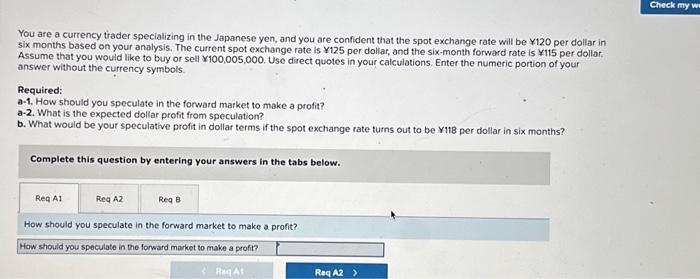

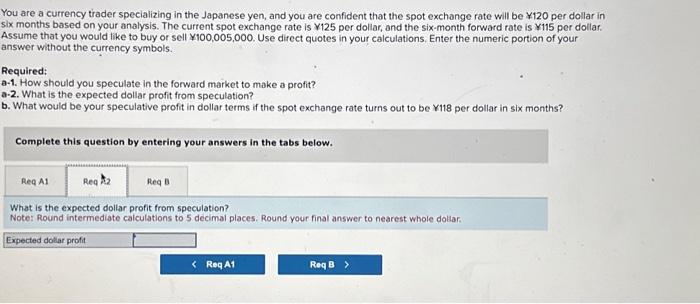

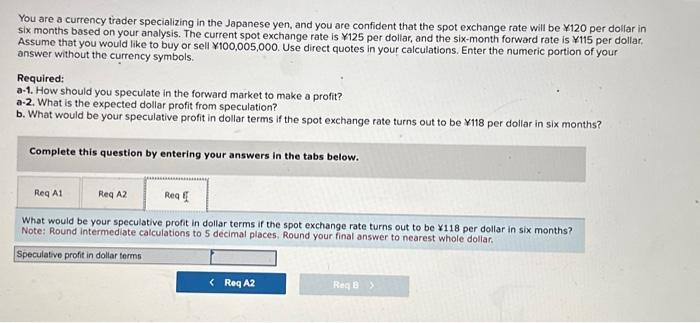

You are a currency trader specializing in the Japanese yen, and you are confident that the spot exchange rate will be 120 per dollar in ilx months based on your analysis. The curfent spot exchange rate is V125 per dollar, and the six-month forward rate is 115 per dollar. Assume that you would like to buy or sell 100,005,000. Use direct quotes in your calculations. Enter the numeric portion of your answer without the currency symbols. Required: -1. How should you speculate in the forward market to make a profit? -2. What is the expected dollar profit from speculation? b. What would be your speculative profit in dollar terms if the spot exchange rate turns out to be v118 per dollar in six months? Complete this question by entering your answers in the tabs below. What is the expected dollar profit from speculation? Note: Round intermediate calculations to 5 decimal places. Round your final answer to nearest whole dollar. You are a currency trader specializing in the Japanese yen, and you are confident that the spot exchange rate will be 120 per dollar in six months based on your analysis. The current spot exchange rate is 125 per dollar, and the six-month forward rate is 115 per dollar. Assume that you would like to buy or sell 100,005,000. Use direct quotes in your calculations. Enter the numeric portion of your answer without the currency symbols. Required: a-1. How should you speculate in the forward market to make a profit? a-2. What is the expected dollar profit from speculation? b. What would be your speculative profit in dollar terms if the spot exchange rate turns out to be Vit8 per dollar in six months? Complete this question by entering your answers in the tabs below. How should you speculate in the forward market to make a profit? How should you speculate in the forward market to make a profit? You are a currency trader specializing in the Japanese yen, and you are confident that the spot exchange rate will be 120 per dollar in six months based on your analysis. The current spot exchange rate is 125 per dollar, and the six-month forward rate is 115 per dollar. Assume that you would like to buy or sell $100,005,000. Use direct quotes in your calculations. Enter the numeric portion of your answer without the currency symbols. Required: a-1. How should you speculate in the forward market to make a profit? a-2. What is the expected dollar profit from speculation? b. What would be your speculative profit in dollar terms if the spot exchange rate turns out to be 118 per dollar in six months? Complete this question by entering your answers in the tabs below. What would be your speculative profit in dollar terms if the spot exchange rate turns out to be 118 per dollar in six months? Note: Round intermediate calculations to 5 decimal places. Round your final answer to nearest whole dollar