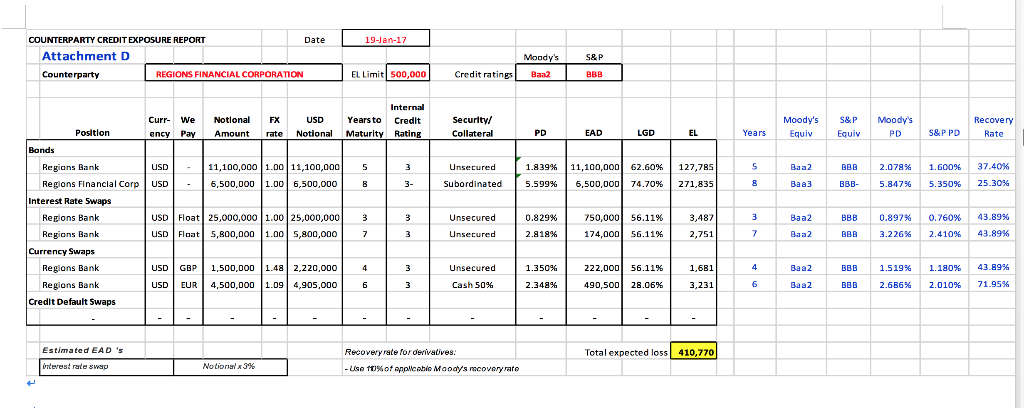

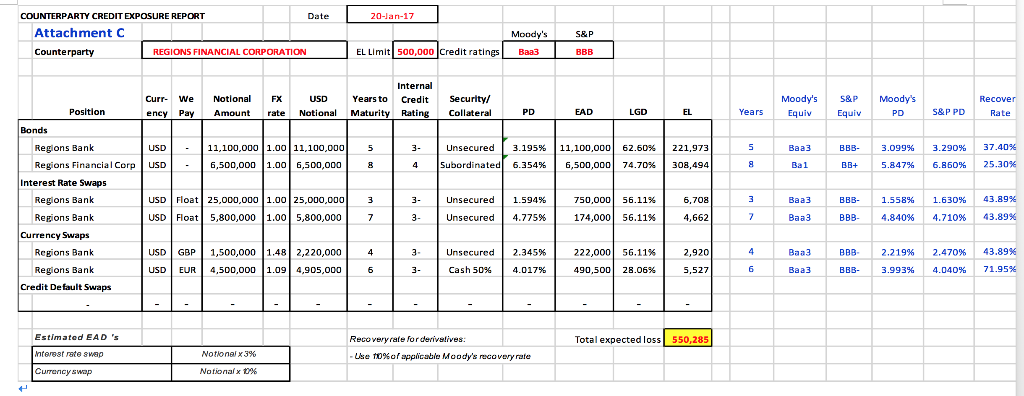

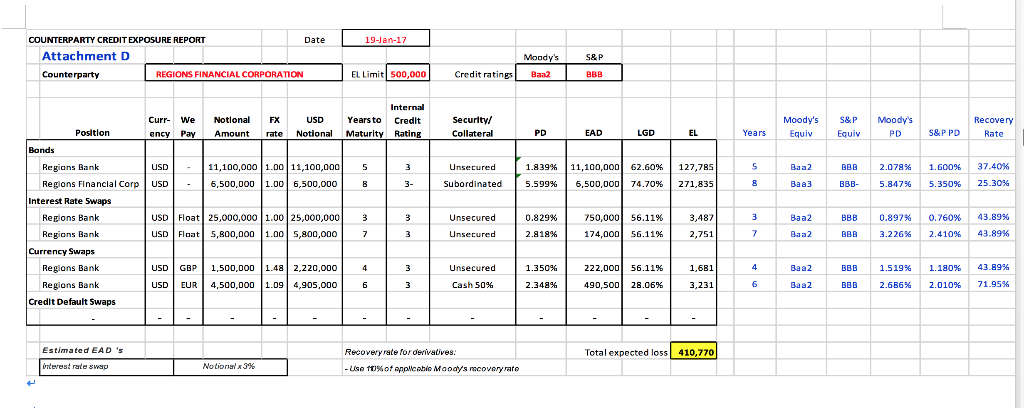

i COUNTERPARTY CREDIT EXPOSURE REPORT Date 20-Jan-17 Attachment C Moody's S&P Counterparty REGIONS FINANCIAL CORPORATION EL Limit 500,000 Credit ratings Baa3 Internal Curr- We Notion X USD Yersto CreditSecurity/ Moody's S&P Moody's Equiv Recover Position ency Pay Amount rate Notional Maturity Rating Collateral PD EAD LGD EL Years Equiv PD S&P PD Rate Bonds Regions Bank Regions Financial Corp USDI 11,100,000 1.001 11,100,000 5 3- Unsecured 3.195% 11,100,000 62.60% 221,973 Baa3 BBB- 3.099% 3.290% 37.40% USD 6,500,000 1.00 6,500,000 8 4 Subordinated 6.354% 6,500,000 | 74.70% 308,494 Ba1 BB+ 5.847% 6.860% 25.30% Interest Rate Swaps Regions Bank Repions Bank USD Float 25,000,0001.00 25,000,0003 3- Unsecured 1.594% 750,000 | 56.11% 6,708 Baa3 BBB- 1.558% 1.630% 43.89% USD Flat 5,800,0001.00 5,800,000 3- unsecured 4.775% 174,000| 56.11% 4,662 Baa3 BBB- 4.840% 4.710% 43.89% Currency Swaps 2,920 43.89% Rcgions Bank Regions Bank Credit Default Swaps USD GBP 1,500,000 1.48 2,220,000 Unsecured 2.345% 222,000 56.11% Baa3 BBB- 2.219% 2.470% USD EUR 4,500,000 1.09 4,905,000 3- Cash 50% 4.017% 490,500| 28.06% 5,527 Baa3 BBB- 3.993% 4.040% 71.95% Estimated EAD 'S nterest rate swap Curroncy swap Recoveryrate for denivelives: Total expected loss 550,285 Notional X 3% Use t0%of applicable M cody's recovery rate COUNTERPARTY CREDITEXPOSURE REPORT Date 19-Jan-17 Attachment D Moady's S& P Counterparty REGIONS FINANCIAL CORPORATION EL Limit 500,000 Credit ratings Baa2 Internal Yearsto Credlt ency Pay Amount rate Notional Maturity Rating Curr- We Notlona FX Securlty/ Collateral Moody's S&PMoody's Equiv USD Recovery Rate Positior PD EAD LGD EL Years Equiv PD S&P PD Bonds 37.40% Regions Bank Regions Financial Corp USD6,500,0001.00 6,500,000 USD11,100,000 1.00 11,100,0005 1.839% 11,100,000 62.60% | 127,785 subordinated 5.599% 6,500,000 74.70% 271,835 Baa2 2.078% 1.600% 3- Baa3 BBB- 5.847% 5.350% 25.30% Interest Rate Swaps Regions Bank USD Float 25,000,0001.00 25,000,0003 Unsecured 0.8 29% 750,000 56.11% 3,487 Baa2 0.897% 0.760% 43.89% Regions Bank USD Float5,800,0001.00 5,800,000 2.818% 174,000 56.11% 2,751 Baa2 BBB 3.226% 2.410% 43.89% Currency Swaps Regions Bank Regions Bank Credit Default Swaps USD GBP 1,500,000 1.482,220,000 Unsecured 1.350% 222,000 56.11% 1,681 Baa2 BBB 1.519% 1.180% 43.89% USD | EUR 4,500,000 1.09| 4,905,000 Cash 50% 2.348% 490,500 28.06% 3,231 Baa2 BBB 2.68656 2.01096 71.95% Estimated EAD S Recoveryrate foroervatives Total expected loss410,770 nterest rade swap No tional x 3% i COUNTERPARTY CREDIT EXPOSURE REPORT Date 20-Jan-17 Attachment C Moody's S&P Counterparty REGIONS FINANCIAL CORPORATION EL Limit 500,000 Credit ratings Baa3 Internal Curr- We Notion X USD Yersto CreditSecurity/ Moody's S&P Moody's Equiv Recover Position ency Pay Amount rate Notional Maturity Rating Collateral PD EAD LGD EL Years Equiv PD S&P PD Rate Bonds Regions Bank Regions Financial Corp USDI 11,100,000 1.001 11,100,000 5 3- Unsecured 3.195% 11,100,000 62.60% 221,973 Baa3 BBB- 3.099% 3.290% 37.40% USD 6,500,000 1.00 6,500,000 8 4 Subordinated 6.354% 6,500,000 | 74.70% 308,494 Ba1 BB+ 5.847% 6.860% 25.30% Interest Rate Swaps Regions Bank Repions Bank USD Float 25,000,0001.00 25,000,0003 3- Unsecured 1.594% 750,000 | 56.11% 6,708 Baa3 BBB- 1.558% 1.630% 43.89% USD Flat 5,800,0001.00 5,800,000 3- unsecured 4.775% 174,000| 56.11% 4,662 Baa3 BBB- 4.840% 4.710% 43.89% Currency Swaps 2,920 43.89% Rcgions Bank Regions Bank Credit Default Swaps USD GBP 1,500,000 1.48 2,220,000 Unsecured 2.345% 222,000 56.11% Baa3 BBB- 2.219% 2.470% USD EUR 4,500,000 1.09 4,905,000 3- Cash 50% 4.017% 490,500| 28.06% 5,527 Baa3 BBB- 3.993% 4.040% 71.95% Estimated EAD 'S nterest rate swap Curroncy swap Recoveryrate for denivelives: Total expected loss 550,285 Notional X 3% Use t0%of applicable M cody's recovery rate COUNTERPARTY CREDITEXPOSURE REPORT Date 19-Jan-17 Attachment D Moady's S& P Counterparty REGIONS FINANCIAL CORPORATION EL Limit 500,000 Credit ratings Baa2 Internal Yearsto Credlt ency Pay Amount rate Notional Maturity Rating Curr- We Notlona FX Securlty/ Collateral Moody's S&PMoody's Equiv USD Recovery Rate Positior PD EAD LGD EL Years Equiv PD S&P PD Bonds 37.40% Regions Bank Regions Financial Corp USD6,500,0001.00 6,500,000 USD11,100,000 1.00 11,100,0005 1.839% 11,100,000 62.60% | 127,785 subordinated 5.599% 6,500,000 74.70% 271,835 Baa2 2.078% 1.600% 3- Baa3 BBB- 5.847% 5.350% 25.30% Interest Rate Swaps Regions Bank USD Float 25,000,0001.00 25,000,0003 Unsecured 0.8 29% 750,000 56.11% 3,487 Baa2 0.897% 0.760% 43.89% Regions Bank USD Float5,800,0001.00 5,800,000 2.818% 174,000 56.11% 2,751 Baa2 BBB 3.226% 2.410% 43.89% Currency Swaps Regions Bank Regions Bank Credit Default Swaps USD GBP 1,500,000 1.482,220,000 Unsecured 1.350% 222,000 56.11% 1,681 Baa2 BBB 1.519% 1.180% 43.89% USD | EUR 4,500,000 1.09| 4,905,000 Cash 50% 2.348% 490,500 28.06% 3,231 Baa2 BBB 2.68656 2.01096 71.95% Estimated EAD S Recoveryrate foroervatives Total expected loss410,770 nterest rade swap No tional x 3%